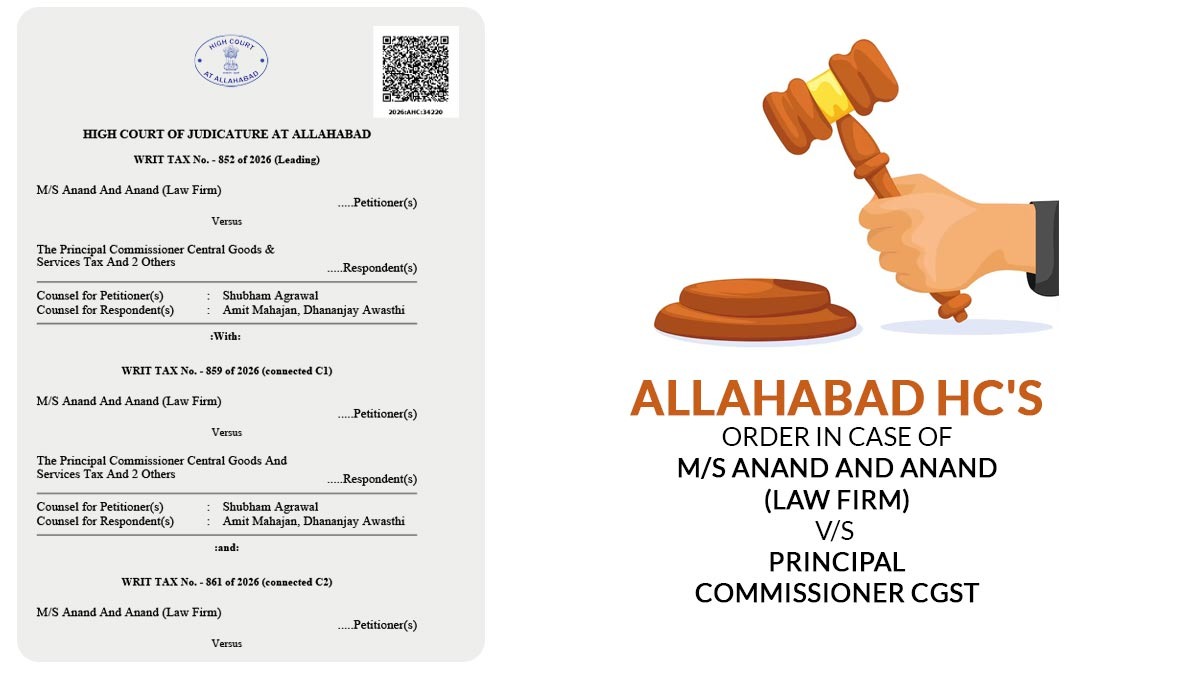

The Allahabad High Court has stated that the Appellate Authority u/s 107(11) of the Central Goods and Services Tax Act, 2017 (CGST Act) does not have any authority to remand cases back to the adjudicating authority. The Court set aside multiple remand orders passed in a refund dispute concerning a leading law firm.

The bench of Justice Vikas Budhwar has stated that the issue was no longer res integra and directed to an earlier decision concerning the same applicant in Anand & Anand (Law Firm) vs. Principal Commissioner of CGST (decided on 04.09.2025). The Court in that case had categorically held that the Appellate Authority cannot remand matters concerning the express statutory bar.

The applicant, a renowned law firm registered under GST at Noida, delivers legal services to both domestic and foreign clients. It said that it had rendered services to foreign clients and obtained consideration in convertible foreign exchange, thereby entitling as export services under the GST law.

The firm, concerning the period March 2021 to August 2021, has submitted the refund application under section 54 of the CGST Act in Form GST RFD-01, seeking a refund of unused ITC on export of services without tax payment.

But, the department furnished system-generated communications (RFD-08) alleging that the Foreign Inward Remittance Certificates (FIRCs) show that services were rendered in India, and thus, the remittance was not connected to the export of services. Thereafter, the refund claims were denied via Orders-in-Original dated 31.10.2023.

The dissatisfied applicant submitted appeals to the Joint Commissioner, CGST (Appeals), Noida. The Appellate Authority, by orders dated 30.04.2024 (Leading Petition), 28.06.2024 (Connected C1), and 31.05.2024 (Connected C2 and C3), recorded findings in favour of the applicant on the fulfilment of export conditions.

But, even after such favourable findings, the authority remanded the case back to the adjudicating authority for redetermination of the place of supply after analysing documents.

The applicant contested the remand part of such appellate orders before the HC. The question before the Court was whether the appellate authority has the power to remand cases under section 107(11) of the CGST Act.

Section 107(11) cites that the appellate authority may validate, edit or annul the decision appealed against, but will not direct the case back to the adjudicating authority.

The revenue said that, as the GST Tribunal is now operational, the applicant must take the other remedy of appeal. However, when the court questioned the revenue accepted that no regulatory provision enabled remand u/s 107(11).

Important: Allahabad HC Rejects Plea to Quash GST Fraud Notice, Orders Tax Department to Reveal Evidence

The Court put reliance on the Division Bench ruling in Kronos Solutions India (P.) Ltd., in which it was stated that once the law limits appellate powers to confirming, modifying, or annulling the order, no inherent power of remand can be exercised.

The High Court stated that even after recording findings in favour of the applicant for the fulfilment of export norms, the appellate authority had still remanded the case, which was opposite to the regulatory mandate.

While the revenue claimed that the applicant is required to approach the GST Tribunal, the Court refused to relegate the applicant to another remedy. It stated that as the appellate authority had acted beyond jurisdiction via ordering remand in breach of Section 107(11), the writ petitions were maintainable.

The Court, permitting the writ petitions, set aside the appellate orders on 30.04.2024, 28.06.2024, and 31.05.2024 that remanded the case to the adjudicating authority.

The Court asked the Joint Commissioner, CGST (Appeals), Noida, to determine the appeals afresh as per the law within 2 months.

| Case Title | M/S Anand And Anand (Law Firm) vs. Principal Commissioner CGST |

| Case No. | WRIT TAX No. – 852 of 2026 |

| For Petitioner | Shubham Agrawal |

| For Respondent | Amit Mahajan, Dhananjay Awasthi |

| Allahabad High Court | Read Order |