A bunch of petitions have been dismissed by the Allahabad High Court contesting central and state government orders/notifications extending the time duration to file the GST return for the FY 2017-18 and also extending the time limit for its investigation and audit via tax officials.

Because of the COVID-19 pandemic, the time limit to file the GST returns was extended in 2020.

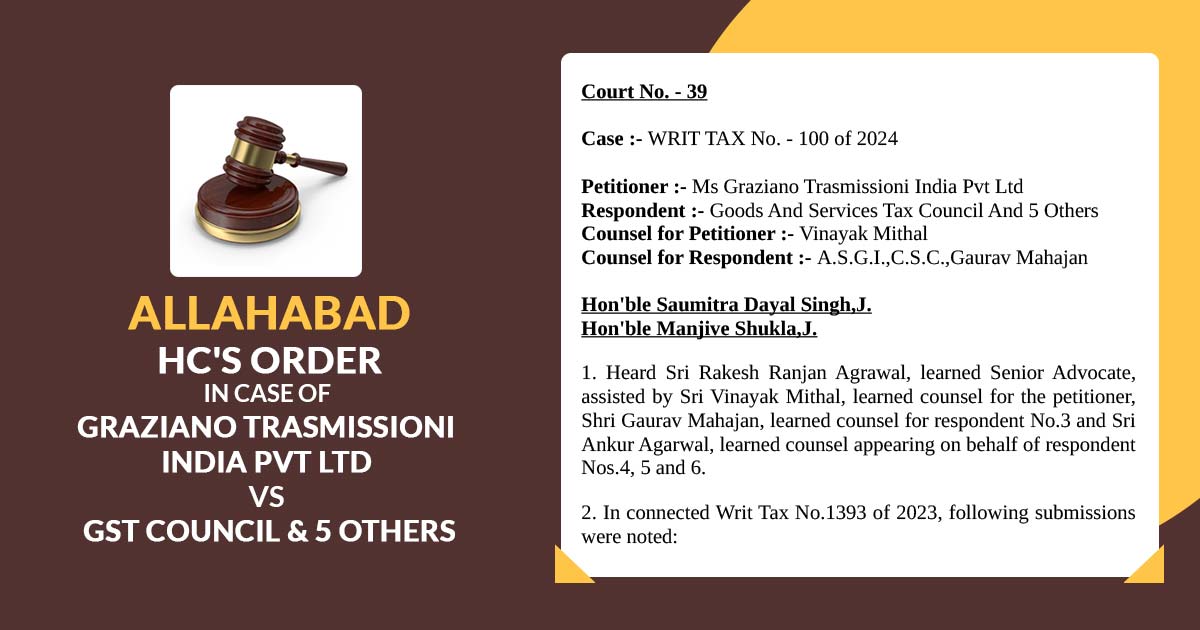

The bench constituting Justice SD Singh and Justice Donadi Ramesh was hearing a clutch of petitions furnished via a multinational firm M/s Graziano Transmission and several others.

As per the court, the government is authorized to extend the time limitation and noted: that the authority to issue the impugned notifications existed. It is undisputed. Concerning our discussion the power was practiced both within the confines of the legislative requirements and occasioned via situations encountered by the legislature.

Read Also: Current GST Return Filing Due Dates for GSTR 1 3B to 9 9C

The judicial review does not extend to the duration for which the power was exercised, i.e., the length of the time extension granted. It is important to note that no excessive extension of time has been granted, noted the bench.

After hearing the counsel for the petitioners and the additional chief standing counsel, Nimai Das, who represented the state government, the court has stated that, based on the evidence, the time limit for filing GST returns was extended due to Covid-19, and there was a thoughtful consideration in extending the time limit for filing GST returns and conducting their scrutiny by tax officials.

| Case Title | M/S Graziano Trasmissioni India Pvt Ltd Vs. GST Council & 5 Others |

| Citation | WRIT TAX No. – 100 of 2024 |

| Date | 06.02.2024 |

| Counsel for Petitioner | Vinayak Mithal |

| Counsel for Respondent | A.S.G.I.,C.S.C.,Gaurav Mahajan |

| Allahabad High Court | Read Order |