The Allahabad High Court has closed a case related to the Goods and Services Tax (GST) system, noting that the GST Appellate Tribunal (GSTAT) is now properly set up and functioning. Previously, the tribunal wasn’t operational, which meant that taxpayers had to go to the High Courts for quick solutions to their problems.

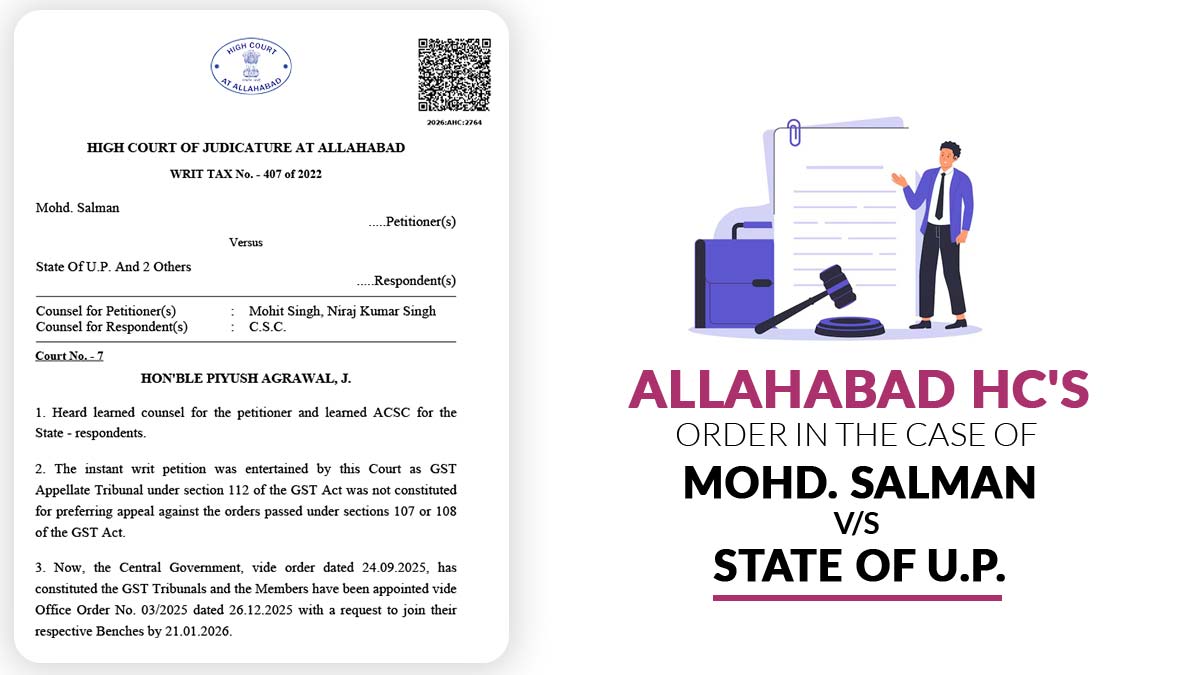

The bench of Justice Piyush Agrawal said that the writ petition was originally entertained only because the GST Appellate Tribunal u/s 112 of the GST Act had not been constituted at the appropriate time. The absence of the appellate forum had left dissatisfied taxpayers with no option but to invoke the writ jurisdiction of the High Court against orders passed under Sections 107 and 108 of the GST Act.

The Court acknowledged that the Central Government established the GST Appellate Tribunal by an order dated September 24, 2025. Members of the Tribunal were appointed through Office Order No. 03/2025 on December 26, 2025, and they have been instructed to join their respective Benches by January 21, 2026. Also, the procedural rules controlling the Tribunal’s operation were officially notified u/s 111 of the CGST Act on April 24, 2025.

Also Read: GSTAT New Delhi: No Action Should Be Taken Once a Contractor Deposits GST ITC Benefit

The court, concerning such developments, held that no valuable objective shall be served by keeping the writ petition pending. As per that, without analysing the merits or legality of the impugned GST orders, the HC disposed of the petition with directions protecting the applicant’s statutory right of appeal.

The GST allowed the applicant to submit a plea to the GST Appellate Tribunal u/s 112 of the GST Act, under the notification on September 17, 2025. The court provided more time permiting the plea to be submitted up to June 30, 2026, and directed that no objection on the ground of limitation shall be raised if the appeal is filed within this period.

The court, addressing the problem of pre-deposit, said that any amount already deposited by the applicant as per the interim orders of the HC shall be considered as compliance with the mandatory pre-deposit requirement u/s 112(8) of the CGST Act. The applicant should provide a certified copy of the interim order, including evidence of these deposit before the Tribunal.

The court then asked the Registry of the GST Appellate Tribunal to inform the applicant of any defects in the appeal within 3 weeks of filing. Thereafter, the applicant provided 30 days to fix these flaws. The HC mentioned that the appeal will be determined by the Tribunal as per the law, on its own merits.

| Case Title | Mohd. Salman vs. State Of U.P. |

| Case Number | WRIT TAX No. – 407 of 2022 |

| For the Petitioner | Mohit Singh, Niraj Kumar Singh |

| For Respondent | C.S.C |

| Allahabad High Court | Read Order |