An assessment order against a homemaker has been set aside by the Ahmedabad Bench of the Income Tax Appellate Tribunal, which directed the assessing officer to conduct a fresh trial after providing a fair opportunity of being heard.

As per the tribunal, the taxpayer did not receive natural justice as she had not obtained proper notices, and the case was determined ex parte.

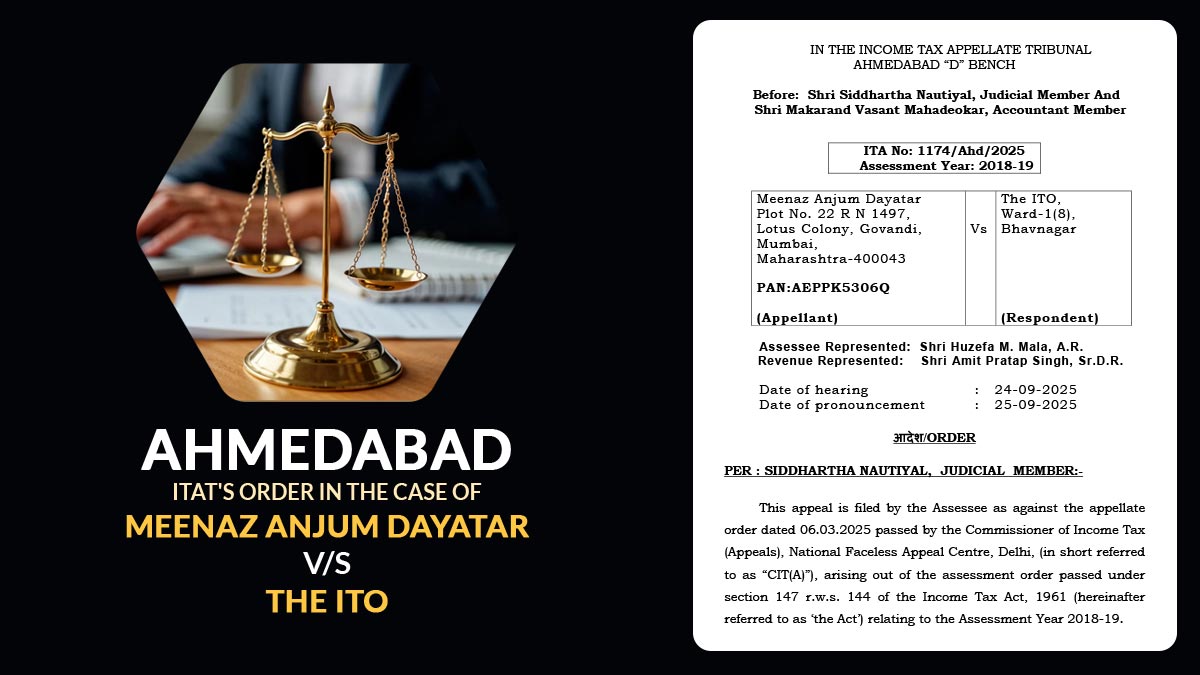

For the fiscal year 2017-18 (Assessment Year 2018-19), Meenaz Anjum Dayatar, a homemaker from Mumbai, had not filed an income tax return. After discovering through its Insight Portal that she had sold an immovable property for Rs. 1.15 crore and had made cash deposits of Rs. 8,89,500 in her bank account, the income tax department had reopened her case.

The Assessing Officer initiated a case reopening under section 147 due to the absence of a filed return. Notices were subsequently issued under section 142(1). In the absence of any response from the taxpayer, the officer classified the total amount of Rs. 1,23,89,500 as unexplained income u/s 68. Consequently, the assessment was finalised u/s 144.

Before the Commissioner of Income Tax (Appeals), dissatisfied, Dayatar appealed. However, the appellate authority dismissed her case ex parte, noting that she had not filed any submissions or attended hearings even after imposing repeated notices. Assessing Officer’s additions were confirmed.

In a recent tribunal case, the counsel for the assessee presented the argument that she was a homemaker without a regular source of taxable income and had limited experience with checking emails.

It was highlighted that following the death of her spouse, the property had been sold by her brother, which led to her not actively monitoring electronic communications. Additionally, she emphasised that while she had updated her postal address, she had not received any physical notices from the department.

The counsel claimed that the assessment was made without permitting the acquisition cost and indexation cost against the sale consideration, and the sale value was incorrectly considered as income under section 68. Also, the addition of cash deposits was not explained.

The orders of the lower authorities have been supported by the departmental representative.

The tribunal post-hearing, both sides said that the assessment was framed ex parte, and the appeal was dismissed ex parte. It ruled that the taxpayer had not been furnished with a fair chance to present her case.

The Bench, including Siddhartha Nautiyal (Judicial Member) and Makarand Vasant Mahadeokar (Accountant Member), said that her appeal of not being aware of the proceedings because of her personal situation cannot be overlooked.

Read Also: ITAT Ahmedabad Partly Quashes PCIT’s Order for Unverified Accommodation Entry Additions U/S 263

It then restored the case to the file of the assessing officer by deciding the case afresh, post providing a fair chance of hearing, and to pass a speaking order as per the regulation. The taxpayer was asked to cooperate in the proceedings.

In conclusion, the appeal was permitted concerning statistical objectives.

| Case Title | Meenaz Anjum Dayatar vs. The ITO |

| Case No. | ITA No: 1174/Ahd/2025 |

| Assessee | Shri Huzefa M. Mala |

| Respondent | Shri Amit Pratap Singh |

| Ahmedabad ITAT | Read Order |