What is the ADT-1 e-Form?

Before the companies act 2013, an auditor has to inform about his appointment by filling out form 23B within 30 days of receiving the appointment letter. But Sec(1) of the companies act 2013 clearly states companies are responsible to inform the registrar of companies about the appointment of a new auditor by using the e-form ADT-1. Also, it’s essential to file form ADT-1 within 15 days of the annual general meeting of the company.

Due Date for Filing ADT-1 Form

Also, there is a strict time within which companies have to inform ROC about the newly making decision to appoint a new auditor for the company. Companies are required to file Form ADT-1 within 15 days of the meeting in which they decided on the appointment of a new auditor.

Required Details to be Presented by the Auditor

Certain details about the auditor are necessary to fill in Form ADT-1, doesn’t matter whether it’s a firm or an individual. Some of these details are Official Email, PAN number, Chartered Accountancy membership number, Date of AGM, Date of Appointment, Period of appointment, Date of vacancy, the reason for vacancy, etc.

Required Documents Submitted with ADT-1 e-Form

- Copy of the Resolution passed in AGM about appointing an Auditor.

- Auditor’s clearly written consent for the new appointment.

- A declaration from the auditor stating that he is eligible and not barred from appointment as an auditor under section 141.

- Copy of the notification provided to the auditor by the company

Important Points to Determine While Filing ADT-1 Form

- It’s mandatory for all companies, whether they are public or private, listed or unlisted, to fill out Form ADT-1.

- It is a widespread misconception that the first auditor of newly formed companies is not required to fill out form ADT-1. And the reason for this is so because Section 139 (1)—the appointment of auditors—is covered by Rule 4 (2) of the 2014 Company Rules, but not Section 139 (6). But it’s the best practice to file Form ADT-1 even if this is your first auditor appointment.

- It is the company’s responsibility, not the auditor, to submit Form ADT 1.

- Even when the auditor is appointed to fill a temporary vacancy, Form ADT 1 must be filed.

Full Process to File e-Form ADT-1 Via Gen Complaw Software

Step 1: First, install ‘Gen Complaw Software‘ on your desktop or laptop.

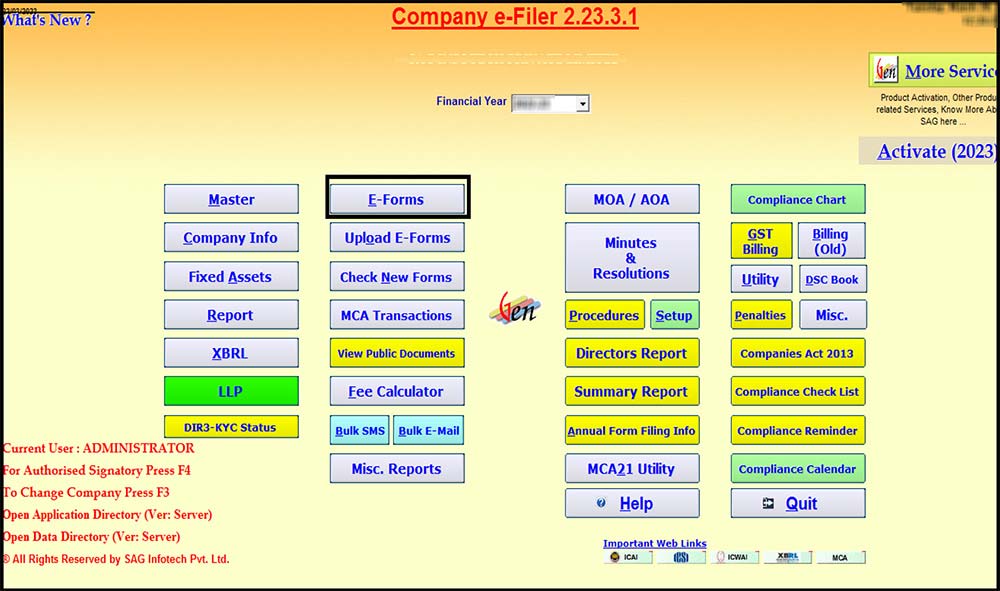

Step 2: Select the ‘Company’ and the financial year for which ADT-1 is required to be filed thereafter. Select option ‘E-form’ from the main screen.

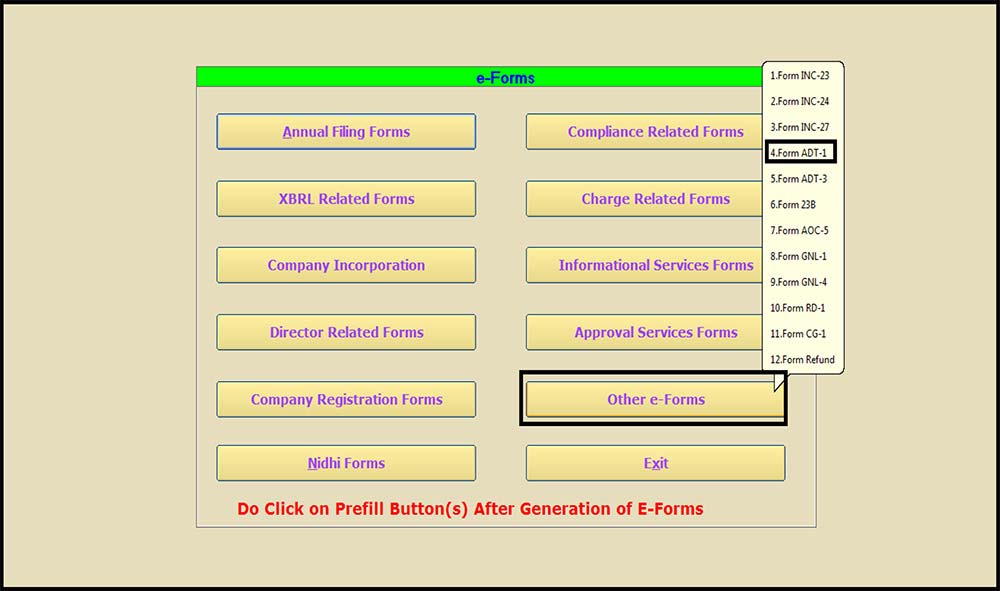

Step 3: Select the ‘Other E-forms’ Option from the Screen Page Will open after That Select E-Form ADT-1.

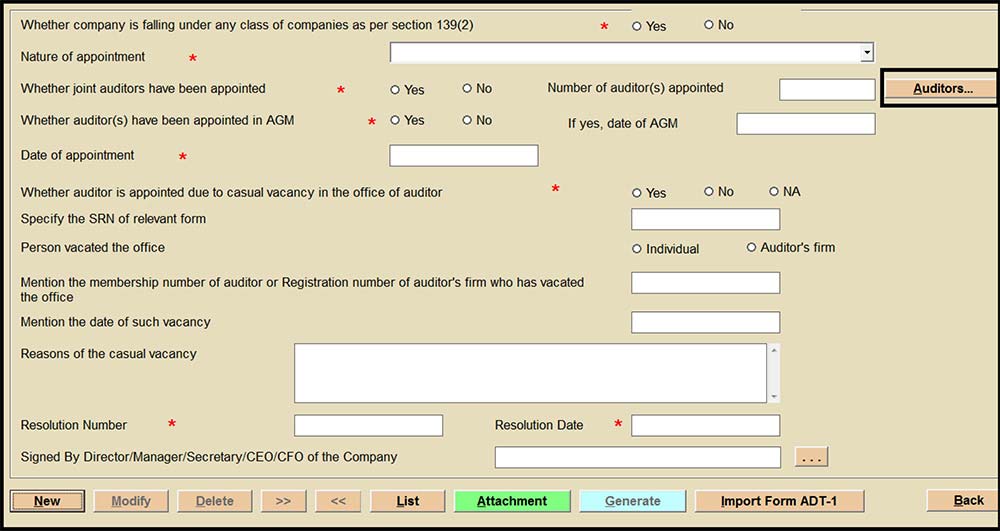

Step 4: Select ‘New ‘ To Fill New Form, If You Have Already Filed the Form In Complaw Software and Want To Modify then select ‘Modify’.

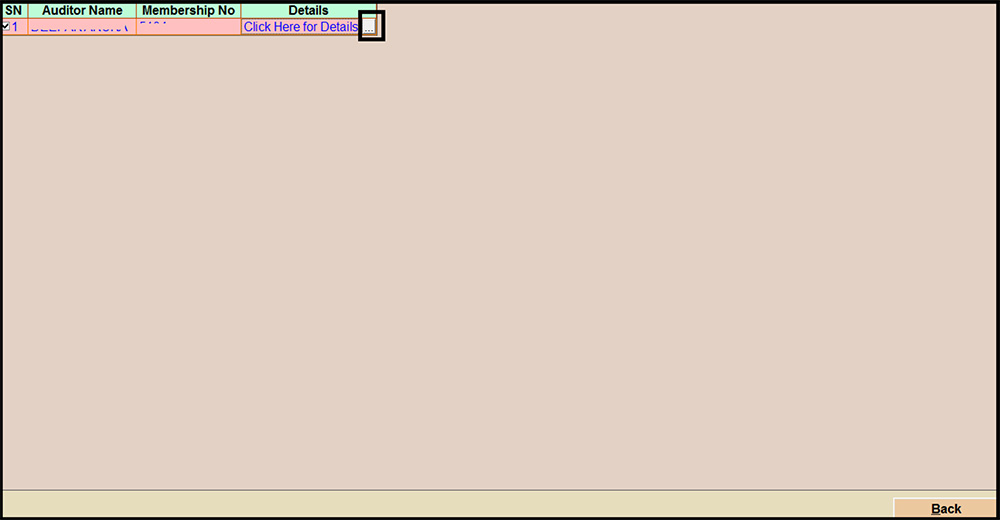

Step 5: After selecting the new/modify option, fill in the details asked. Select the nature of appointment to fill in the details of the auditor, select the option from ‘Auditors’.

Step 6: Select the ‘Details option’ to fill in the details.

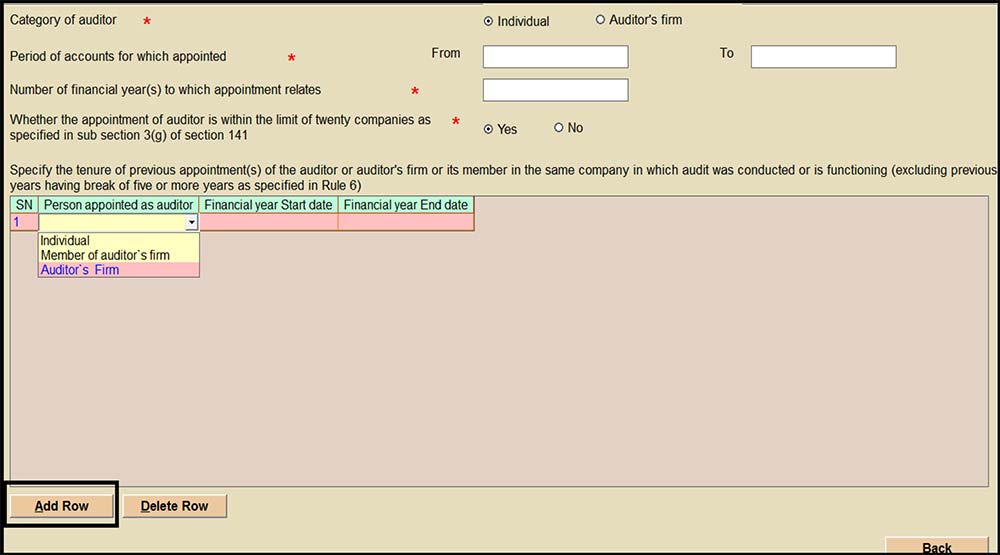

Step 7: After that, provide the details whether the auditor is appointed in AGM, date of appointment, whether the appointment is recommended by the audit committee has been considered by the board of directors before the appointment. Also specify the SRN of INC-28 filed with the ROC for notice of the order of the tribunal for the appointment of an auditor.

Step 8: If an auditor is appointed due to a casual vacancy in the office of auditor, then specify the reason whether it is due to resignation or another reason, such as death, disqualification and fill in all the required details.

Step 9: Now, Select the Director whose DSC is required to be attached to the form and click on the save option to save the details after that Attach the required attachment by selecting the attachment option and after providing all the relevant information, Select the generate option to upload the form details on the MCA portal.

Step 10: You can also import the details from the ‘e-form’ ADT-1 already filed.

ROC Filing Solution by Gen Complaw software

If you ask to name one best software that has all the features for ROC and at the same time is much more user-friendly and responsive. Gen Complaw should be the clear winner without any competitor near it. Gen Complaw is a one-stop solution for MCA V3 e-Forms ADT-1 form, ROC e-Forms, XBRL, Minutes, Resolutions, Registers, and other various MIS reports. We have highly functional MCA software that performs complete XBRL E-filing without any errors.

Gen Complaw software comes with amazing features such as s Complete MCA/ROC Filing, Complete e-Filing of various MCA V3 Forms as well as all compliance-related forms, Auto Prepared Statutory Registers, Easy management of Meetings, Notices, Agenda, Minutes all in one place, Regular software updates, timely reports, etc. if you have an upcoming ROC filing don’t wait anymore, Contact us today to know more about Gen Complaw a complete solution for ROC filing and more.