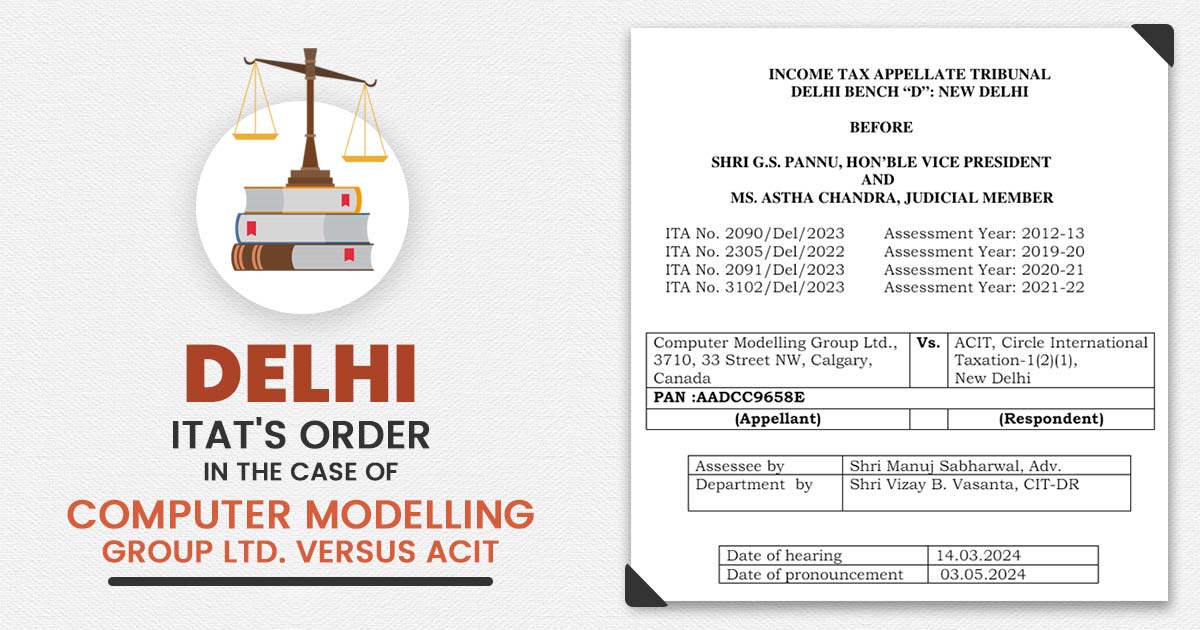

The Income Tax Appellate Tribunal (ITAT), Delhi bench, during deleting the addition under section 69A of the income tax act 1961 held that the cash gift through the brother and sister does not be treated as “unexplained.” The taxpayer, Ms. Ritu Jain claimed that towards the poor health of her husband, the taxpayer’s sister had […]