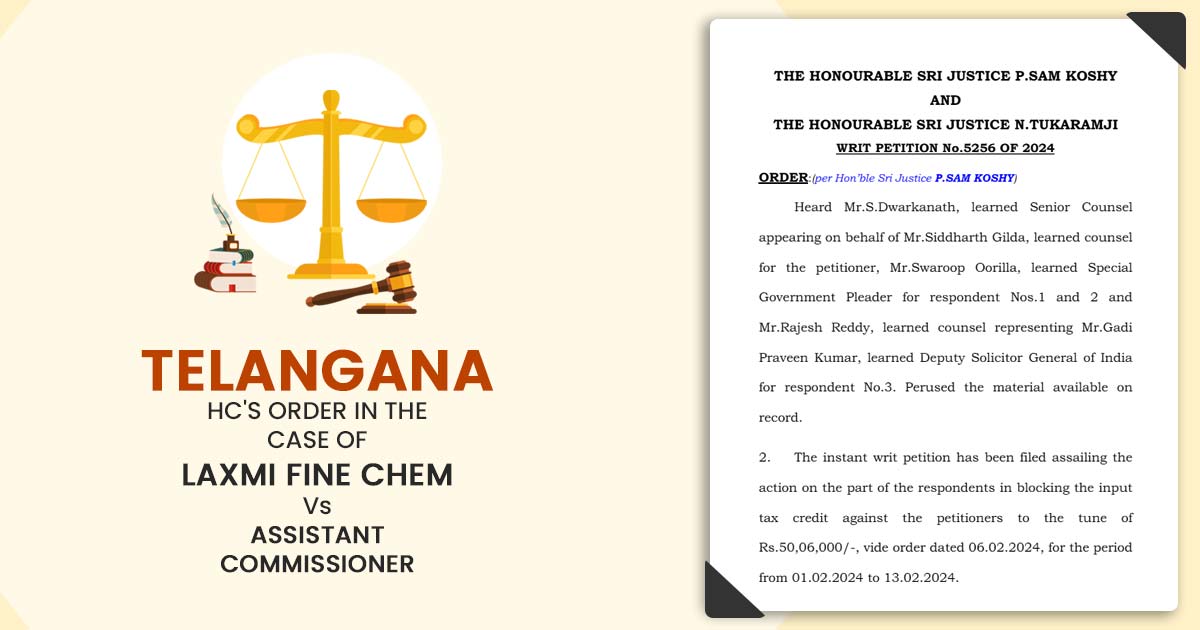

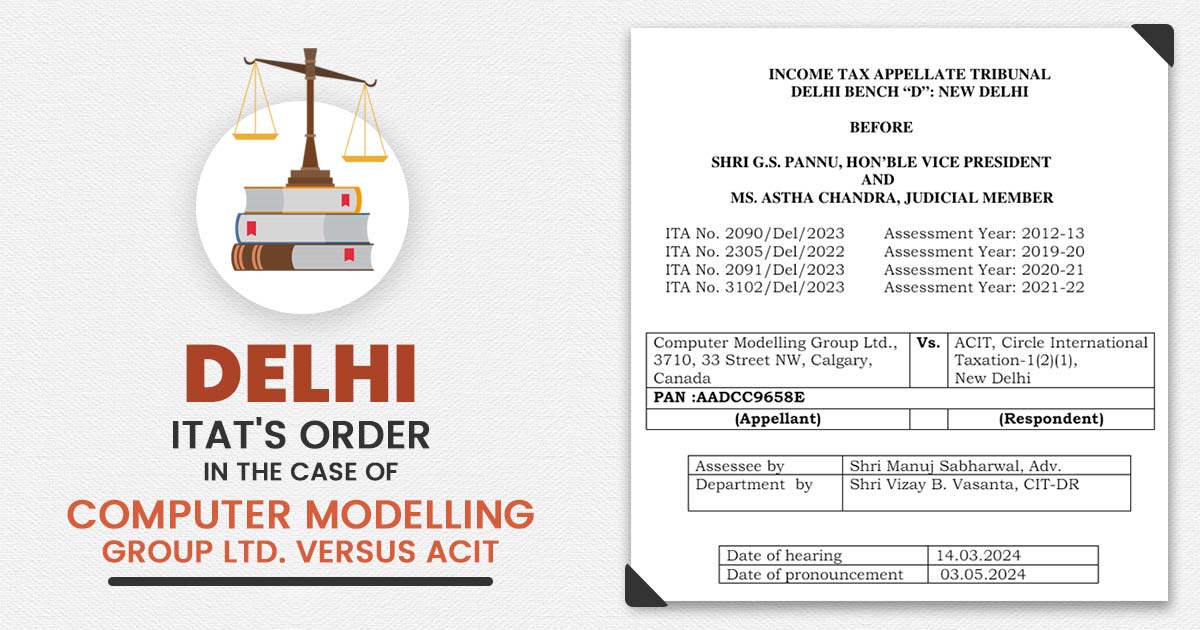

What is GST Compliance? In the ever-changing world of taxation, businesses face different kinds of barriers to ensuring adherence to Goods and Services Tax (GST) regulations. GST, a comprehensive indirect tax imposed on the provision of goods and services, has become a fundamental aspect of financial operations worldwide. This article delves into the fundamentals of […]