What is the Reverse Charge Mechanism(RCM) under GST?

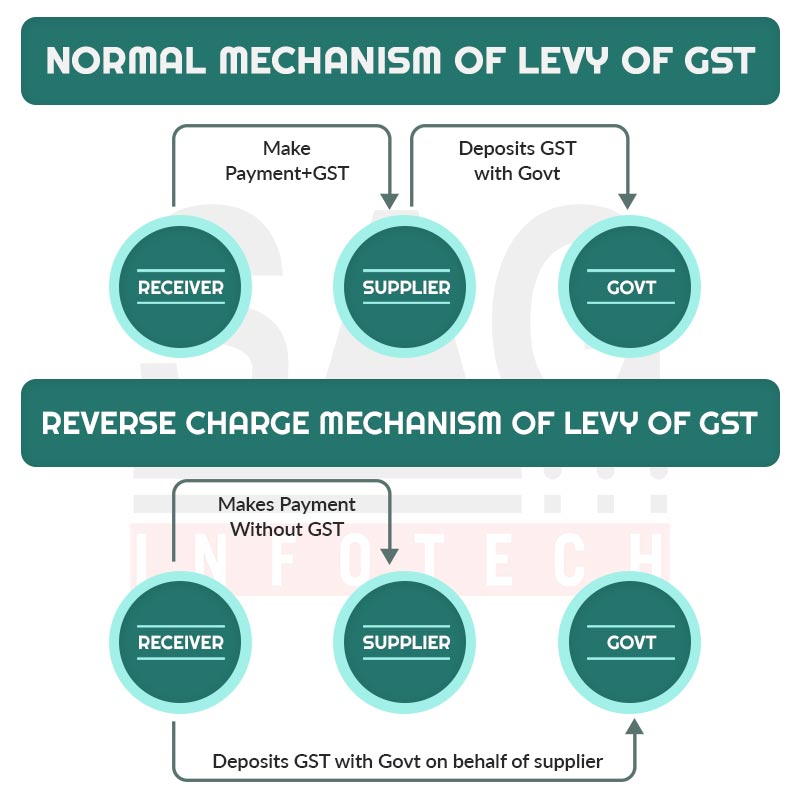

The Reverse Charge Mechanism (RCM) is the process of GST Payment by the receiver instead of the supplier. In this case, the liability of tax payment is transferred to the recipient/receiver instead of the supplier.

Latest Update

- 54th GST Council Meeting – “To bring the renting of commercial property by an unregistered person to a registered person under the Reverse Charge Mechanism (RCM) to prevent revenue leakage.”

- GST Portal has introduced a new statement for reporting Reverse Charge Mechanism (RCM) transactions called RCM Liability/ITC Statement. View more

- 53rd GST Council Meeting Update: To simplify claiming ITC, the Council recommends clarifying that purchases under the RCM from unregistered suppliers follow a specific rule. When the recipient issues the invoice for such a purchase, the relevant financial year for calculating the ITC time limit under section 16(4) of the CGST Act will be the year the invoice is issued.

The Reverse Charge Mechanism is applicable in the case of :

- Imports

- Purchase from an unregistered dealer

- Supply of notified goods and services

This reverses the scenario as the person who is receiving the goods and services needs to pay the taxes. If the receiver is purchasing goods from unregistered providers, there needs to be a GST paid on their behalf. A payment voucher needs to be issued from the supplier to the recipient. The recipient must be a registered person as per Section 2(94) of the CGST Act,2017.

As per section 2(98) of CGST Act 2017, “Reverse-Charge” means the liability to pay tax by the recipient of the supply of goods or services or both instead of the supplier of such goods or services or both

- Under sub-section (3) or sub-section (4) of section 9, or

- Under sub-section (3) or subsection (4) of section 5 of the Integrated Goods and Services Tax Act

Need GST Billing Software for RCM Dealers

Current Situation in Reverse Charge Mechanism (RCM)

In the present scenario, the reverse charge mechanism is applicable in service tax for services like Insurance Agent, Manpower Supply, Goods Transport Agencies, etc. Unlike Service Tax, there is no concept of partial reverse charge. The recipient has to pay 100% tax on the supply.

In the earlier government scenario, it was hard to collect service tax from the numerous unorganized sectors just similar to goods transportation. The effort has been made to place the services as per the existing regime and Compliances and tax collections will, therefore, be increased through the reverse charge mechanism. Currently, there is no reverse charge mechanism on the What is Mixed and Composite Supply Under GST? The reverse charge may be applicable for both goods and services.

RCM Provisions Under GSTR Forms – GSTR 1 – GSTR 2

This system is being carried forward from the VAT regime. In case the supplier is registered, but the goods or services come under the reverse charge mechanism, the input tax credit cannot be claimed by the supplier as the tax is not credited by him but the receiver is paying the taxes.

In the case of importers of goods, taxes need to be paid under the reverse charge mechanism to the Government on the import. This is in addition to the import duties.

The details of the charges pertaining to the inward supply of goods or services are to be mentioned in GSTR 1. The details of inward supply are stated in the form GSTR 2.

A person who is liable to pay tax under the reverse charge mechanism needs to be registered under GST irrespective of the turnover.

The goods/service supplier gets the input tax credit that is paid under the reverse charge. The only condition is that the input tax credit is used only for the furtherance of business.

The list of services to be included under the reverse charge mechanism are:

- Goods Transport Agency

- Recovery Agent

- Director of a company or body corporate

- An individual advocate or firm of advocates.

- An insurance agent

The Scenario Where Reverse Charge Will Be Applicable under GST

Supply by Unregistered Dealer

In case an unregistered person is selling goods or providing any services to the registered person, then the liability to pay tax shifts on the registered person i.e. the recipient of goods/services, where such supply is of taxable supplies. No reverse charge mechanism in the case of exempted supplies.

The tax will be paid by the registered dealer and all the provisions of the act will be applicable to him as if he is the supplier of the goods or services The concept behind this is to prevent tax evasion since it would be almost impossible to collect tax from the unregistered dealer. It would increase tax compliance and promote transparency. Input credit will be allowed to the registered dealer for the tax paid by him under the reverse charge mechanism.

Recommended: What is Mixed and Composite Supply Under GST?

This extra compliance under the Act will force all the registered persons to purchase goods only from the registered dealers and this is what the new regime aims at.

Under RCM, Who is Responsible for Paying GST?

RCM requires that the recipient pay GST on goods/services. Nonetheless, in order to comply with GST law, the supplier of goods is required to indicate whether RCM tax is due on the invoice.

RCM GST payments should be made keeping the following points in mind:

- ITC on RCM tax amounts can only be claimed by recipients of goods or services if they are used to conduct business or further that business.

- If a composition dealer discharges liability under RCM, he should pay tax at the normal rates, not the composition rates. Additionally, they are not eligible to claim GST credit.

- RCM tax payables or charges can be subject to GST compensation cess.

For Services Provided by E-commerce Operator

In the case of services provided by e-commerce operators, the liability to pay tax lies on the recipient of services. If the assessee has no physical presence in the taxable area, then the representative of such an e-commerce operator will be liable to pay tax. If there is no representative, then the assessee has to appoint one who will be liable to pay GST.

For Services

CBEC has notified a list of services on which the reverse charge mechanism will be applicable under the GST

| S. No. | Provider | Recipient |

|---|---|---|

| 1 | Goods transport agency | Casual Taxable person, body corporate, partnership firm, any society, factory, any person registered under CGST, SGST, IGST Act |

| 2 | Recovery Agent | Banking Company, NBFC or any financial institution |

| 3 | A director of a company or a body corporate | A company or a body corporate |

| 4 | An individual advocate or firm of advocates, An arbitral tribunal | Any business entity |

| 5 | An insurance agent | Any person carrying on insurance business |

| More: Illustrative list on which the reverse charge mechanism is applicable for services |

Supply of Goods Under RCM

| S.No | Description of Supply of goods | Supplier of Goods | Recipient of Goods |

|---|---|---|---|

| 1. | Cashew nuts, not shelled or peeled | Agriculturist | Any registered person |

| 2. | Silk yarn | Any person who manufactures silk yarn from raw silk or silk worm cocoons for supply of silk yarn | Any registered person |

| 3. | Raw cotton | Agriculturist | Any registered person |

| 4. | Used vehicles, seized and confiscated goods, old and used goods, waste and scrap | Central Government, State Government, Union territory or a local authority | Any registered person |

Supply of Services Under RCM

| S. No | Description of Supply of Service | Supplier of Goods | Recipient of Service |

|---|---|---|---|

| 1. | Any service supplied by any person who is located in a non-taxable territory to any person other than non-taxable online recipient | Any person located in a non-taxable territory | Any person located in the taxable territory other than non-taxable online recipient. |

| 2. | GTA Services | Goods Transport Agency (GTA) who has not paid integrated tax at the rate of 12% | Any factory, society, cooperative society, registered person, body corporate, partnership firm, casual taxable person; located in the taxable territory |

| 3. | Legal Services by advocate | An individual advocate including a senior advocate or firm of advocates | Any business entity located in the taxable territory |

| 4. | Services supplied by an arbitral tribunal to a business entity | An arbitral tribunal | Any business entity located in the taxable territory |

| 5. | Services provided by way of sponsorship to any body corporate or partnership firm | Any person | Any body corporate or partnership firm located in the taxable territory |

| 6. | Services supplied by the Central Government, State Government, Union territory or local authority to a business entity excluding, – (1) renting of immovable property, and (2) services specified below- (i) services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Central Government, State Government or Union territory or local authority; (ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) transport of goods or passengers. | Central Government, State Government, Union territory or local authority | Any business entity located in the taxable territory |

| 7. | Services supplied by a director of a company or a body corporate to the said company or the body corporate | A director of a company or a body corporate | The company or a body corporate located in the taxable territory |

| 8. | Services supplied by an insurance agent to any person carrying on insurance business | An insurance agent | Any person carrying on insurance business, located in the taxable territory |

| 9. | A banking company or a financial institution or a nonbanking financial the company, located in the taxable territory | A recovery agent | Services supplied by a a person located in nontaxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India |

| 10. | Supply of services by an author, music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright-covered under section 13(1)(a) of the Copyright Act, 1957 relating to original literary, dramatic, musical or artistic works to a publisher, music company, producer or the like | A person located in non-taxable territory | Importer, as defined in clause (26) of section 2 of the Customs Act, 1962(52 of 1962), located in the taxable territory |

| 11. | Supply of services by an author, music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright-covered under section 13(1)(a) of the Copyright Act, 1957 relating to the original literary, dramatic, musical or artistic works to a publisher, music company, producer or the like | Author or music composer, photograph her, artist, or the like | Publisher, music company, producer or the like, located in the taxable territory |

| 12. | Supply of services by the members of Overseeing Committee to Reserve Bank of India | Members of Overseeing Committee constituted by the Reserve Bank of India | Reserve Bank of India. |

Points to be noted:

No partial reverse charge will be applicable under GST. 100% tax will be paid by the recipient if the reverse charge mechanism applies.

- In the case of B2B import of other services, the tax shall be payable by the recipient of services

- In the case of B2B import of goods, the tax shall be payable by the recipient of goods

Liability of Registration Under RCM (Reverse Charge Mechanism)

Under Reverse Charge Mechanism who is liable to register in the new tax regime?

- A person who pays taxes under reverse charge is required to register under GST irrespective of the threshold and the annual threshold Limit is 20 lakhs (10 lakhs in the case of Hill states and North Eastern State)

Note: In the GST council meeting, states were given the liberty to impose a double threshold limit for registration i.e. 40 lakh up from the earlier INR 20 lakh.

Time of Supply

Under GST, time of supply means a particular point in time when the goods or services are rendered or supplied. It allows us to find out the tax rate, value and due dates for filing returns. Under the Reverse Charge Mechanism, the receiver is entitled to pay GST. However, the time of supply for supplying goods and services under reverse charge varies from the supplies which are under forwarding charge.

How do Find Out the Time of Supply under the Reverse Charge Mechanism (RCM)?

In the case of Goods: Time of supply in case of supplying goods when tax payable under Reverse Charge, whichever is earliest from the following dates:-

- the date of the receipt of goods;

- the date of payment as entered in the books of account of the recipient;

- the date on which the payment is debited in his bank account, whichever is earlier;

- the date immediately following thirty days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier

Note: However, if it is not possible to find out the time of supply in the above-mentioned cases than the time of supply will be considered the date of entry in the books of account of the recipient of the supply.

Let us understand by an example given below:-

- Date of Payment – 18th June 2023

- Date of Invoice – 1st July 2023

- Date of Entry in books by the recipient – 19th June 2023

In this case, the time of supply will be 18th June 2023

If the supplier is located outside India, then the time of supply shall be the earliest of: ‘When the amount is paid i.e. the date of payment’

OR

‘When the recipient records the payment in his books of account’.

In the case of services: Time of supply in case of supplying services when taxes are payable under reverse charge mechanism, whichever is earliest from the following dates:-

- The date of payment; or

- The date immediately following after sixty days from the date of issue of the invoice by the supplier; whichever is earlier

However, if it is not possible to find out the time of supply in the aforementioned cases, the time of supply will be considered the date of entry in the books of account of the recipient of the supply.

Let us understand by an example given below:-

- Date of Payment – 18th August 2023

- Date of Invoice – 1st September 2023

- Date of Entry in books by the recipient – 19th August 2023

Note: In this case, the time of supply will be 18th August 2017, Due to some reasons if the time of supply can’t be ascertained under 1 or 2 heads, in this case, it will be 19th August i.e., the date of entry in books by the recipient.

There are two types of reverse charge scenarios mentioned in the law. The first one is dependent on the nature of the supply and the nature of the supplier. This is covered under section 9 (3) of the CGST/ SGST (UTGST) Act and section 5 (3) of the IGST Act. The second one taxable supply made by the unregistered person to a registered person covered under section 9 (4) of the CGST/SGST (UTGST) Act and section 5 (4) of the IGST Act.

The Manner of Payment of GST under the Reverse Charge Mechanism

As per section 49(4) of CGST Act’2017, ITC can be used for payment of output tax only. Therefore tax under reverse charge can be paid through cash only without availing the benefit of ITC. The supplier must mention in his tax invoice whether the tax is payable on reverse charge.

Input Tax Credit:

The service recipient can avail of Input Tax credit on the Tax amount that is paid under reverse charge on goods and services. The only condition is that the goods and services are used or will be used for business or furtherance of business.

If the composite dealer falls under the reverse charge mechanism then the dealer is ineligible to claim any credit of tax paid. The tax will be paid at the normal applicable rates and not at the composition rates.

Registration Requirement under Reverse Charge Mechanism (RCM):

As per Section 24 of CGST Act 2017, A person paying tax under the reverse charge mechanism has to compulsorily get registered even if the turnover is below the threshold limit.

Applicability of GST Compensation Cess:

GST Compensation Cess will be applicable on tax paid under the reverse charge mechanism also. The purpose is to compensate States for loss of revenue on the implementation of GST. This will be applicable for 5 years from the date GST gets implemented.

Important Points to be Taken Care Under RCM :

- Goods and services notified under section 9(3) or section 9(4) must have a person registered under GST.

- Under the reverse charge mechanism, the GST applicable must be submitted to the government on every 20th of next month

- The input tax credit will be available for all the RCM goods and services used for the furtherance of business according to the GST paid. And the service-acquiring individual, who is also paying the reverse charge can take the benefits of an input tax credit.

- There will be no auto-population of details of the GST paid under the RCM in GSTR 2, but it will be subjected to the manual furnishing of details.

- Wherever the RCM is applicable the invoice must be arranged by the recipient on itself while the invoices along with the consolidated purchases should be issued on a daily basis. on all the GST applicable who are under section 31(3).

- A payment voucher must be issued by the recipient during the period of supplier payment.

- The ITC is not available for the reverse charge payment to the authority.

- The composition scheme registered individuals also come under the reverse charge, well there will be no credit of RCM availed.

- The reverse charge mechanism applies to payments made in advance also.

Note: If in case, a dealer is unregistered under GST, then he is not allowed to deal in any interstate transactions. For any reverse charge mechanism to be applicable, there must be only intra-state transactions.

Conclusion: With the biggest tax reform ready to be implemented, the Reverse charge mechanism is not a new concept as we are already dealing with this in the service tax. But imposing a 100% reverse charge is definitely a big change. There are both pros and cons of this reverse charge mechanism but then no accurate conclusion can be drawn currently as to how society will be impacted by its imposition. On one hand, it will definitely be burdensome for the small supply receivers, but on the other hand, it will increase tax compliance for the country as a whole and would increase transparency.

Non GST supply . RCM paid for transportation from registered and unregistered . is there any rule to avail ITC other than RCM ( like GST paid on rent , insurance , professional fees etc..) and then reverse ITC OF RCM AND OTHER ITC .

sir god morning. RCM latest Notification for Building RCM Paid for the month of Effect from Jul’2024. but my question is Laster 55th GST Counseling Composition Scheme not Mentratry.

your Opinion.

IS RCM APPLICABLE ON

1. Since Rent Agreement was for 5 years , We Got Rent Agreement registered in Government , its charges where about 1.5 Lakhs, is rcm applicable for it

2. DISH Factory License , Inspector of Factories

3. Partnership Renewal Fees, paid to Registrar of companies

4. Import export code application fees

The invoice from an RCM vendor who has given ‘services’ to us in July 01 has submitted the invoice dated July 01, for payment, on next month ,August 21, after their GSTR 1 filing. As the RCM has to be paid before 20th of the month by the beneficiary:

1) whether penalty will be imposed on next 3B filing as the accounts of the beneficiary is debited on Aug 21

2. Is it possible pay RCM alone before filing the next month 3B returns, without penalty.

3. Can suggest any alternate method to avoid penalty.

thanks

Sir, we are a REGISTERED company doing transport service business and when we filed TRANSPORTATION bill under GST it was done at 0% instead of RCM. Now we got a legal letter from our customer. The letter said that they should refund the TAX of the transportation bill made from 2020 to 2023. What is the solution for this? Please give me a reply

God morning sir,We are a GST registered company in Tamilnadu and we are hiring a TV @Rs.7000 for 2 day programme in june24 in the same tamilnadu, chennai area from a unregistered GST supplier in the sameTamilnadu and whose turnover per year is below 40lacs, RCM is applicable on Rs.7000/- ? since we are getting service from unregistered supplier in the same state..Please clarify our doubt.Thanking you,K.Rengarajan