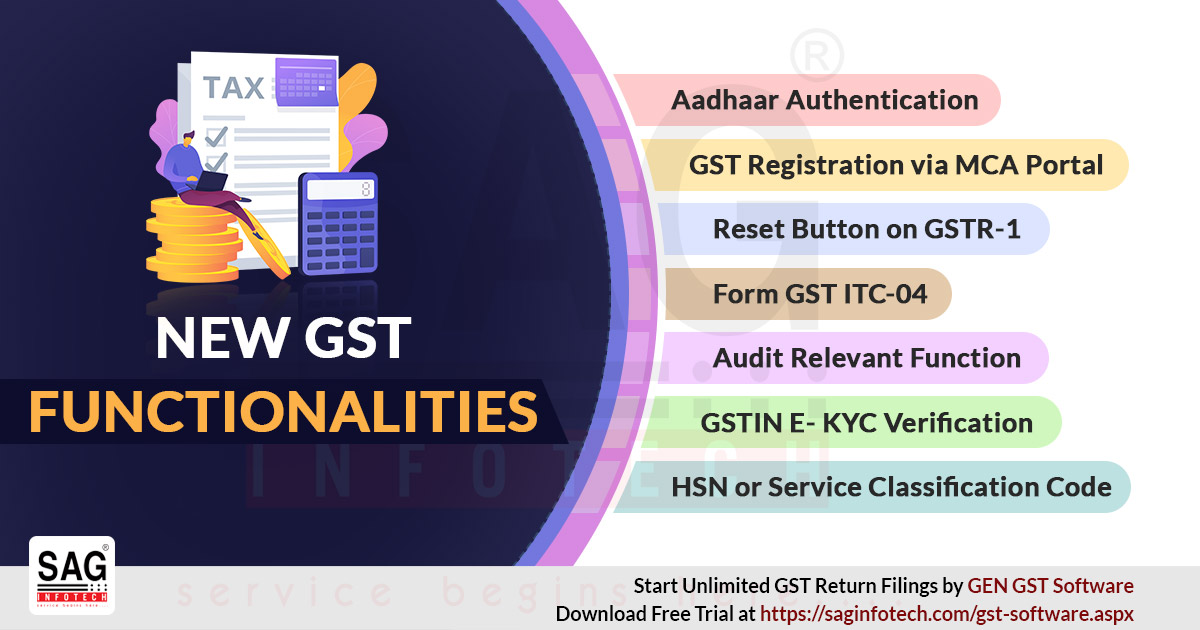

The Goods and Service Tax Networks (GSTN) is open for newer functionalities concerning the enrollment, returns, audit, front office, and Webinars Directed for Taxpayers on GST Portal.

Latest Update

13th September 2022

- The GSTN department released a presentation about August 2022 new functionalities for taxpayers. Read PDF

07th May 2022

- The GST department has deployed the new functionalities related to refund, returns, registration, etc.

New Applications to Enrollment for Some Cases with Similar PAN & State/ UT

The new enrollment applications of the petitioners, whose before application towards the enrollment were either not accepted through the assessee or whose GSTIN was revoked (either suo-moto or if surrendered by the taxpayer), will be assigned towards the corresponding authority of the state or center who has not accepted the same, whenever these petitioners or assessee apply for the enrollment beneath the same PAN and in the similar state or union territory.

Aadhaar Authentication Allowed for Persons/ Petitioners Registering for GST Registration via MCA Portal in SPICe -AGILE Form

The persons/ petitioners applying for fresh registration in GST, via the MCA portal in SPICe -AGILE Form, can choose Aadhaar Authentication

Disabling Registering Aadhaar Number Through the Taxpayers/Petitioners in the Enrollment Application

The field for inserting the Aadhaar number has been disabled for Taxpayers in two scenarios.

- Firstly through the addition of authorized Signatory/Authorised representatives through Non-Core amendment of enrollment.

- Secondly, during adding Promoter/ Partner via Core revision of registration.

The petitioner or assessee’s adding the information of the authorized Representatives in the latest enrollment application.

Opting the Core Business Activity Through the Existing Assessee on the GST Portal

The existing assessee has been given the functionality upon the GST portal to opt for their core business activity. Upon the grounds of the turnover named as the manufacturer, Wholesaler/Distributors/ Retailers, and Service Providers and others

Reset Button Enabled on GST Portal for Form GSTR-1/ IFF

The ordinary assessee’s disregard to their furnishing of the profile in a quarter or month possesses the RESET button on the GST portal in Form GSTR-1/IFF

GSTR-5A Form by OIDAR Applicants Reporting & Paying Interest & Other Amounts

The individual enrolled as OIDAR can now declare the interest and any other liabilities in Table 6 i.e.the interest or another amount of their Form GSTR 5A and release via electronic cash ledger.

Download of Table 5 data, Post Furnishing, Allowed for Form GST ITC-04

The enrolled manufacturer who are needed to furnish the quarterly Form GST ITC-04 (to implement the information of inputs or capital goods given to the job worker excluding payment tax can now download the information of table 5 of Form GST ITC-04

This is to download the information when there is a revision in the State/ UT code before the goods are taken back.

Form GST RFD-01 Furnishing Through the exporter of Services Foreign Exchange

This system will before verified the refund amount availed through the exporter of services (with payment of tax), with respect to the proceeds disclosed (with respect to the exports, as submitted by the petitioner in form of FIRC).

If in the BRC/FIRC column the value disclosed was lower than the refund amount claimed then these assessees have not permitted to furnish the refund application on the GST portal. This validation is eliminated and the assessee will be permitted to furnish the refund applications in these cases as the value disclosed in BRC/FIRC might vary because of foreign exchange variations and net realization might be lower than the refund amount.

Towards Assessee Audit Relevant Function is Open

Beneath additional notices and orders, all the notices given through the tax council are to be open to the assessee. The assessee can answer the audit notices and will upload the credentials. Assessee can accept or reject or pay the liabilities, discrepancy-wise as mentioned in the notice for the inconsistencies or in addl. Notice for Discrepancies (if any) or in Audit Report Form GST ADT-02. Towards the tax officer, the assessee applied for the Adjournment or for extension of the date of Audit

Read Also: List of Latest Features on Official GST Portal for Taxpayers

In Search Taxpayer Functionality Status of Aadhaar authentication or E- KYC verification of a GSTIN

Searching in assessee functionality both pre-login and post-login the user will be able to show the status of Aadhar authentication or E-KYC verification of the searched GSTIN.

Revision in Label and Functionality of HSN or Service Classification Code Tax Rate Search

The label for “Search HSN / Service Classification Code Tax Rate” must now be an amendment to “Search HSN Code”. The functionality will also be increased in which the user searches for the item or HSN code the output is shown in the platform beneath the linked case, the explanation of keyed in HSN code along with other linked HSN codes (all hyperlinked) along with it. (Services> User Services > Search HSN Code).

GST E-invoicing Webinar

The Webinar on e-invoicing for the assessee particularly towards those who go to execute the e-invoicing from 1/03/2021.