Gujarat Authority of Advance Ruling (AAR) has mentioned that the Selling of machinery to bring 18% GST on commission income from Japan in foreign currency.

The petitioner is the owner of Dharmshil Agencies where the agreement has done with Tsudakoma Corporation, Japan to sell the machinery with respect to the specific services, they are collecting the commission through Japan in foreign currencies.

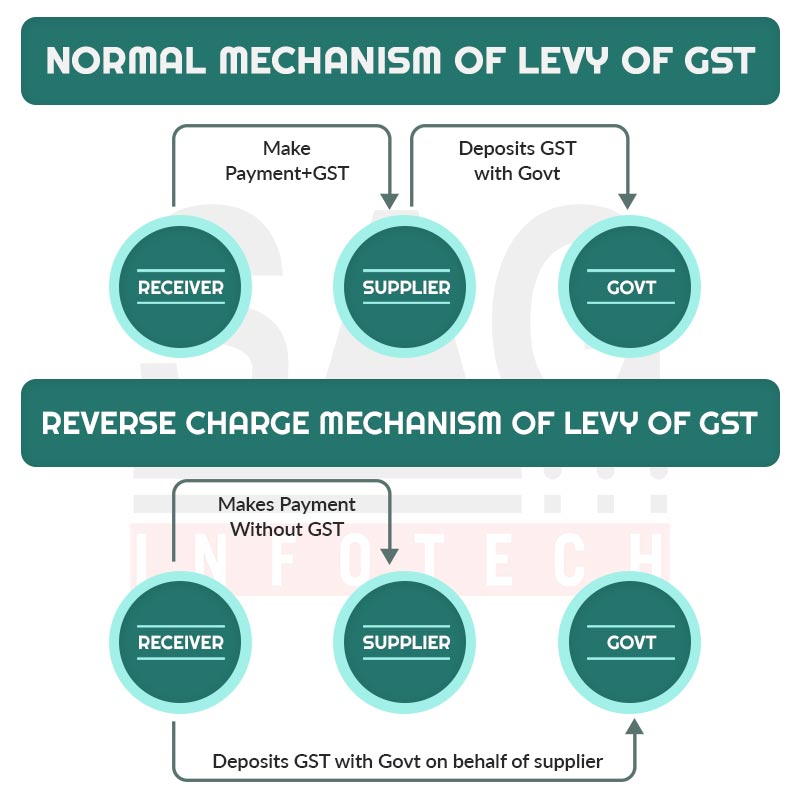

The petitioner has provided that below the service tax agreement they pay 18 per-cent tax below RCM (Reverse Charge Mechanism)

Post furnishing to the GST they initiated to give IGST and in GSTR-1 they had mentioned below export of services. Indeed they too engaged in the export of goods and they had made export with the payment of duties due to the export of services, but due to these exports, the issues are raised in ICEGATE site and they were unable to refund because of mismatch in the amounts and which they had furnished IGST up for 31 March 2018.

The petitioner stood that because of errors they examined through the GST assistance for the council and came to determine that they are payable for CGST and SGST and thus the identical was needed to be displayed in GSTR-1 below B2C transaction. The petitioner has raised the issue where the advance ruling is needed either to impose CGST and SGST or IGST

The two judges Sanjay Saxena and Mohit Agarwal ruled that the current process of GST payment which is obeyed through the petitioner that is the payment of CGST and SGST on the services given by them is conventional. With 18% the petitioner is entitled to furnish GST in terms of provision of notification No:11/2017-Central Tax (Rate) on June 28, 2017.