Covid-19 Pandemic, lockdowns, and implementation of the BS-VI norms in the country are making the way tougher for India’s Automobile industry. And with the same belief, they have appealed to the Government of India to reduce taxes to mitigate the price increase on Bharat Stage-VI vehicles. It will help to and increase the demand before the festive season.

Representatives of major vehicle manufacturers including Toyota Kirloskar Motor India Private Limited. Ltd, Maruti Suzuki India Ltd, Mahindra & Mahindra Ltd and Hero MotoCorp said that a reduction in the GST on automobiles

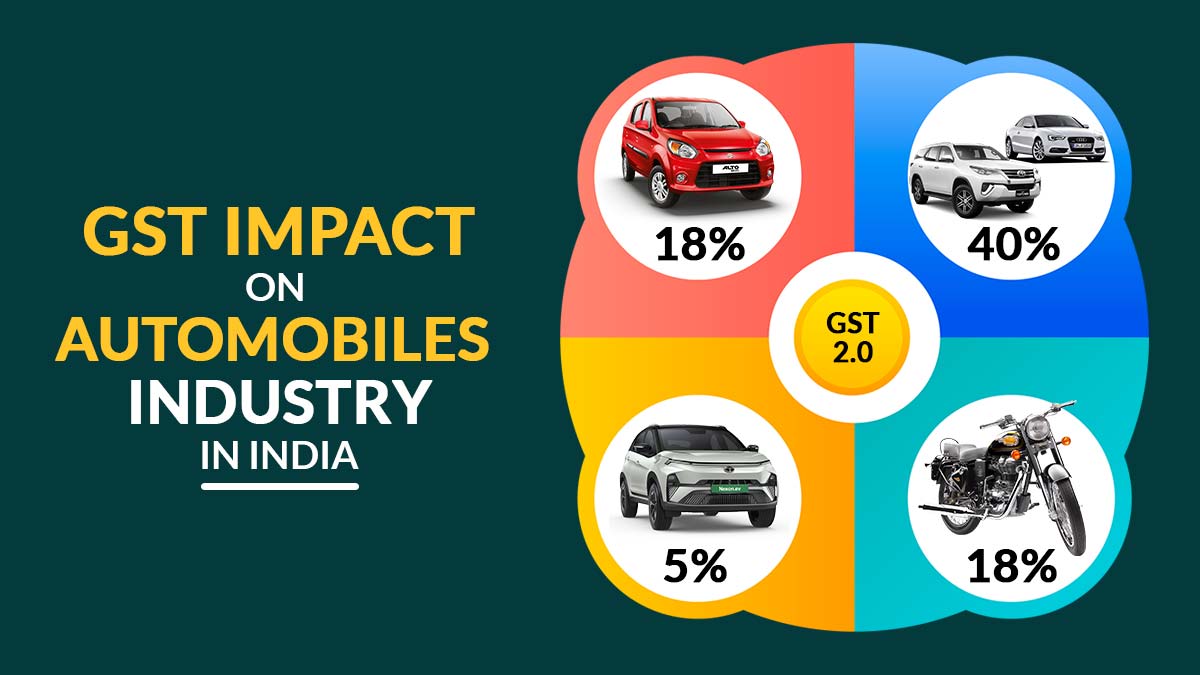

Meanwhile, if we take a look at the tax rate in the Automobiles sector then it attracts GST at a base rate of 28%

Vice-Chairman of Toyota, Shekar Viswanathan, said that high taxes on cars is keeping companies at the shore from building scale in India.

He further added that, “The message we are getting after we have come here and invested money, is that we don’t want you”. He further informed that the company has no plan to exit India but they will also not scale up their operations.

In a statement, Toyota said that The industry has been requesting the government to provide some help to the industry through an appropriate tax structure. At the current GST rate Toyota’s cars such as Innova and Fortuner, attract 43% tax.

India’s largest carmaker Maruti Suzuki India Ltd also supported the idea of reducing taxes “We will eagerly wait for GST reduction and scrappage

Ayukawa added that “The government will be able to offset the revenue loss from a reduction in GST on automobiles through increased vehicle sales as companies pass on the tax benefits to consumers,”.

Prakash Javadekar, the Union minister for environment, forest and climate change, also responded that the government needs to evaluate the possibility of GST rate cut to two and three-wheelers to increase the demand.

Society of Indian Automobile Manufacturers (Siam) already estimated that sales are going to be 25%-45% low in Financial Year 2021. Major automakers also believe that some support from the government such as tax cut can bring the sector back to the growth path. Toshihiro Suzuki, president and chief operating officer, Suzuki Motor Corp, responded that the estimated target of selling 10m units by 2030 may not be achieved.