A senior officer from Ashok Leyland recently said that Reduction in rate of GST and introducing of scrappage policy can revive the commercial vehicle sector which has been going through a tough time for quite some time now.

The Hinduja Group flagship company also expects something similar, amid the current slowdown in the industry which gets worsen due to the COVID-19 pandemic, to improve the condition gradually during the ongoing financial year.

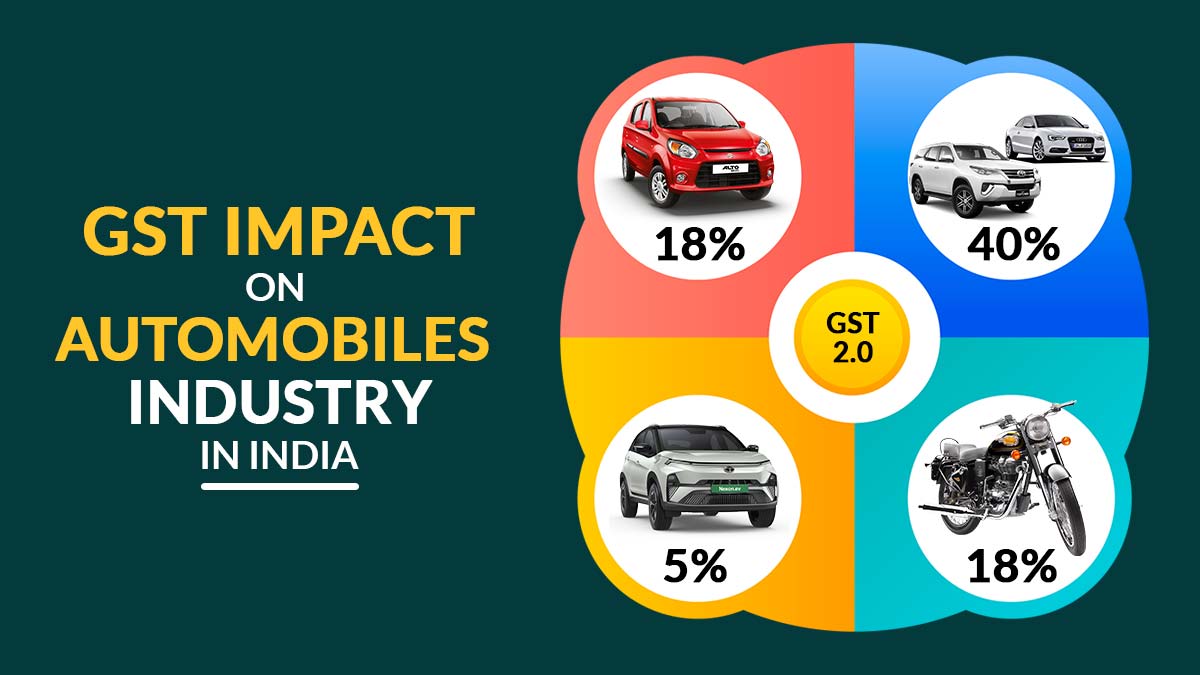

In response of if the GST rate cut on commercial vehicles would help in reviving the sector Ashok Leyland MD and CEO Vipin Sondhi told that “The answer is yes, it certainly will,”. He further added that “When you look at the commercial vehicle industry, it’s core to the country, it is pretty much the core industry…to have it at 28 percent (GST rate)

Sondhi also added that “The other trigger points could be the introduction of a scrappage policy and more investment in rural India”.

In the response of queries related to the sales outlook for the commercial vehicle industry in the current financial year, Sondhi said, “Fundamentally what we are seeing is that each segment of the commercial vehicle industry will have its own trajectory.”

However, he further clarified that the situation will depend on various factors such as the impact of reforms initiated by the government, availability of liquidity at the right time, and some other factors.

“I think every quarter will be better than the previous one and we will have to be ready,” he added.

Meanwhile, as per recent updates in the same matter, the auto industry body, SIAM has been requesting the central government for a rate cut in GST on vehicles

The Central government also indicated that it is working on a scrappage policy