The new e-invoice system has brought the policy in which there is no need for data entry of purchase invoice to be done by the buyer. The e-invoice states that the invoice will be shared electronically and viewed among the accounts department of the buyer. The invoice will present in the system before the arrival of the goods and services.

However, the experts from the trade industry have fostered that due to limited roll-out of the e-invoice has not served the purpose as defined. Previously the government had planned the e-invoice for 100 cr or more but after the voice raised from Small, medium and large scale industries the Government has now decided to raise it to 500 cr or more as from October 1, 2020.

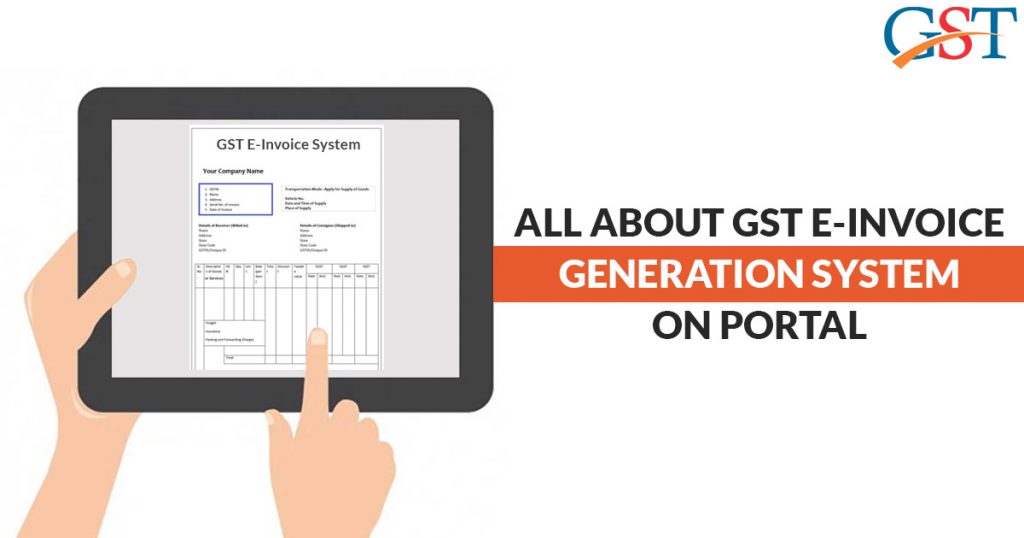

The aim of implementing the subject is to have an invoice in a proper format so that ERP’s will read and use it. The ERPs provide proper formatting and eliminate the multiple reporting by taxpayers in various formats for e-way bills and another for filing returns Know the details of GST forms such as return filing Sugam, Sahaj, rule, registration, challan, refund, invoice that will facilitate the taxpayers to file online easily. Read more

E-invoice will not require any data entry for the purchase invoice because the invoice will be shared electronically and then it will be used for the accounting system. The reporting of e-invoices in GST portals gets generated from the standards made by the Government which leads to pre-filled sales purchasing the returns.

In earlier times the government had first decided to mandate e-invoices to those companies whose turnover is 100 cr or more. But now the limit is extended to 500 cr or more.

The smaller companies might face issues regarding the new GST e-invoice system

From the GST networks point of view, the companies involved in providing the 70 percent of the business that has been enrolled whose turnover is less than Rs 5 cr.

The experts discuss that during the time of pandemic the government could have postponed the incomplete e-invoicing system for a few months in order to accommodate a much larger section of registered businesses.

The e-invoice platform will provide the automatically if the services will be provided among all the small as well as medium enterprises. An industry person states that implementing the e-invoice will prove to be an effective solution if automation is done within small and medium scale businesses.