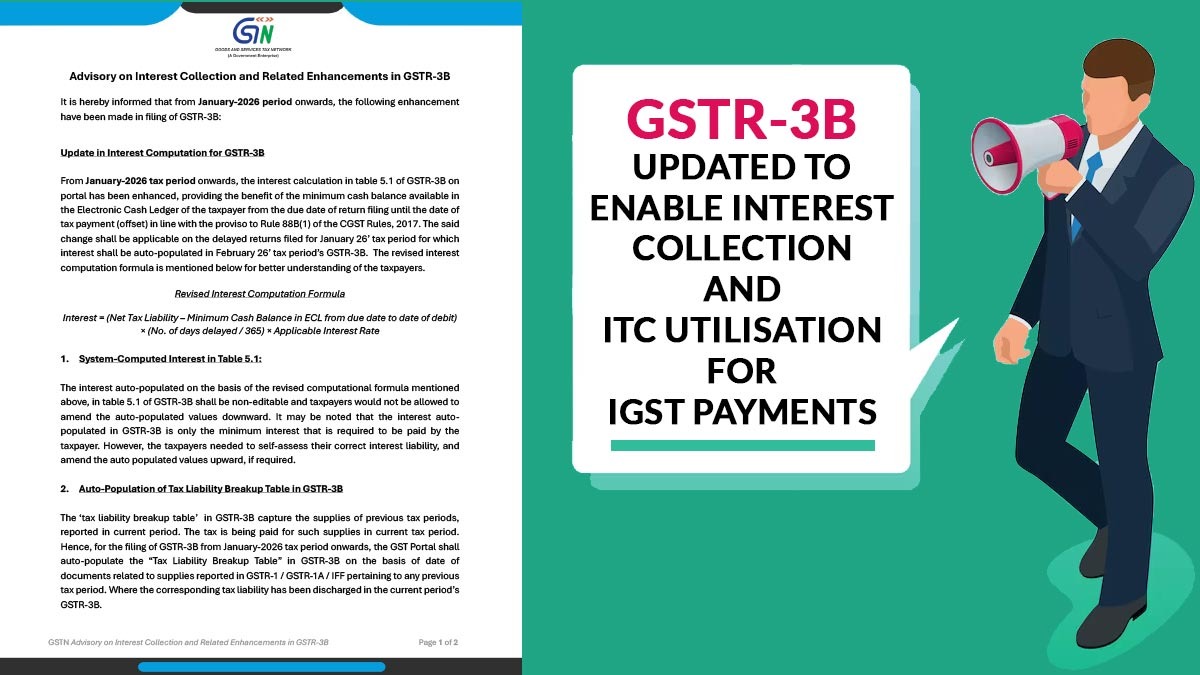

The Goods and Services Tax (GST) network has introduced an important update about how interest is collected and how businesses can use their input tax credits in their monthly GST returns. This change builds on an earlier announcement made on January 30, 2026.

The goal is to give taxpayers more flexibility in handling their tax responsibilities, making it easier for them to manage their payments.

Important Update: GST ITC Utilisation Flexibility Rolled Out

The GST authorities have announced an important update for taxpayers. Starting from the tax period in February 2026, taxpayers will be able to use their CGST or SGST credits to pay off their IGST liabilities. This change will take effect once they have used up all of their available IGST credits.

The same enhancement aligns with point number 3 of the earlier advisory and is anticipated to ease the payment process of tax while enhancing the cash flow management of businesses.

For Taxpayers is Significant

With this update, taxpayers filing returns in GSTR-3B can now:

- “Use CGST or SGST input tax credit towards IGST liability”

- “Choose the order of utilisation after fully exhausting the IGST credit”

- “Experience improved flexibility in tax set-off mechanisms”

- “Reduce cash outflow where sufficient ITC balances are available”

Enhancement Aim

The decision is part of the current measure to improve transparency and ease compliance within the GST framework. The update, via permitting the effective flexibility in ITC usage, has the motive to reduce the procedural bottlenecks and assist in the seamless filing of returns for taxpayers.

Addendum to Advisory

On January 30, 2026, the same update is issued in continuation of the advisory, which specifies amendments for the interest calculation and Input tax credit (ITC) usage regulations.

Important: How GST Software Resolves GSTR-3B & 2A/2B ITC Mismatches

Taxpayers should review their ITC balances at the time of filing returns for the February 2026 period to ensure precise reporting and compliance.

Read Official PDF