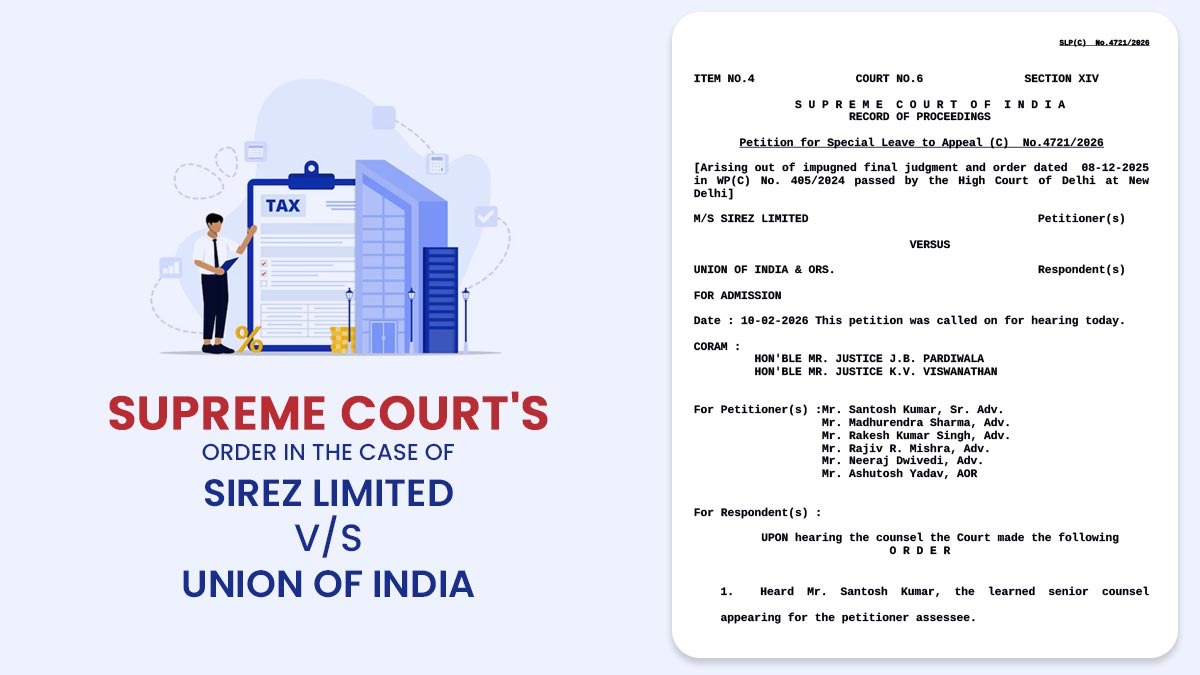

The Supreme Court of India will examine whether the Income Tax Department can accept a tax return filed 30 months late. The case is under review because the taxpayer was unable to carry forward business losses or claim a TDS refund due to the delayed filing

M/s Sirez Limited filed a Special Leave Petition questioning whether the Income Tax Department has the power under the Income Tax Act, 1961, to condone delays in filing an Income Tax Return.

The case has emerged via an earlier writ petition before the Delhi High Court, where the taxpayer sought the setting aside of the Central Board of Direct Taxes (CBDT) order through which the applicant’s application for condonation of delay and praying for release of TDS refund was denied for the reason of limitation itself.

The applicant’s company did not submit its ITR for AY 2018-19 within the extended due date of 31.10.2018 and then filed the return on 20.09.2021, resulting in a delay of approximately 30 months.

Santosh Kumar, Medhurendra Sharma, and Rajiv Ranjan Mishra, appearing for the applicant before the HC, claimed that the delay had taken place because of an inter se dispute among the directors of the company, coupled with financial hardship.

It said that losses in business are there and that refusal of condonation shall prevent it from the benefit of carry forward u/s 72 of the Act and refund of TDS. The counsel relied on judicial precedents to specify that “genuine hardship” needs to be construed liberally while exercising powers u/s 119(2)(b).

The claim has been countered by the revenue’s counsel, citing that the internal disputes among directors do not consists genuine hardships and that the company has a separate identity from that of its directors, therefore having separate regulatory requirements to comply.

The Division Bench of Justice V. Kameswar Rao and Justice Madhu Jain said that internal disputes among directors can not explain a 30 month delay in regulatory compliance, and further said that no documentary proof was provided to substantiate extraordinary circumstances and dismissed the writ petition.

In the present SLP, the Supreme Court bench of Justice J.B. Pardiwala and Justice K.V. Viswanathan noted prima facie that ITR was filed with a delay by the petitioner for AY 2018-19.

The Court mentioned that the refusal of CBDT to condone the delay results in the rejection of carrying forward the business loss of Rs 1,06,60,750 and the refusal of refund/credit of TDS of ₹19,73,540.

Read Also: Important Points to Know When Filing ITR Using Tax Software

The Apex Court said that the question for acknowledgement was whether late ITR filing can be condoned u/s 119(2)(b) of the Act, and accordingly issued notice. The case has been listed for further hearing on 09.03.2026.

The result of this case in the future will become precedent concerning how ITR filing delays and condonation may be considered in the future.

| Case Title | Sirez Limited vs Union of India |

| Case No. | SLP(C) No.4721/2026 |

| For Petitioner | Mr. Santosh Kumar, Sr. Adv. Mr. Madhurendra Sharma, Adv. Mr. Rakesh Kumar Singh, Adv. Mr. Rajiv R. Mishra, Adv. Mr. Neeraj Dwivedi, Adv. Mr. Ashutosh Yadav, AOR |

| Supreme Court | Read Order |