The Gauhati High Court, in a ruling, mentioned that a GST demand could not be raised merely on the grounds of a summary of a show cause notice in Form GST DRC-01, and that a proper SCN u/s 73 of the Central Goods andServices Tax (CGST) Act, 2017/ Assam Goods and Services Tax (AGST) Act is obligatory.

The applicant, Md Shoriful Islam, contested the GST proceedings initiated by the Assam State Tax authorities. A summary of SCN on 02 May 2024 has been issued to him in Form GST DRC-01, which states that a SCN was attached. Merely an attachment demonstrating the tax determination was uploaded, and no separate SCN was issued.

No response was submitted by the applicant, citing that SCN was seeking him to elaborate or defend himself. Thereafter, the department passed an order in Form GST DRC-07 ministering the applicant as having accepted the demand due to non-reply.

The applicant mentioned that the attachments to both DRC-01 and DRC-07 were unsigned and that no personal hearing was provided. Established on the order, his bank accounts were also frozen.

The applicant’s counsel said that Rule 142 needs the issuance of a proper SCN u/s 73, and merely a summary could be issued in DRC-01. It was mentioned that the attachment was just a tax calculation statement and not an SCN. It was mentioned that unsigned notices and orders would not have legal value and that refusal of personal hearing breached section 75(4).

The counsel of the State specified that the summary and tax determination provide sufficient information about the reply and accepted that no separate SCN was issued. They accepted that the attachments do not consist of signatures; however, they claimed that uploading to the GST portal is directed to authentication.

Justice Soumitra Saikia stated that Section 73 needs an SCN citing causes for the demand, and a summary cannot supersede it. The court said that the attachment was just a statement u/s 73(3) and not a notice u/s 73(1).

The Court stated that a proper officer must authenticate the notices as well as the orders; also personal hearing is obligatory when an adverse order is passed.

Read Also: SC Quashes ₹8.9 Cr GST Demand, Cites Lack of Proper Service Violating Natural Justice

The Court quashed the demand order and permitted the department to initiate fresh proceedings u/s 73 after complying with the due process. The spent duration in earlier proceedings was asked to be excluded for limitation, and the bank accounts of the applicant were ordered to be frozen.

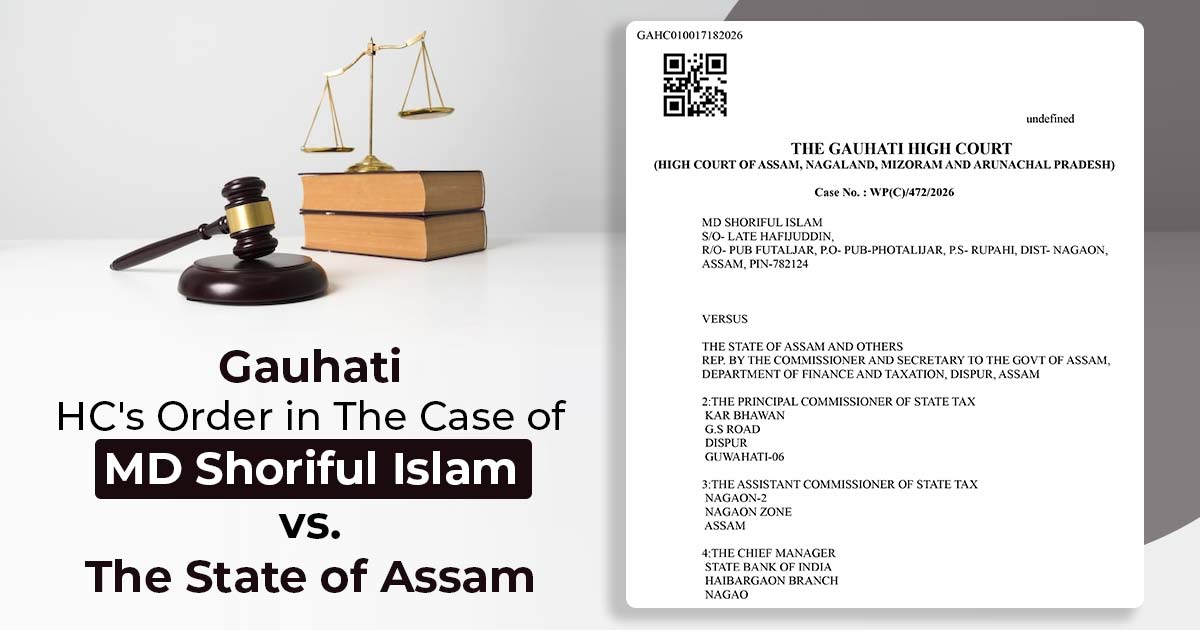

| Case Title | MD Shoriful Islam vs. The State of Assam |

| Case No. | WP(C)/472/2026 |

| Counsel for the Petitioner | MR. R S Mishra, MS. M Dey, and MS B Sarma |

| Counsel for the Respondent | SC, Finance and Taxation |

| Gauhati High Court | Read Order |