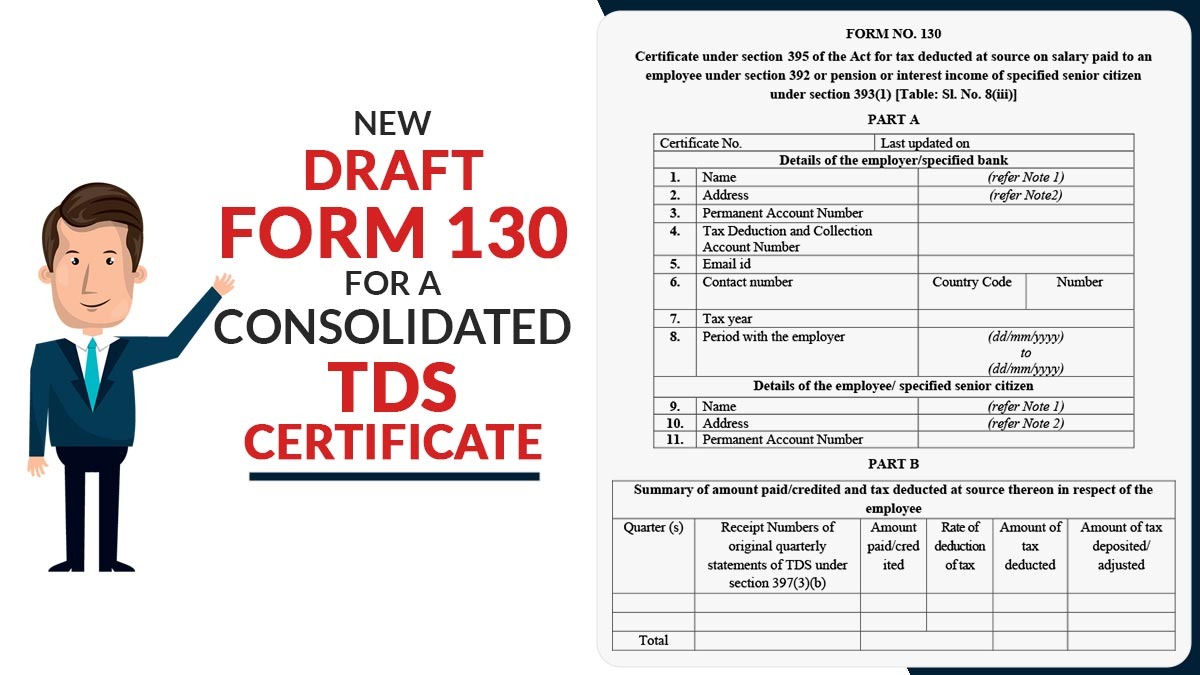

The Central Board of Direct Taxes (CBDT) has released Draft Form No. 130, offering a new consolidated TDS certificate u/s 395 of the Income-tax Act. The draft form is for easing certification of tax deducted at source on salary, pension, and specified interest income, bringing greater standardisation and reporting clarity for employers, banks, and deductors.

The proposed Form 130 will apply to:

- Income from pension

- Salary income is taxed under Section 392

- Interest income of established senior citizens under section 393(1)

New Draft Form 130

Form 130 is made as a comprehensive TDS certificate, which substitutes fragmented disclosures that are spread across multiple documents at present. It consists of the deductor details, payee particulars, tax computation, and proof of deposit in a single structured format.

The form is classified into three components:

- Part A: Details of deductor and deductee

- Part B: Tax deducted and deposited overview

- Part C: Detailed annexures based on the nature of income

Part A: Details of Deductor and Payee

Part A consists of crucial identification details of:

- A specified bank or employer

- Worker or selected senior citizen

It comprises PAN, TAN, address, contact details, tax year, and period of employment or income coverage. The format confirms uniform reporting of identity and jurisdictional data, lowering mismatch risks during verification.

Part B: Details of Tax Deduction & Deposit

Part B delivers a quarter-wise summary of income paid and tax deducted, including:

- Payment of tax deducted

- Payment deposited or changed

- Rate-wise tax deduction

It separately monitors tax paid via:

- Book adjustment (BIN-based reporting)

- Tax challan mode (CIN-based reporting under TIN 2.0)

This dual reporting procedure assures precise reconciliation with Form 137 and government payment records.

Part C (Annexure-I): Salary Income Computation

Annexure-I applies to employees protected under section 392 and contains a clear salary computation framework, along with:

The annexure shows return-level computation, improving pre-filled precision and audit traceability.

Important: How TDS Software Solves Return Filing Errors for Users

Part C (Annexure-II): Pension and Interest Income for Senior Citizens

Annexure-II is made for the particular senior citizens, which includes:

- Interest income produced by selected banks

- Tax deductions under Chapter VIII

- Pension income

- Calculation of tax liable to be paid after rebate and relief

The same targeted annexure facilitates compliance for senior citizens who depend on banks for tax deduction on pension and interest income.

Features of the New Draft Form 130

Specific compliance-friendly features are:

Effect for Employers, Banks, and Deductors

Once notified, Form 130 is anticipated to:

- Rectify matching with online TDS returns and Form 122/137

- Improve clarity for employees and senior residents

- Lessen replication in TDS certificates

- Fewer reconciliation conflicts during assessments

The form for tax professionals shows a transformation towards calculation-level disclosure at the certificate phase itself, aligning TDS reporting with the new compliance architecture under the Income Tax Act.

What is the Next Thing?

As this is a draft form, stakeholders can furnish feedback before the final notification. After execution, Form 130 is expected to become a central compliance document for salary, pension, and established interest income TDS certification.