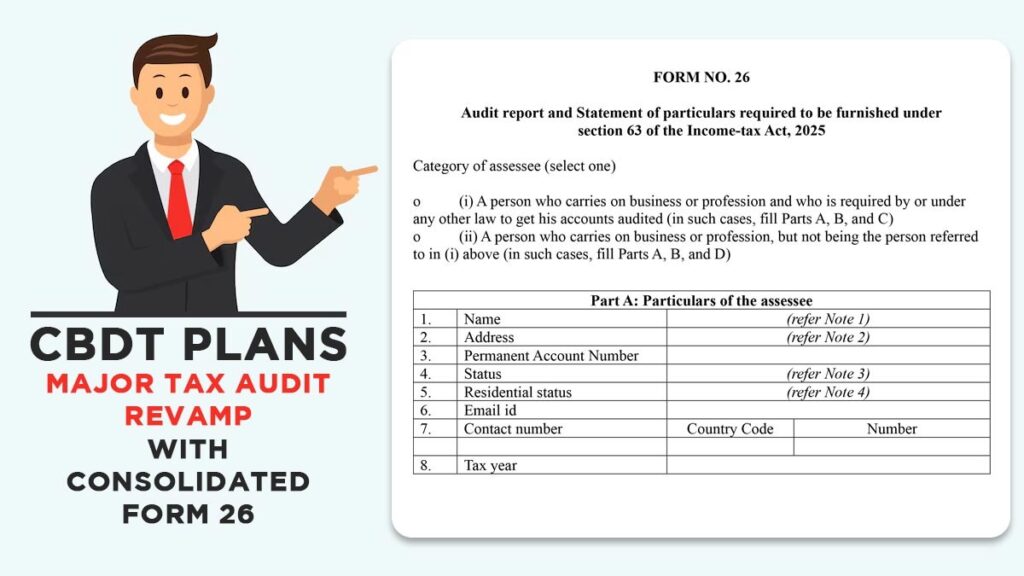

The Central Board of Direct Taxes (CBDT) has put out a new draft form called Form No. 26. This form includes a new type of audit report and a set of details that individuals or businesses will need to submit, according to the rules outlined in the Income Tax Act of 2025.

This draft form no. 26 serves as an important compliance document for taxpayers whose accounts require an audit. It signifies a move toward structured reporting, standardisation, and improved disclosures under the new tax regime.

Who Must Deliver Draft Form 26?

It is applicable for two types of taxpayers:

- An individual with a business or profession who must get their accounts audited under any other law, and

- An individual with a business or profession does not come within regulatory audit under other laws, but comes under the audit thresholds specified under the Income Tax Act.

The taxpayer, as per the category, should provide Parts A and B, along with Parts C or D, as applicable.

Framework of Draft Form 26

The draft form is classified into demarcated parts, making compliance appropriate:

- Part A: Particulars of the taxpayer: Has basic information such as name, address, PAN, status, residential status, contact details, and tax year.

- Part B: General Information: Needs disclosure of the specific clause of section 63 under which the audit is conducted, the nature of business or profession, and whether presumptive taxation provisions have been opted for.

- Part C / Part D: Audit-Specific Disclosures: These parts vary based on whether the taxpayer is earlier subject to audit under another law, ensuring tailored reporting rather than a one-size-fits-all approach.

Improved Focus on Transparency and Traceability

Draft Form 26 includes a specific feature, i.e., its emphasis on clarity for the applicability of audit, partner/member details for firms or associations, and changes in profit-sharing ratios or business activities during the tax year.

Read Also: How Income Tax Software Companies Should Prepare for Act 2025

What it Defines for Taxpayers and Auditors

- Auditors shall be required to know about the revised format and ensure precise mapping of disclosures to section 63.

- Taxpayers should prepare for granular data reporting, particularly where multiple business activities or presumptive taxation options are engaged.

- Firms and LLPs must know about the partner-level disclosures and revisions for the year.

The Solution

The draft of Form 26 has been released for review, and stakeholders are encouraged to evaluate the proposed format and provide their feedback before it is finalised. Once completed, this form will serve as a key compliance document for tax audits under the Income Tax Act of 2025, superseding the outdated reporting formats used under the previous legislation.

Form 26 in PDF Form