The Delhi High Court has refused to quash a reassessment notice issued u/s 148 of the Income Tax Act, 1961, holding that disputes of factual correctness cannot be analysed in writ jurisdiction.

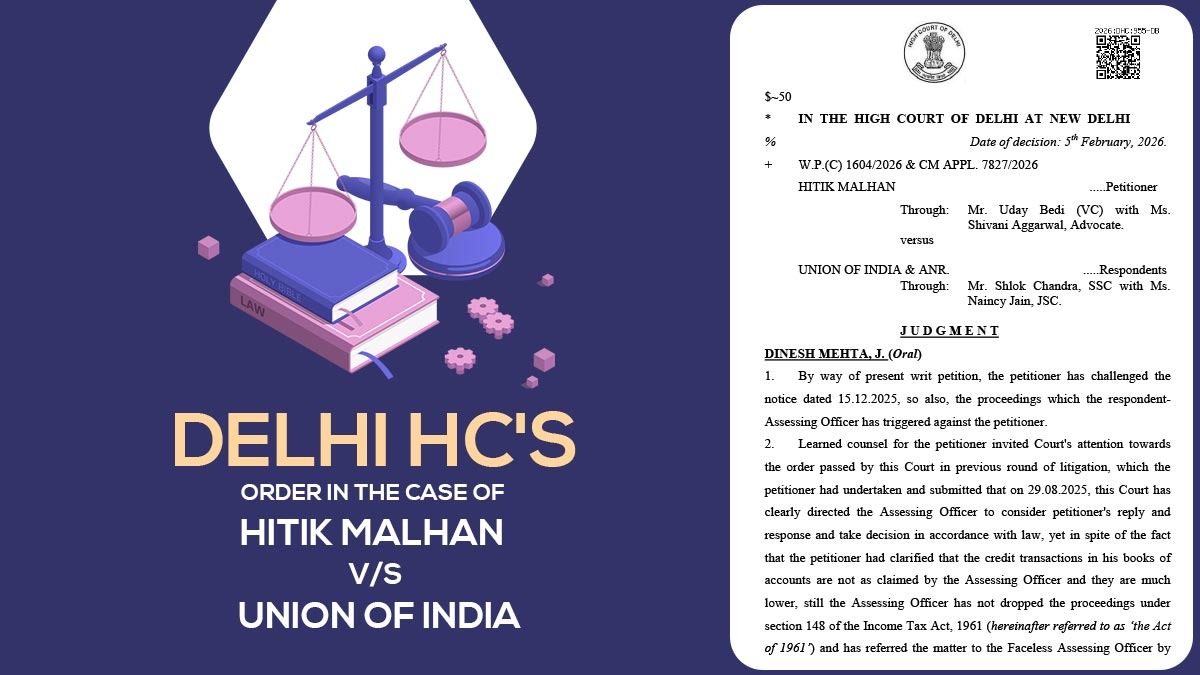

A Division Bench, comprising Justice Dinesh Mehta and Justice Vinod Kumar, dismissed the writ petition contesting the validity of the reassessment notice issued on December 15, 2025. By upholding the notice, the Court validated the subsequent procedural actions initiated by the Assessing Officer (AO), effectively affirming the Revenue’s jurisdiction to proceed with the reassessment under the Income Tax Act 2025.

The applicant had approached the HC, assailing the validity of reassessment proceedings initiated via the income tax department. It claimed that in an earlier litigation, HC had asked the assessing officer to acknowledge the response of the applicant and pass an order as per the law.

As per the applicant, even after filing a detailed reply citing that the credit entries shown in his books of accounts were lower than what was alleged via the department, the Jurisdictional Assessing Officer failed to drop the proceedings.

The case was directed for the Faceless Assessing Officer via issuing a notice u/s 144B of the Act. As per the applicant, the reassessment proceedings were vitiated because of the non-consideration of his response, and were then obligated to be quashed.

According to the Income Tax Department, in the earlier round of litigation, the coordinate Bench did not accept the opinion of the applicant and had noted that the problems raised needed adjudication via the assessing officer.

The department also mentioned that the applicant is not able to specify the way the reassessment proceedings were conducted without jurisdiction, a requirement for invoking the extraordinary jurisdiction of the HC under Article 226 of the Constitution.

Read Also: Delhi HC Sets Aside Reassessment Notice for Breaching Section 148A Norms

The High Court, post-hearing, both sides and analysing the record categorically ruled that the reassessment notice and proceedings cannot be mentioned to be without jurisdiction or fundamentally void. The Bench cited that a challenge to a notice or proceedings at the threshold phase is kept merely in specific situations, like when the action is patently without jurisdiction.

The applicant cannot expect the High Court to intervene only because they dispute the facts of the proceedings or believe that the material used by the Assessing Officer is incorrect.

The Court stressed that the Income Tax Act of 1961 furnishes a sufficient statutory procedure to handle issues stemming from incorrect or factually inaccurate assessment orders. Consequently, the High Court dismissed the writ petition and all pending applications, stating that no case for interference had been established.

Furthermore, the Court emphasised that issues concerning factual determinations should be raised and resolved before the Assessing Officer, following the established statutory framework.

| Case Title | Hitik Malhan vs. Union Of India |

| Case No. | W.P.(C) 1604/2026 & CM APPL. 7827/2026 |

| Counsel for Petitioner | Mr Uday Bedi and Ms Shivani Aggarwal |

| Counsel for Respondent | Mr Shlok Chandra and Ms Naincy Jain |

| Delhi High Court | Read Order |