The Ministry of Corporate Affairs (MCA) has announced an extension for the deadline to file the DIR-3 KYC e-form and the web-form DIR-3 KYC-WEB.

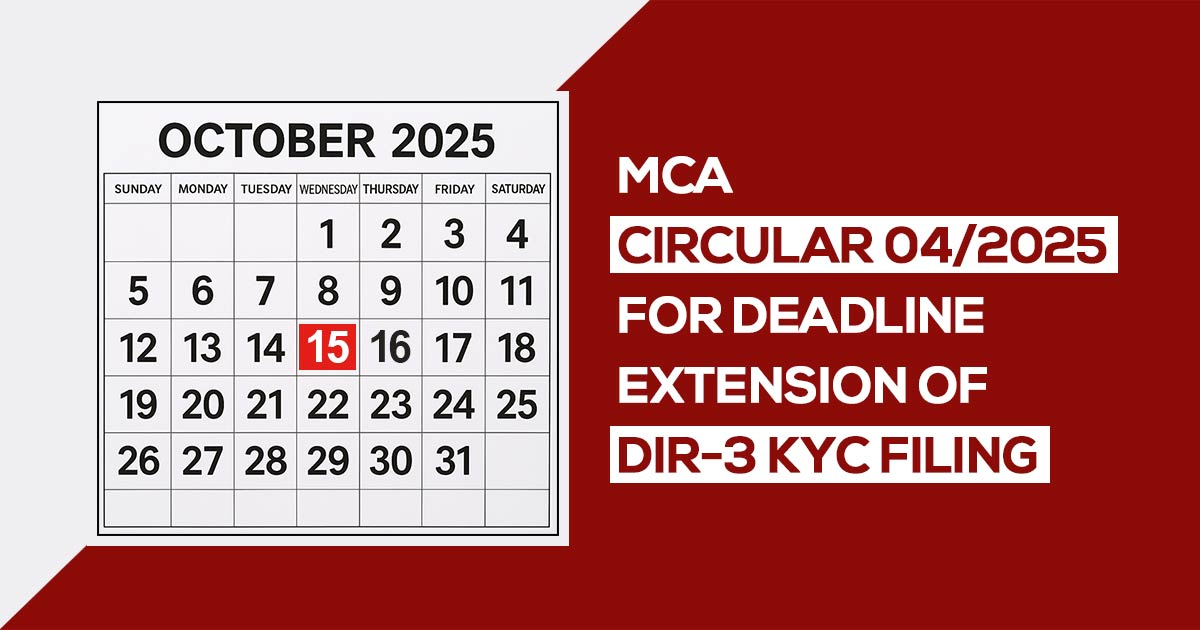

According to General Circular No. 04/2025, which was released on September 29, 2025, directors are now allowed to fulfil their KYC compliance obligations until October 15, 2025, without incurring any late filing fees. This extension provides directors with an opportunity to ensure their KYC filings are completed on time.

The previous due date to file was 30th September 2025. The ministry has provided this extension to furnish relief and ensure seamless compliance following the suggestions and representations of stakeholders.

Read Also: Latest Official Updates Under Company Law by the MCA Dept.

The DIR-3 KYC filing is an obligatory annual compliance prerequisite for all directors, assuring that their personal details and contact information remain updated in the MCA records.

Unable to file in the specified duration draws a penalty and consequence in the director’s DIN (Director Identification Number), being marked as “Deactivated.”

Directors with this extension obtain an additional 15 days to finish their filings, which lessens the stress and prevents penalties.

Read MCA General Circular 04/2025