The Chandigarh Bench of the Income Tax Appellate Tribunal (ITAT) has issued a directive for the refund of ₹37.88 lakh within one month. This decision arises from a determination that there was an under-allocation of Tax Deducted at Source (TDS) credit related to a property sale, in accordance with section 143(1) of the Income Tax Act 961.

Old: The taxpayer, Amardeep Sandhu, was a Canadian non-resident who sold a house in Chandigarh for Rs 4.65 crore in AY 2023-24, on which ₹1.20 crore was deducted as TDS at 26%. On 19-12-2023, he filed his return declaring taxable income of ₹3.71 crore, including long-term capital gains, and claimed a refund of ₹37.88 lakh.

On December 19, 2023, he submitted his income tax return, which reported a taxable income of ₹3.71 crore, including long-term capital gains. Additionally, he requested a refund amounting to ₹37.88 lakh.

U/s 143(1) CPC issued an intimation dated 19-01-2024 raising a demand of ₹29.95 lakh after reducing the TDS credit to ₹63.27 lakh by applying Rule 37BA(2)(i). The correct income and TDS have been exhibited by the return and Form 26AS; however, the error has emerged due to the TIS incorrectly showing the same property transaction twice.

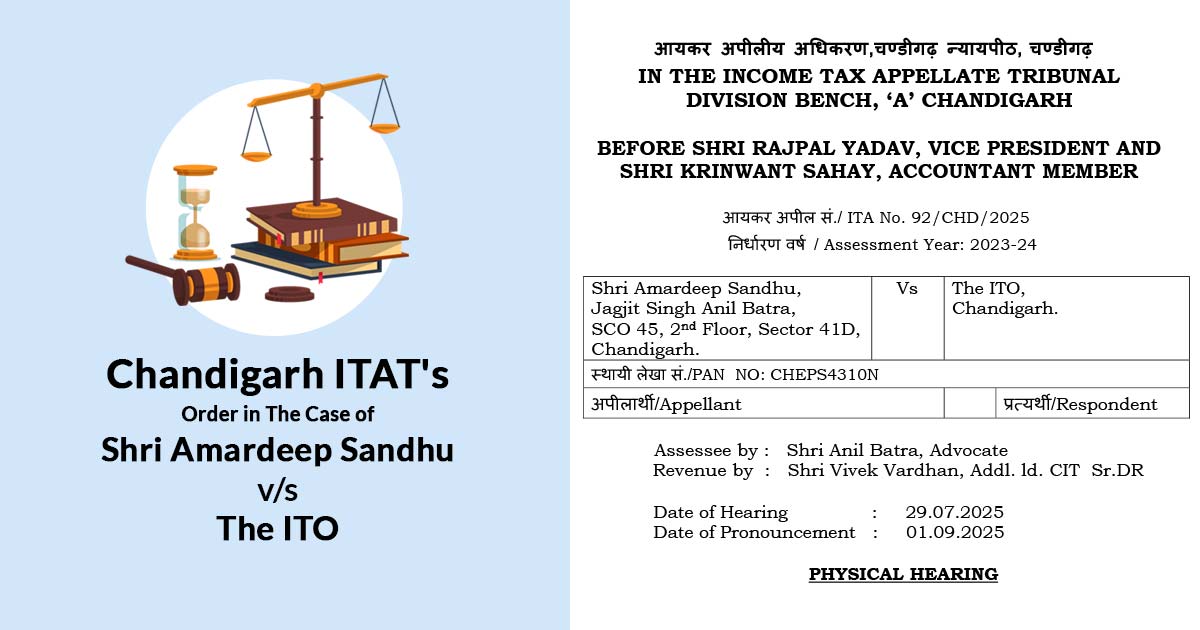

The record has been analysed by the tribunal with the support of the representative and observed inconsistencies between the intimation of the CPC u/s 143(1) and the order of the Commissioner of Income Tax (Appeals)[CIT(A)].

The claim has been rejected by the CIT(A) for full TDS credit because the part corresponds to another person, Mehtab Kaur, and mentions the non-submission of the bank statement.

The two-member bench, including Rajpal Yadav (Vice President) and Krinwant Sahay (Accountant Member), discovered the same reasoning to be ineffective, as it does not elaborate on how the name of another person appeared in the TDS credit or why the explanation given was not considered. It said that the CIT(A) must verify the record before deciding the matter.

Read Also: Easy Explanation on TDS for Property Sale by NRI (New Guide)

By considering that CPC has mistakenly cut the TDS credit, and CIT(A) has unnecessarily validated it, the tribunal has permitted the appeal and mandated the department to refund Rs 37,88,470 within 1 month.

As per that, the appeal was permitted.

| Case Title | Shri Amardeep Sandhu vs The ITO |

| Case No. | ITA No. 92/CHD/2025 |

| Assessee by | Shri Anil Batra |

| Revenue by | Shri Vivek Vardhan |

| Chandigarh High Court | Read Order |