The Delhi High Court has pointed out that there is a delay between when the GST Department issues a demand order and when the Form DRC-07 is made available online.

A division bench of Justices Prathiba M. Singh and Shail Jain did not infer such a gap as rendering the demand order time-barred, towards the fact that the demand was served upon the taxpayer in question via email.

The bench observed,

“Prima-facie, this Court is of the opinion that the e-mail dated 4th February 2025, is a sufficient mode of service…the delay in uploading Form DRC-07 or the order on the portal would not make the order barred by limitation.” On 5th February 2025, the period of limitation to pass a demand order came to an end, the applicant cited. Also, it added that since the impugned order was passed dated 1st February 2025, it was uploaded, including the DRC-07, on the GST portal only on 19th February 2025.

Therefore, the applicant claims that the demand was limited in time.

Applicant was provided with an email copy of the order dated 4th February, 2025, and the standing counsel notified the court.

Read Also: Gen GST Software E-Mail and WhatsApp Facility for Reports

As per the applicant, the order was being provided before his CA and not to him, the court cited.

“Firstly, the order itself is dated 1st February, 2025. Secondly, the e-mail which has been handed over shows that the impugned order has been communicated either to the Petitioner or to his Chartered Accountant…Prima-facie this Court is of the opinion that e-mail dated 4th February, 2025 is sufficient mode of service.”

As per the court, a total of 650 notices and allegations of fraudulent claim of Input Tax Credit to the tune of Rs 173 crores were there in the case.

“When there are 650 noticees, obviously, the generation of DRC-07 for each of the noticees could take some reasonable time so long as the order has been communicated through e-mail or post or other modes as contained in Section 169 of the CGST Act. Accordingly, the delay in uploading Form DRC-07 or the order on the portal would not make the order barred by limitation,” the Court cited and refused to interrupt in the case.

Marking that the impugned order is an appealable one, it furnishes liberty to the applicant to contest the same u/s 107 of the CGST Act, along with the issue of limitation.

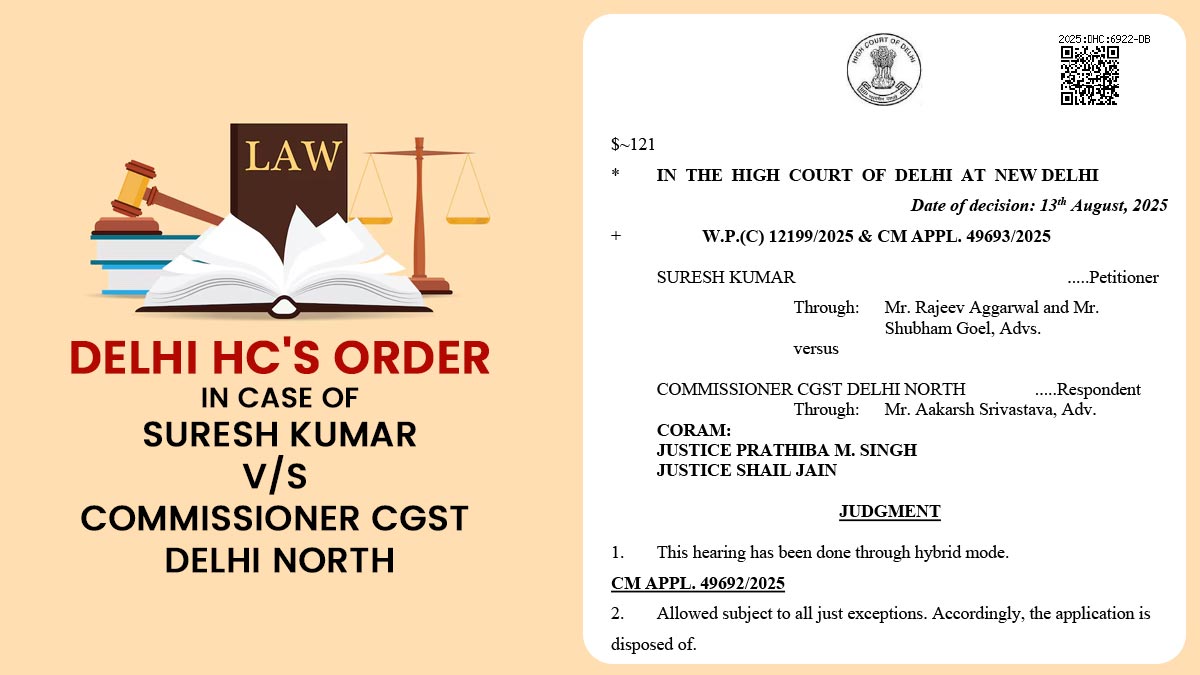

| Case Title | Suresh Kumar vs. Commissioner CGST Delhi North |

| Case No. | W.P.(C) 12199/2025 & CM APPL. 49693/2025 |

| For Petitioner | Mr. Rajeev Aggarwal and Mr. Shubham Goel, Advs |

| For Respondent | Mr. Aakarsh Srivastava, Adv. |

| Delhi High Court | Read Order |