The Bombay High Court, concerning the clash between the procedural compliance and substantive tax credit under the GST transition, ruled that the manual revisions to pre-GST returns cannot be rejected only because electronic filing was unavailable.

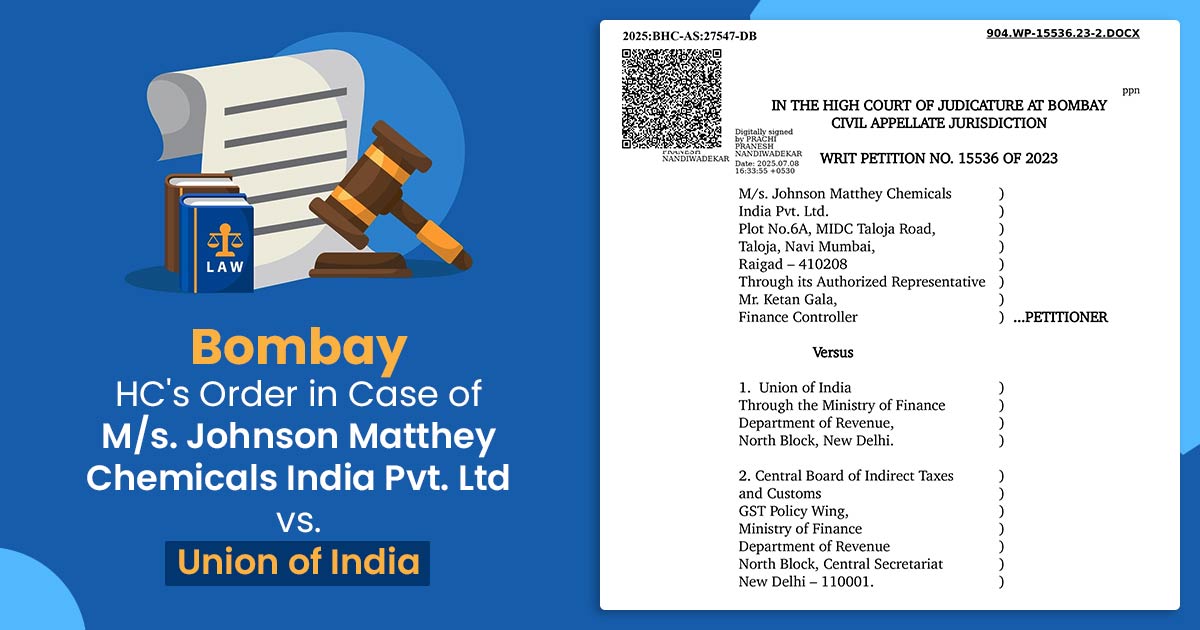

An order of the Deputy Commissioner, CGST Raigad, which had rejected M/s. Johnson Matthey Chemicals India Pvt. Ltd., the benefit of transitional CENVAT credit worth ₹1.16 crore has been quashed by the Division Bench of Justice M.S. Sonak and Justice Jitendra Jain.

The rejection was based on the fact that the updated tax return, which was submitted to fix an error involving missed credits, had not been submitted through the proper electronic process.

The applicant, a manufacturer of industrial catalysts, had filed its original TRAN-1 in August 2017 but was unable to include three bills of entry from May and June 2017. After the directions of the Supreme Court in Union of India v. Filco Trade Centre Pvt. Ltd. led to the reopening of the GST portal, the company manually revised its ER-1 return on 23 November 2022 and submitted a revised TRAN-1 form.

The authorities rejected the claim, mentioning two reasons:

- The ER-1 form was not updated online.

- The claim was made after the one-year deadline set by the CENVAT Credit Rules of 2004 had passed.

The Court, rejecting both contentions, said that:

“It would amount to calling upon the petitioner to do something which was not possible electronically post 1 July 2017.”

As per the bench, the excise portal was corrupted after 1 July 2017, which makes the electronic revision of ER-1 returns factually and legally impossible. Therefore, penalising the applicant for not following a corrupted procedure was not justified.

The court, on the issue of limitation, ruled that the applicant has duly notified the department about the errors through a letter on 16 February 2018 within a specified 1-year duration. Due to technical limitations, the formal correction was delayed, not because of procedural laxity.

The Court, relying on Aberdare Technologies Pvt. Ltd. v. CBIC, reaffirmed that technical lapses must not defeat substantive claims in the absence of revenue loss. It mentioned the Gujarat High Court’s ruling in Jekson Vision Pvt. Ltd. v. Union of India, which outlines that “substantive rights cannot be curtailed for mere procedural infirmities.”

The court permitting the petition asked the tax authorities to accept the manually revised ER-1 return and give effect to the transition of ₹1,16,29,351 in CENVAT credit. In 8 weeks, the whole process must be completed as per the order.

| Case Title | M/s. Johnson Matthey Chemicals India Pvt. Ltd vs. Union of India |

| Case No. | WRIT PETITION NO. 15536 OF 2023 |

| For Petitioner | Ms. Priyanka Rathi a/w Mr. Prasad Avhad i/by Mr. Kuldeep U. Nikam |

| For Respondent | 904.WP-15536.23-2.DOCX Mrs. Neeta Masurkar a/w Mr. Harshad Shingnapurkar |

| Bombay High Court | Read Order |