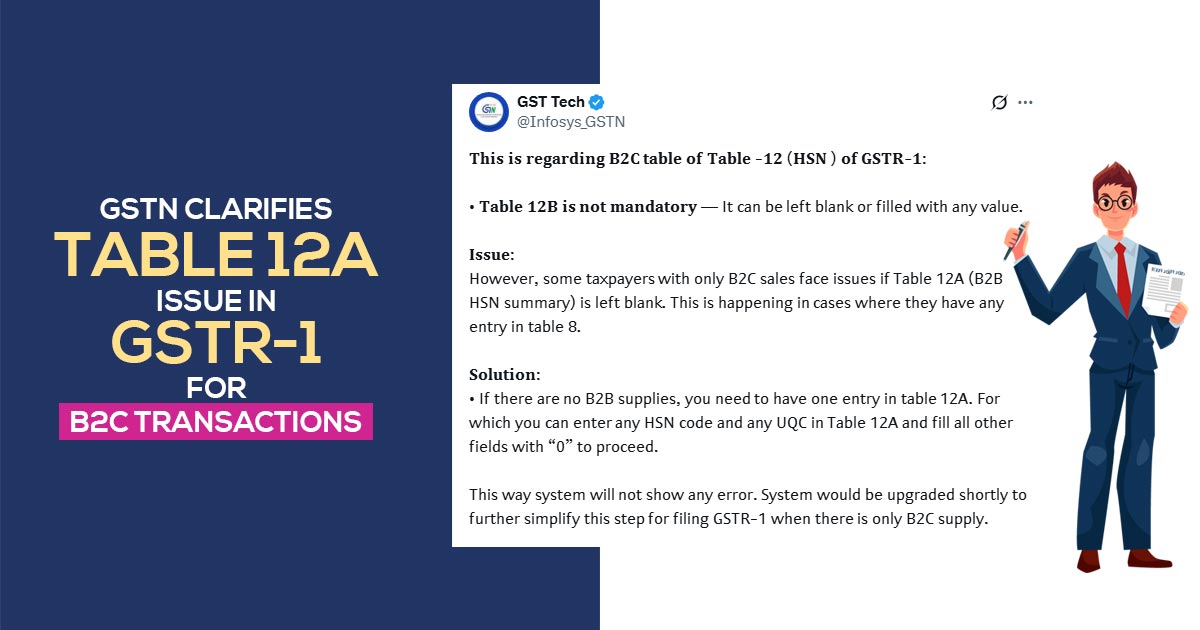

For Table 12 of the GSTR-1 form, specifically the HSN summary of outward supplies, it is mentioned that the taxpayers who are only dealing in B2C supplies must have reported problems with Table 12A when left blank.

Table 12B (related to B2C transactions) is not obligatory and could be left blank or filled with any value. complications emerge when no B2B supplies are mentioned in Table 8, though at least one entry is made in Table 8.

The Main Issue

Many individuals and businesses that mainly deal directly with consumers (B2C transactions) are facing challenges when filing their GSTR-1 tax forms. A common problem arises when they leave a specific section, known as Table 12A (which summarises transactions with other businesses), blank.

Read Also: GST Filing Update: GSTR-1 Table 12 Now Divided into B2B and B2C Categories

This issue is especially noticeable if there is any entry in another section called Table 8, which covers items that are either not taxed, exempt from tax, or not subject to GST.

In the system, an error occurs, causing confusion for the filers which consequence in delays.

The Solution

The authorities to address the same problem have recommended an easier workaround-

- The registered taxpayers should ensure that Table 12A is not left completely blank.

- Even if there are no B2B supplies, they can enter any HSN code and UQC (unit quantity code) and fill all other fields with “0”.

- This dummy entry will authorise the system to process the GST return without generating an error.

The system improvements declared under the Goods and Services Tax Network (GSTN) are in process to solve the same issue permanently.

The process of GSTR-1 filing after implementation for the taxpayers dealing only with B2C supplies shall be easier, removing the requirement for such workaround entries.

Critical Takeaway

The taxpayers are requested to stay updated and use the advised workaround in the meantime to prevent disruptions in the filing of GSTR-1. The CBIC and GSTN are continuing to track the system behaviour and are operating for an intuitive and error-free experience for all users.