The Gujarat High Court has ruled that a Permanent Account Number (PAN) is not required to claim the benefit of a lower Tax Deducted at Source (TDS) rate under a Double Tax Avoidance Agreement (DTAA).

As per the bench of Justice Bhargav D. Karia and Justice Pranav Trivedi, Section 206AA of the Income Tax Act does not override the provisions of Section 90(2) of the Income Tax Act, 1961, outlining the prevalence of DTAA when they propose promising terms to the taxpayer.

Every taxpayer, as per section 206AA of the Income Tax Act, who gets taxable income to file their PAN to the payer of this income. It is applicable for both resident and non-resident receivers.

The payments for the residents shall comprise salary, rent, professional receipts, contractual receipts, etc. For non-residents, the same shall comprise all receipts that are levied to tax in India.

As per Section 90(2) in The Income Tax Act, 1961, where the Central Government has entered into an agreement with the Government of any country outside India or defined territory outside India, as per the case, under sub-section (1) for granting relief of tax, or as the case may be, avoidance of double taxation, then, concerning the taxpayer to whom such agreement applies, the provisions of this Act shall applicable to the scope they are more useful to that taxpayer.

The case is of Section 206AA of the Income Tax Act, which demands a 20% tax deduction at source (TDS) if a foreign receiver is unable to file a PAN.

Adani Wilmar applied the lower rates outlined in the DTAAs between India and various countries, claiming that these rates were more advantageous and permissible u/s 90(2) of the Income Tax Act, 1961.

As per the department, if PAN was not provided, then Section 206AA, with its non-obstante clause, mandated a 20% TDS irrespective of DTAAs. But the Tribunal and HC kept the Double Tax Avoidance Agreement (DTAA) provisions, protected u/s 90(2), and kept dominance in these cases.

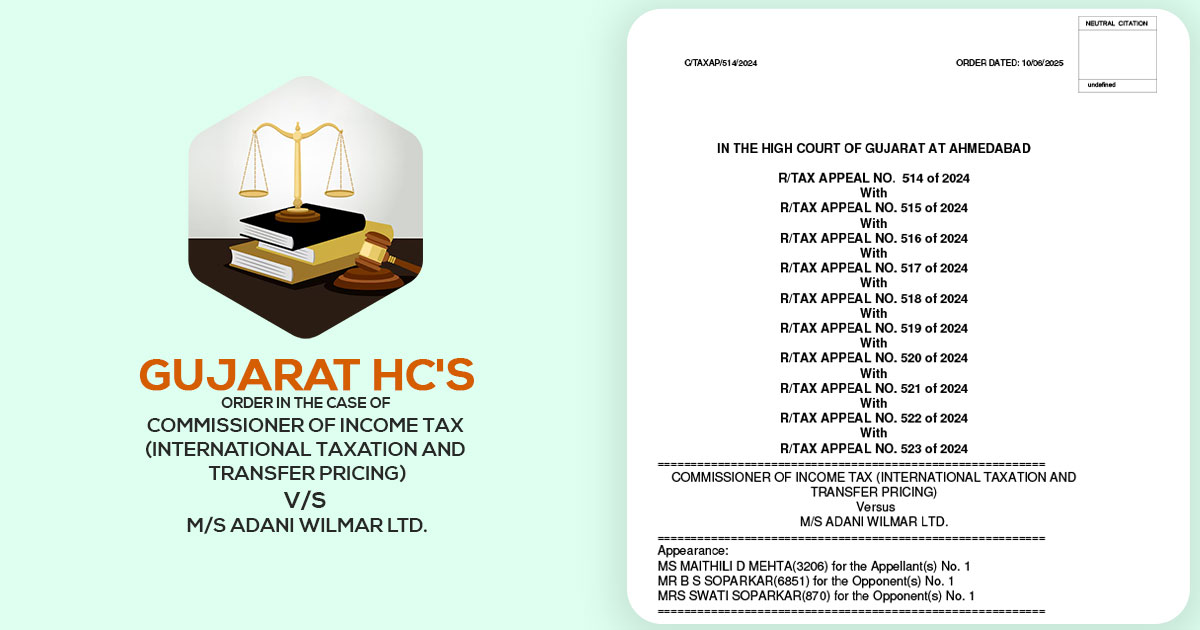

The 10 appeals of the Commissioner of Income Tax (International Taxation and Transfer Pricing) have been dismissed by the court contesting the rulings of the Income Tax Appellate Tribunal (ITAT) in favour of Adani Wilmar.

| Case Title | Commissioner of Income Tax (International Taxation And Transfer Pricing) vs. M/S Adani Wilmar Ltd. |

| Case No. | R/TAX APPEAL NO. 514 of 2024 With NO. 515 of 2024 |

| Counsel For Appellant | MS Maithili D Mehta |

| Counsel For Respondent | Swati Soparkar |

| Gujarat High Court | Read Order |