The Income Tax Appellate Tribunal (ITAT) in Bangalore ruled that the provisions related to Minimum Alternate Tax (MAT) under section 115JB of the Income Tax Act do not apply to the taxpayer bank. As a result, the tax on book profits is not applicable to the bank. The tribunal has allowed the appeal filed by the taxpayer bank.

Facts- Banking business belongs to the taxpayer. Investigation was proposed for the taxpayer case, and as per that, notices u/s 143(2) as well as 142(1) of the Act were issued, including a questionnaire for different details to verify the income tax return claims of the taxpayer.

Under the regular provisions, the assessment order has been passed by the AO by assessing the total income of Rs. 1750,77,68,383/- and also ruled that section 115JB of the Act applies to the taxpayer bank and determined the book profit at Rs 447,95,02,243.

The appeal has been permitted partly by CIT(A), and the present appeal is submitted, being dissatisfied.

The Special Bench ruled in favour of the taxpayer regarding the referred question. It was determined that clause (b) of sub-section (2) of section 115JB of the Income-tax Act, which was inserted by the Finance Act, 2012, effective from the assessment year 2013-14, does not apply to banks that were formed as “corresponding new banks” under the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970.

Consequently, the provisions of section 115JB are not applicable, and therefore, the Minimum Alternate Tax (MAT) on book profits does not apply to such banks. This ruling pertains to ITA No. 424/Mum/2020 and ITA No. 3740/Mum/2018 involving the Union Bank of India and the Central Bank of India.

Before the taxpayer bank, it held that the provisions of section 115JB of the Act cannot be applicable, and therefore, the tax on book profits (MAT) does not apply to the taxpayer bank.

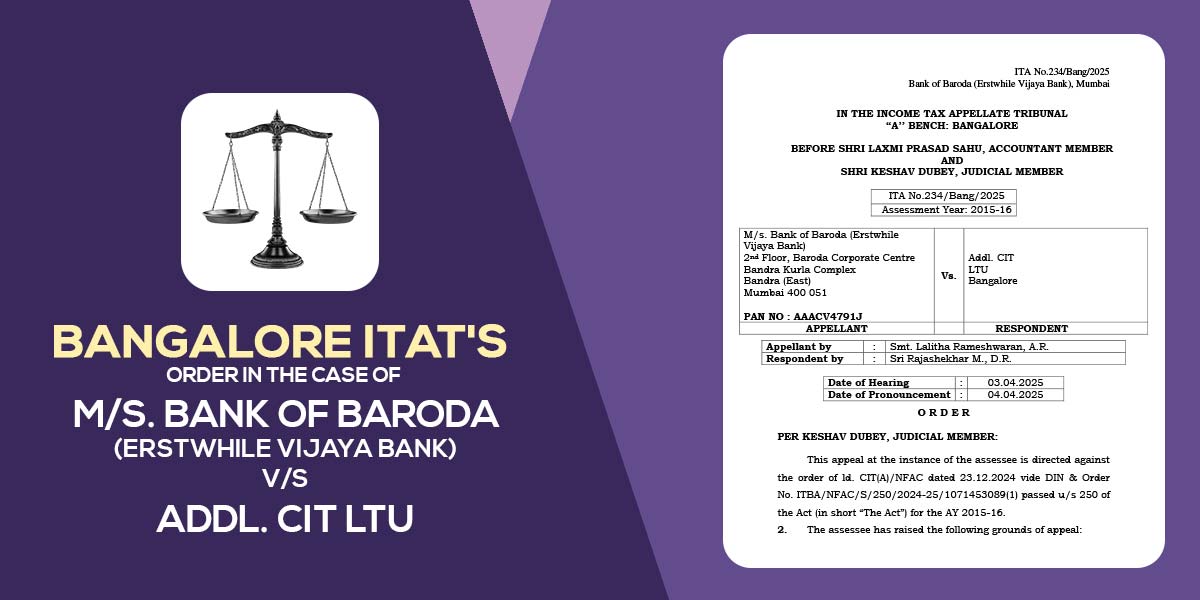

| Case Title | M/s. Bank of Baroda (Erstwhile Vijaya Bank) vs. Addl. CIT LTU |

| Case No. | ITA No.234/Bang/2025 |

| Appellant by : | Smt. Lalitha Rameshwaran, A.R |

| Respondent by : | Sri Rajashekhar M., D.R |

| ITAT Bangalore | Read Order |