The Raipur Bench of the Income Tax Appellate Tribunal (ITAT) in a ruling has partly permitted the pleas for multiple assessment years by keeping that where the income is assessed on an estimated basis, separate disallowances like those u/s 40A(3) are unsustainable.

The taxpayer, Nishant Jain, a civil contractor working in government infrastructure projects, had filed appeals for Assessment Years (AY) 2014–15, 2017–18, and 2018–19. The additions incurred via the lower authorities differ for each year and are based on various bases.

The Assessing Officer (AO) for AY 2014-15 has made an addition of Rs 1.36 crore, quoting a mismatch between the turnover as shown in Form 26AS and the taxpayer’s books of account.

As per AO, the taxpayer is unable to reconcile the discrepancy attributable to mobilization and machinery advances. The addition was carried out by CIT(A), citing that the taxpayer is unable to file enough proof depicting that the difference has been accounted for in the forthcoming years.

For the case related to the 2017-17 AY survey proceedings u/s 133A, the taxpayer proposes to declare the net profit at 8% of the turnover under the discrepancies discovered at the time of the survey, like cash expenses, unsubstantiated purchases, and corresponding-party payments.

AO, even after the same disclosure, moved to make various disallowances like ₹18.08 lakh concerning alleged unexplained investment in a building project, ₹3.43 lakh for turnover discrepancy based on Form 26AS, ₹6 lakh disallowance u/s 40A(3) for cash payment, and ₹84,398 for delayed ESI/PF deposits. Thereafter, these additions were subsequently confirmed by the CIT(A)

The ITAT noted that the addition of ₹1.36 crore arose from advances received from a government agency, which the taxpayer claimed were accounted for in the subsequent year.

The tribunal, while marking that the CIT(A) has taken cognizance of the same claim, discovered that the explanation warranted verification. The case was remanded to the Assessing Officer (AO) for fresh consideration with the direction to remove the addition if the claim was confirmed.

Initially, the taxpayer accepted a report from the valuer and agreed to reveal Rs 18.08 lakh and Rs 7.33 lakh, respectively, as unexplained investments. But he therefore claimed that his declaration of higher net profit covered these amounts.

The ITAT rejected the same claim, marking that the additional profit was proposed to address other discrepancies and cannot be stretched to cover the capital investments. Therefore, the additions were upheld.

The ITAT, comprising Arun Khodpia and Ravish Sood (Judicial member), removed both disallowances made u/s 40A(3), keeping that once the income of the taxpayer has been approximated on a presumptive basis at 8% of turnover, then no additional disallowance was explained.

It mentioned that the decision in CIT v. Smt. Santosh Jain [(2008) 296 ITR 324 (P&H)], established that the estimation of income subsumes minor discrepancies and cash transactions unless separately claimed. The disallowance for late ESI/PF payments was kept, following the Supreme Court judgment in Checkmate Services Pvt. Ltd. v. CIT.

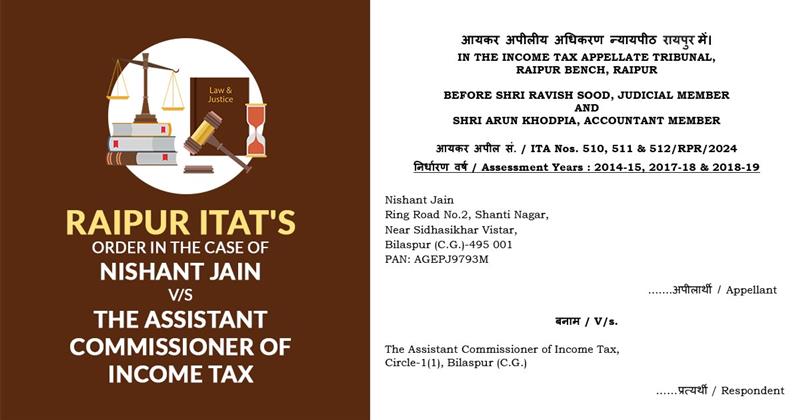

| Title | Nishant Jain vs. The Assistant Commissioner of Income Tax |

| Citation | ITA Nos. 510, 511 & 512/RPR/2024 |

| Date | 20.10.2025 |

| Assessee by | S/shri Sunil Kumar Agrawal, Vimal Kumar Agrawal |

| Revenue by | Smt. Anubhaa Tah Goel |

| Raipur ITAT | Read Order |