Janak Texturisers Pvt. Ltd. (the assessee) has filed an appeal before the Income Tax Appellate Tribunal (ITAT) Mumbai against a reassessment order passed by the Joint Commissioner of Income Tax (CIT) for the assessment year (A.Y.) 2010-11.

The issue concerns the validity of the reassessment notice under section 148 of the Income Tax Act and the assessing officer’s (AO) disallowance of expenses amounting to Rs. 6,78,980.

It was claimed by the taxpayer that the notice issued u/s 148 of the Income Tax Act was vague and void due to the absence of prior sanction and failure to furnish the causes for the assessment reopening. The earlier assessments were kept by the tribunal, dismissing the claims for the validity of the reassessment notice.

The problem in the plea was the disallowance of expenses, amounting to Rs. 6,78,980, which the taxpayer had made. The expenses comprise operational costs like bank charges, electricity, depreciation, office rent, repairs, and vehicle expenses.

Recommended: How to File a Complaint Against Income Tax Officer?

The Assessing Officer(AO) disallowed such expenses, claiming that the taxpayer does not secure any business income and, therefore, the expenses pertinent to the business operations cannot be claimed.

It was said by the taxpayer that even after the sluggish manufacturing operations, the rental income via the factory premises, which is a part of the business asset, justified these expenses.

The facts presented by the assessee have been regarded by the tribunal, marking that the rental income made from the factory premises was considered income from the house property and not as business income.

The tribunal referred to section 57 of the Income Tax Act, citing that the expenses made to keep the property rented out can be deducted under the same section as opposed to being treated as business expenses.

Read Also: AO Must Form Prima Facie Opinion Before Rejecting Section 197 Application for Nil or Lower TDS

The taxpayer quoted various judicial precedents to support its opinion, including the case of Raja Bahadur Motilal Mills Ltd. vs. ACIT and Hindustan Chemical Works Ltd. vs. CIT, where it was ruled that the expenses for maintaining assets, even if not generating income at the time, can still be claimed as deductions.

However, the tribunal discovered such matters distinguishable on facts, as the taxpayers did not establish any revival of business operations in the present or subsequent years.

Final Judgment The plea was partly allowed by ITAT. It asked the AO to validate the rental income made via the taxpayer and calculate the taxability u/s 57 authorizing proportionate expenses of the rental income.

The tribunal rejected the wider claim for the business expenses u/s 37(1) due to the absence of evidence showing the continuation or revival of the business activities.

Closure to that, the ruling of the ITAT furnished clarity on the treatment of the rental income and business expenses, supporting the need for precise classification under the pertinent sections of the income tax act.

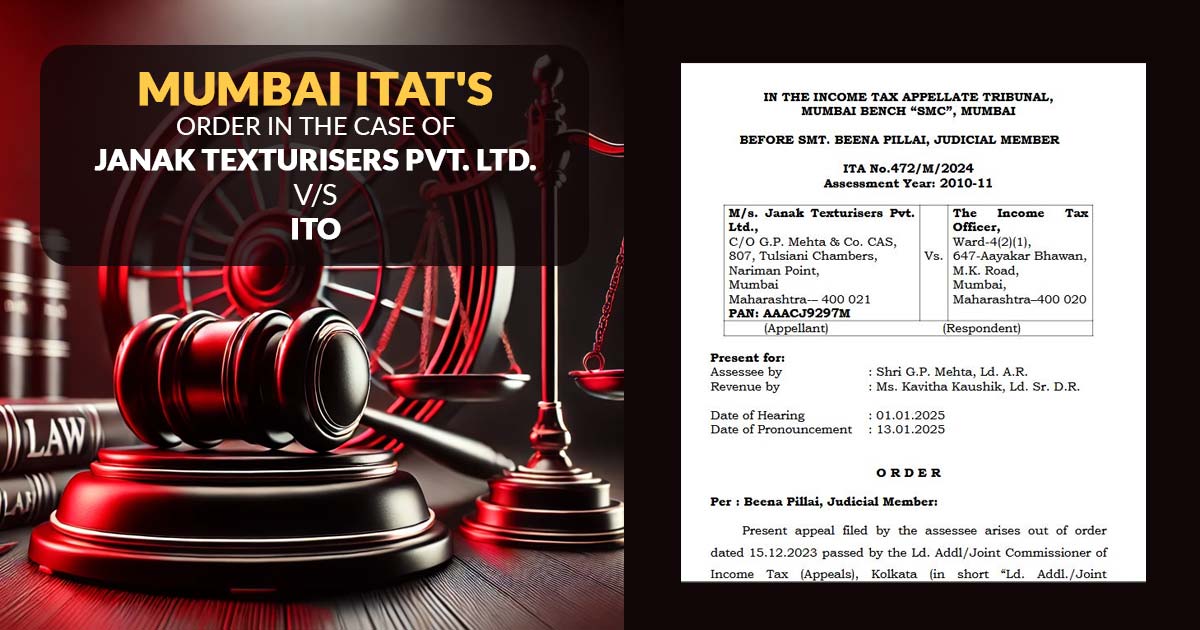

| Case Title | Janak Texturisers Pvt. Ltd. vs. ITO |

| Citation | ITA No.472/M/2024 |

| Date | 13.01.2025 |

| Appellant by | Shri G.P. Mehta, Ld. A.R. |

| Respondent by | Ms. Kavitha Kaushik, Ld. Sr. D.R. |

| Mumbai ITAT | Read More |