The Jaipur Bench of the Income Tax Appellate Tribunal (ITAT) has determined that the ₹12 lakh addition u/s 69A of the Income Tax Act, 1961, was unwarranted, as the sundry debtors recorded in the books could not be classified as unexplained income.

The petitioner Ratika Kumbhat was selected for the limited scrutiny to validate the cash deposits made during the demonetization period (November 9 to December 30).

Subsequently, on December 22, 2017, the Principal Commissioner of Income Tax (PCIT) issued a letter converting the case to complete scrutiny.

For the assessment year 2015-16, she filed her ITR dated March 31, 2017. A notice was issued dated September 16, 2017, via Computer-Aided Scrutiny Selection (CASS) and sent by registered post.

The assessing officer (AO) found that in the assessment, she had deposited Rs 25,00,000 in cash during demonetization, asserting it was declared under the IDS scheme 2016. However, she did not provide the evidence, though no addition was made to the same problem.

Also, AO discovered that she had reported Rs 12,00,000 as debtors though does not furnish the proof to establish their identity. As she is unable to explain the claim the AO treated the amount as her capital, disguised as debtors to elaborate the cash deposits. Consequently, Rs 12,00,000 was added as fake debtors and was imposed to tax u/s 69A of the act.

The taxpayer challenged the ₹12,00,000 addition as unexplained income u/s 69A of the Income Tax Act by appealing to the Commissioner of Income Tax (Appeals) [CIT(A)].

It was noted by CIT(A) that she had reported debtors of Rs 12,00,000 though unable to furnish the confirmations or basic information like PAN or address. Instead, she recommended that the AO can summon them. As the burden of proof was on her the absence of proof was regarded.

It was discovered by CIT(A) that she did not establish the source or genuineness of the amount and repeated the same assertions from the assessment phase. The addition of ₹12,00,000 u/s 69A was kept, and the appeal was dismissed as no valid explanation or proof was provided.

Read Also: ITAT Chennai Deletes INR 12.14 Lakh Addition Under Section 69 of the IT Act

The tribunal dissatisfied with the CIT(A) decision has appealed to the tribunal.

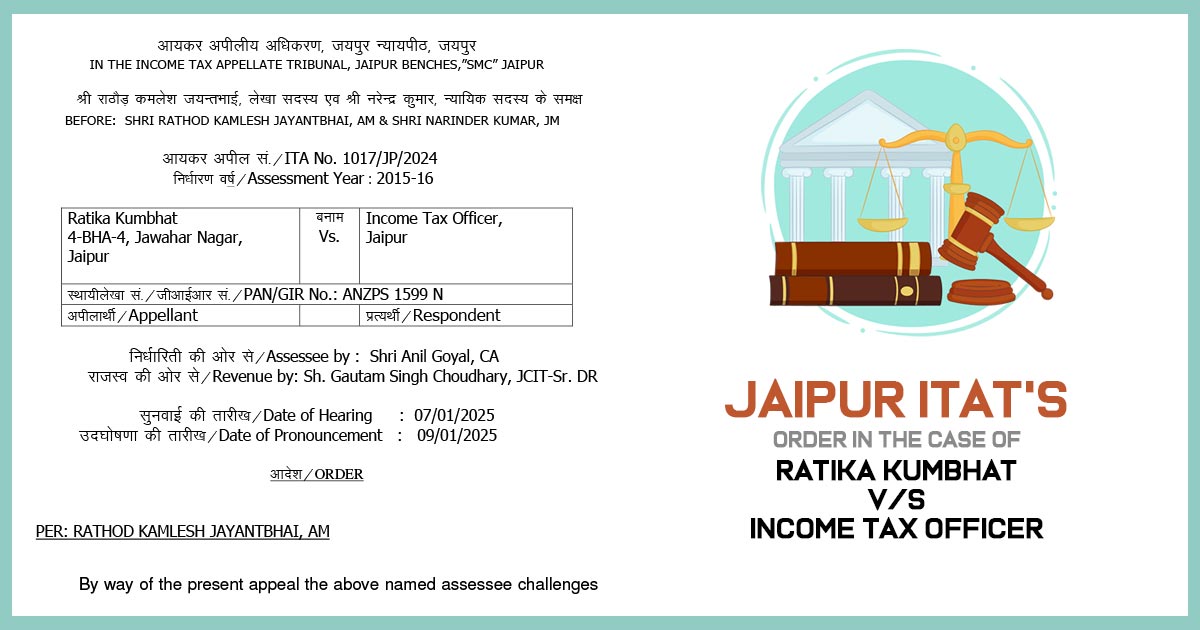

The case was analyzed by the two-member bench including Narinder Kumar (Judicial Member) and Rathod Kamlesh Jayantbhai (Accountant Member) and heard both sides. The taxpayer contested Rs 12,00,000 addition u/s 69A of the act. The case was chosen to validate the cash deposits and subsequently converted into full scrutiny.

The Assessing Officer (AO) identified an amount of ₹12,00,000 listed as debtors without adequate supporting evidence, resulting in its inclusion as unexplained investment u/S 69 of the Income Tax Act.

The addition was kept by CIT(A) mentioning a ruling of the Supreme Court that unexplained receipts could be treated as taxable income. However, the appellate tribunal observed that sundry debtors recorded in the books do not come u/s 69A.

Also, it was discovered that such debtors related to 2013 and 2014, were not the appropriate assessment year (2015-16). As this fact was undisputed the tribunal carried that the addition was not explained and permitted the plea.

| Case Title | Ratika Kumbhat vs. Income Tax Officer |

| Citation | ITA No. 1017/JP/2024 |

| Date | 09.01.2025 |

| Assessee by | Shri Anil Goyal |

| Revenue by | Sh. Gautam Singh Choudhary |

| Jaipur ITAT | Read Order |