The Assessing Officer’s ( AO ) decision has been set aside by the Bangalore Bench of Income Tax Appellate Tribunal ( ITAT ) classifying the Indian subsidiary as a Dependent Agent Permanent Establishment ( PE ) in software sales and remanded the case for fresh examination.

The taxpayer-appellant QlikTech International AB is a foreign company selling software products. Its Indian subsidiary, QlikTech India Private Limited, paid Rs. 55.91 crore after deducting Tax Deducted at Source(TDS) of Rs. 5.59 crore, as demonstrated in Form 26AS for the relevant year. However, the taxpayer did not include this payment in its taxable income and claimed a refund of the deducted TDS at the time of filing its return.

AO in the assessment discovered that based on agreements between the taxpayer and its Indian subsidiary, the subsidiary manages chores like finding customers, negotiating prices, and finalizing contracts for product sales in India of the appellant.

It was determined by the Assessing Officer (AO) that the Indian subsidiary was a dependent agency permanent establishment of the taxpayer. Consequently, the AO imposes a tax on the income of the taxpayer in India at 30% on Rs 96.87 crore from product sales. Dispute Resolution Panel (DRP) carried out the same decision.

Before the tribunal, the taxpayer has appealed.

The two-member bench including Keshav Dubey(Judicial Member) and Waseem Ahmed(Accountant Member) examined the opinions and records and discovered that the transaction between the appellant and its Indian subsidiary had already undergone Transfer Pricing Officer (TPO) adjustment. As the sale was assessed under transfer pricing, the problem of a dependent agency permanent establishment does not take place.

The ITAT set aside the issue to the AO for fresh examination, as the Transfer Pricing (TP) order was submitted as additional proof but was not verified by the lower authorities.

Hence the taxpayer’s plea has been permitted for the statistical objective.

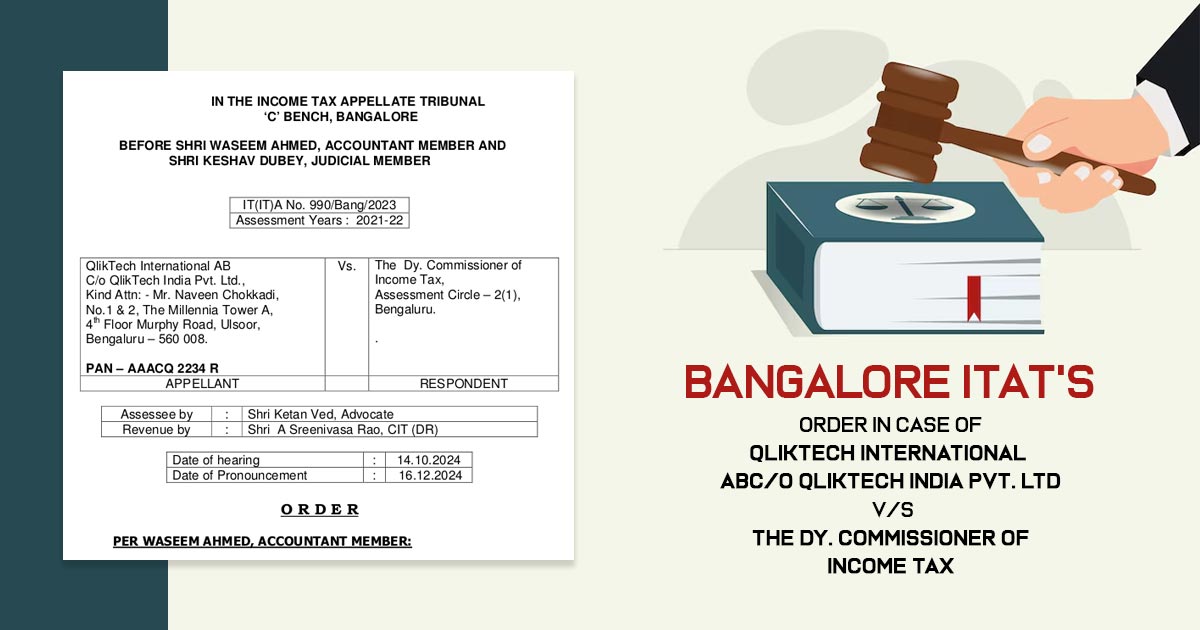

| Case Title | QlikTech International ABC/o QlikTech India Pvt. Ltd Vs. The Dy. Commissioner of Income Tax |

| Citation | IT(IT)A No. 990/Bang/2023 |

| Date | 16.12.2024 |

| Counsel For Appellant | Shri Ketan Ved, Advocate |

| Counsel For Respondent | Shri A Sreenivasa Rao, CIT (DR) |

| Bangalore ITAT | Read Order |