What is the MCA LLP BEN-2 Form?

Form BEN-2 is a regulatory document mandated by the Companies Act 2013, which requires every company to file a declaration regarding its Significant Beneficial Owners (SBOs) with the Registrar of Companies (RoC).

This form is been used to reveal the identities of individuals or entities that practice control over the company via shareholding or voting rights. It targets those holding, directly or indirectly not less than 10% of the shares and voting rights of the company.

To keep clarity this declaration is significant in the corporate structure since it discloses who holds the influence within the company. It should be filed within 30 days if the beneficial ownership is acquired or any changes to existing interests.

Significant Beneficial Owner (SBO) Compliance in India

It directed to the regulatory requirements levied via the Companies Act, 2013, concerning identifying and reporting individuals who have beneficial ownership in a company. The regulation’s objective is to improve clarity and avert the misuse of corporate structures for prohibited activities.

The Purpose of Filing the LLP BEN-2 Form

The filing objective of BEN Form 2 is multifaceted and centred on the disclosure and management of influential beneficial ownership. Below are the reasons to file Form BEN-2:

- Declaration of Significant Beneficial Ownership

- Updates on Changes in Significant Beneficial Ownership

- Compliance with Section 90 of the Companies Act, 2013

- Transparency in Corporate Ownership Structures

Penalties for Not Filing LLP BEN-2 Form

If any person (both the registered member and beneficial owner) is unable to file Form BEN-2, then they will be punishable with-

| Description | Penalty |

| Initial Fine | Fine, which may extend to Rs. 50,000/ |

| Continuing Failure | Further fine of Rs. 1,000/- for every day during which the failure continues |

If the company and every officer are in default and are unable to file Form BEN-2 then they will be punishable with-

| Description | Penalty |

| Initial Fine | Fine which shall not be less than Rs. 500/- and may extend to Rs. 1,000/- |

| Continuing Failure | Further fine of Rs. 1,000/- for every day during which the failure continues |

Steps to File LLP BEN-2 via Gen Complaw Software

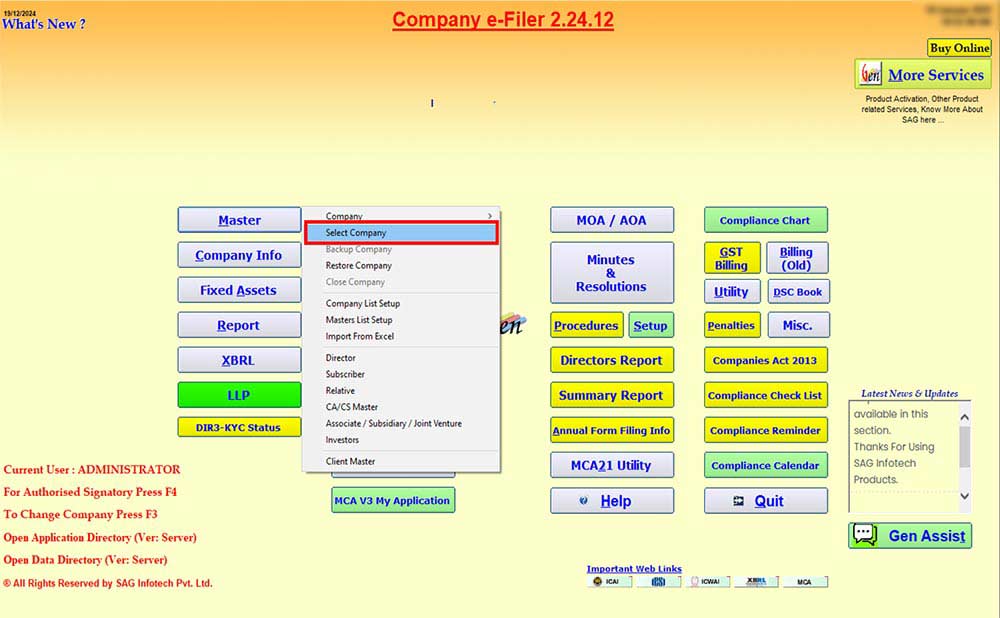

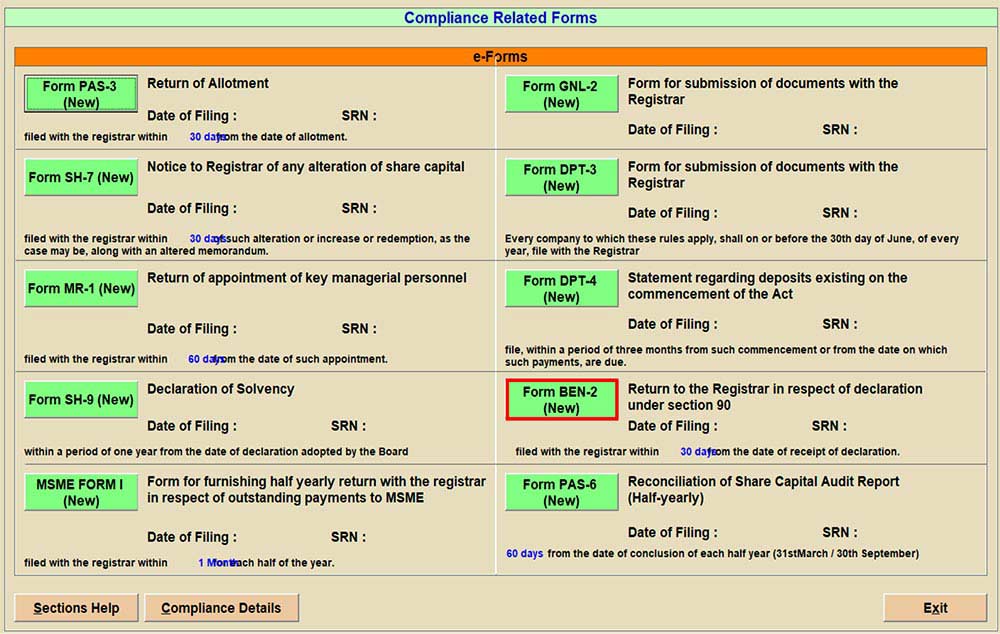

Step 1. Open the SAG Infotech’s ROC software and select the company and Financial year

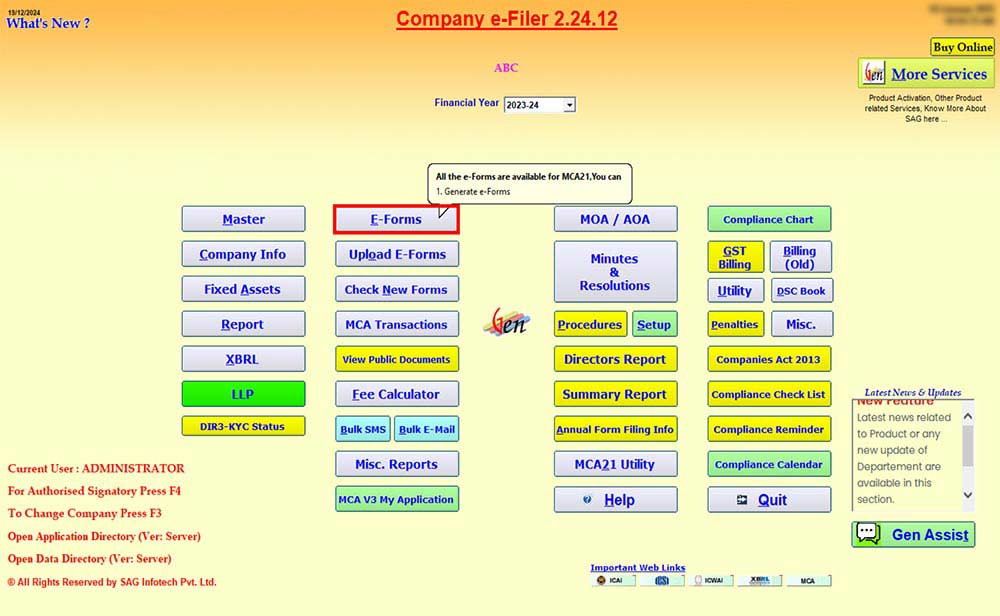

Step 2. Click on E-forms

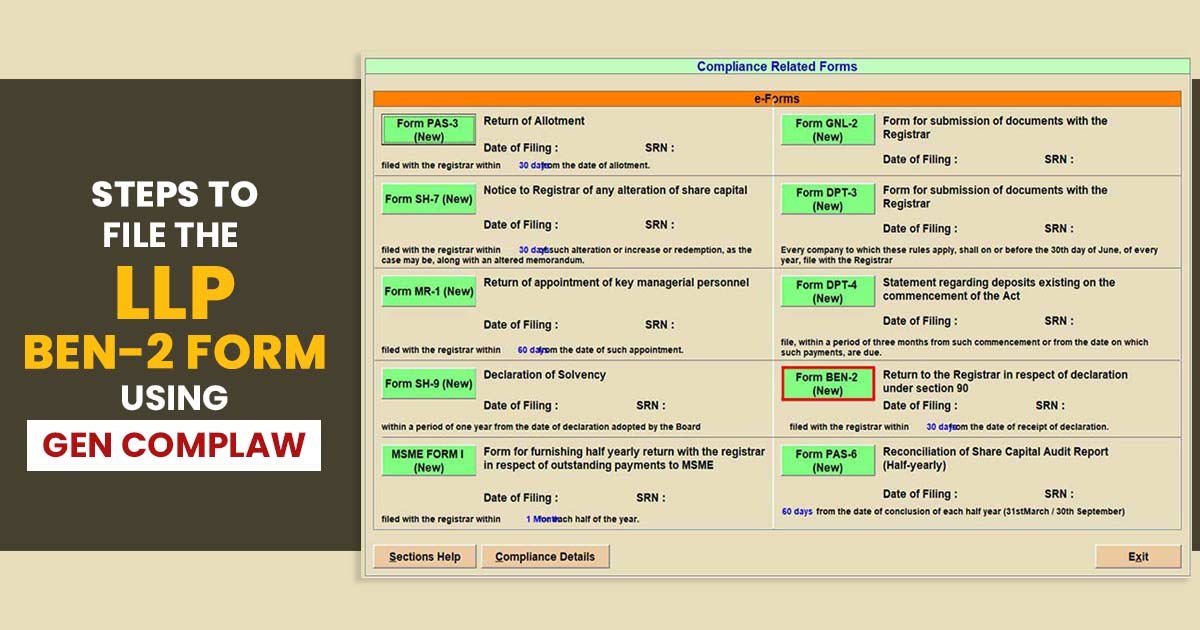

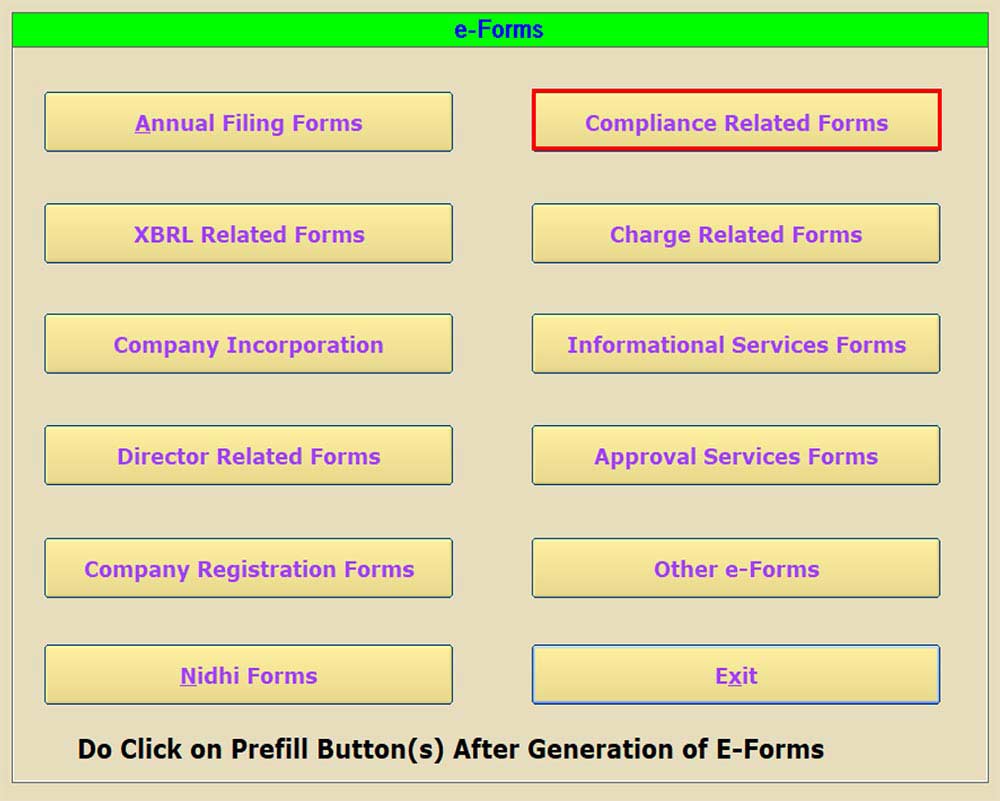

Step 3. Select Compliance-Related Forms

Step 4. Select Form BEN-2 option

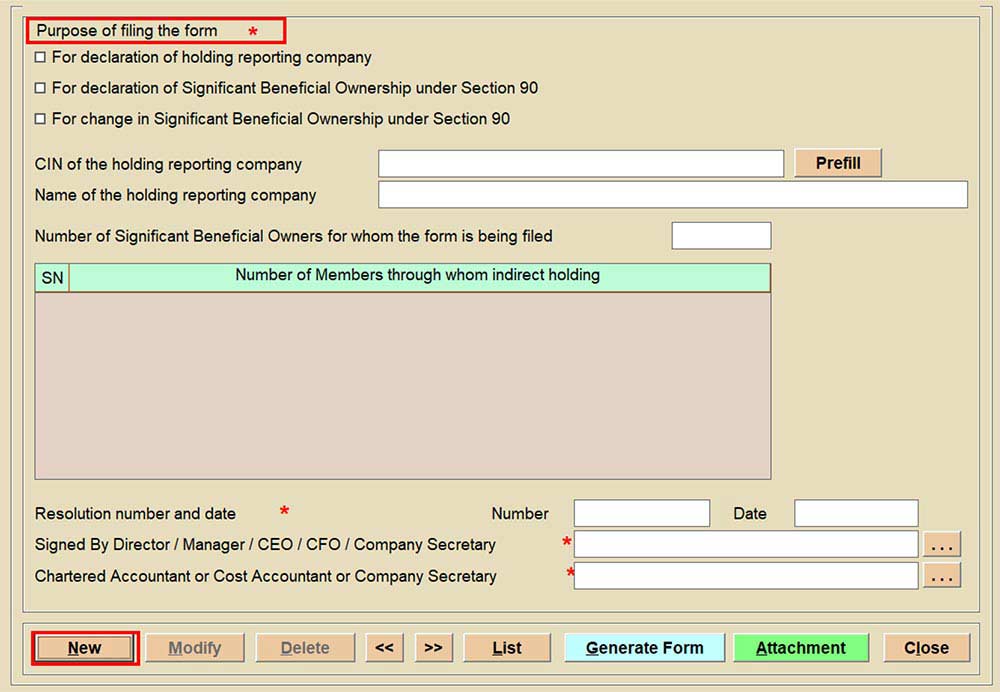

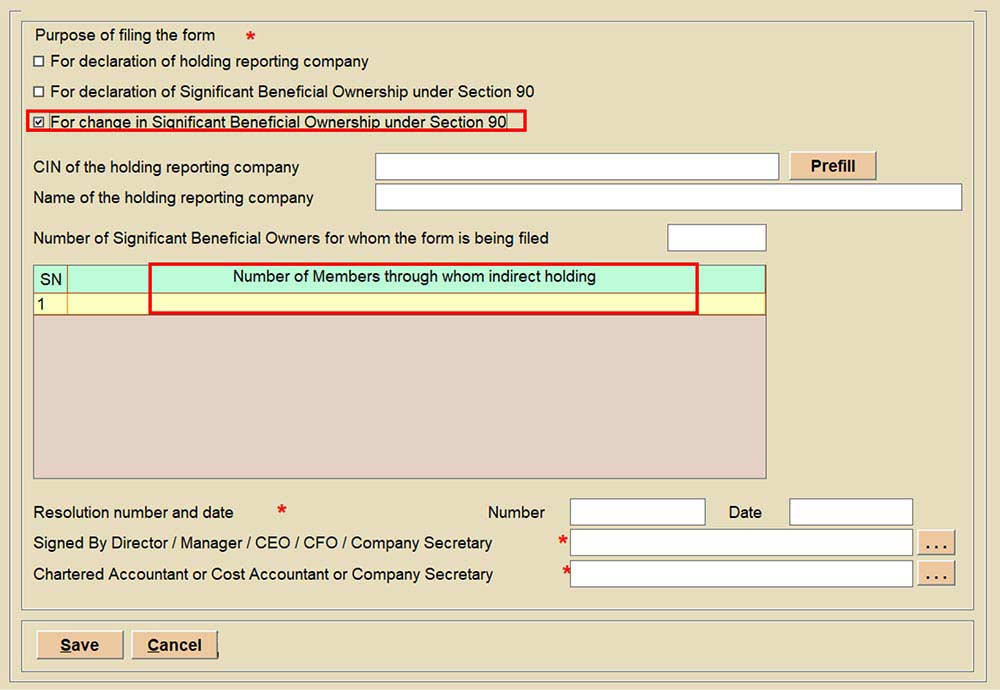

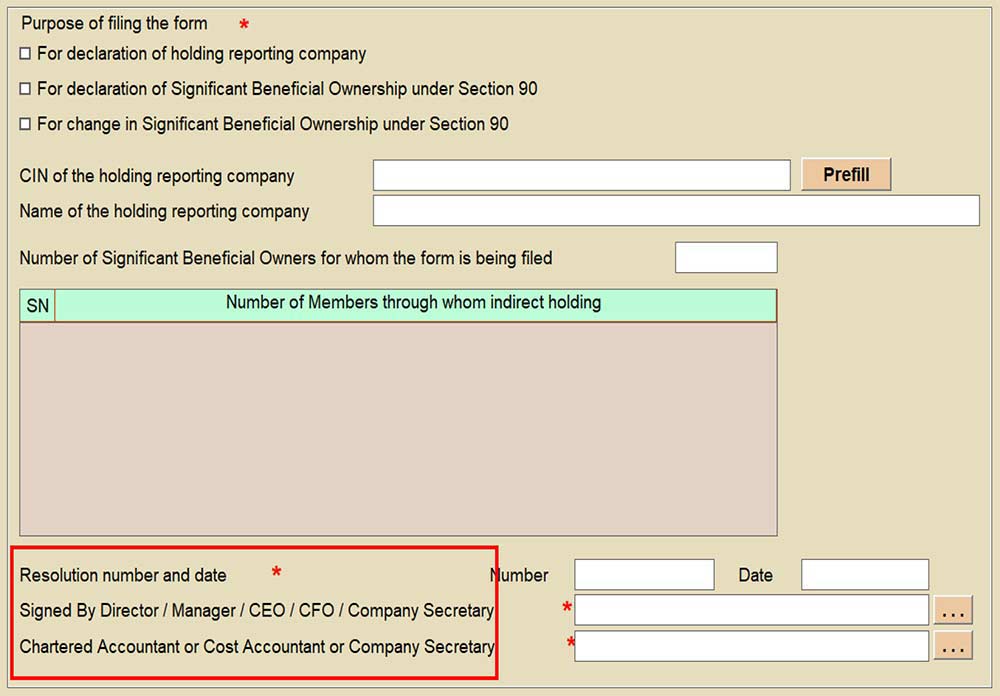

Step 5. Click on New to start a form and select the purpose of filing the form from the given 3 options.

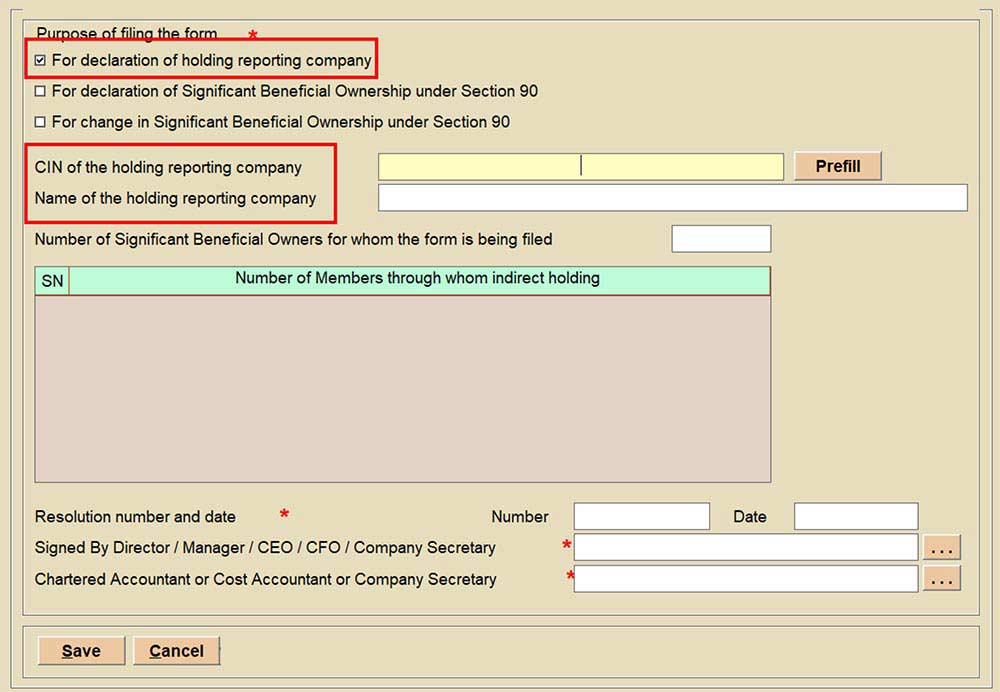

Step 6. Please note that the option CIN and Name of holding reporting will be enabled only when the purpose is selected as “For declaration of holding reporting company.

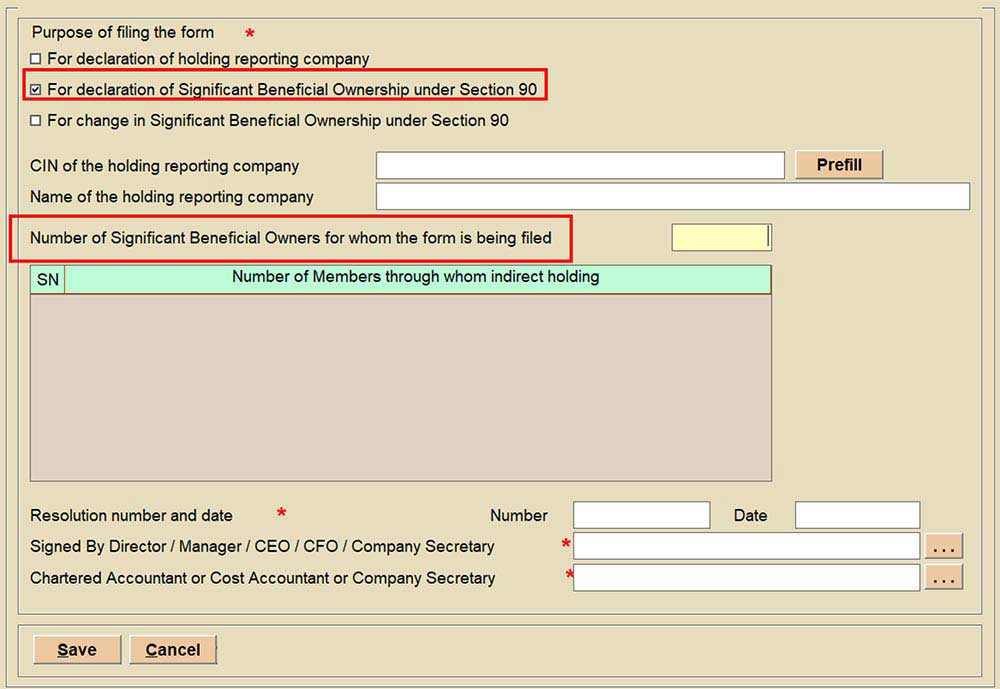

Step 7. Option “Number of Significant Beneficial Ownership for whom the form is being filed” will be enabled if “For declaration of Significant Beneficial Ownership under Section 90” purpose is selected.

Step 8. Option “Number of members through whom indirect holding” will be enabled if “Fora change in Significant Beneficial Ownership under Section 90” purpose is selected. Users have to double-click on the highlighted row

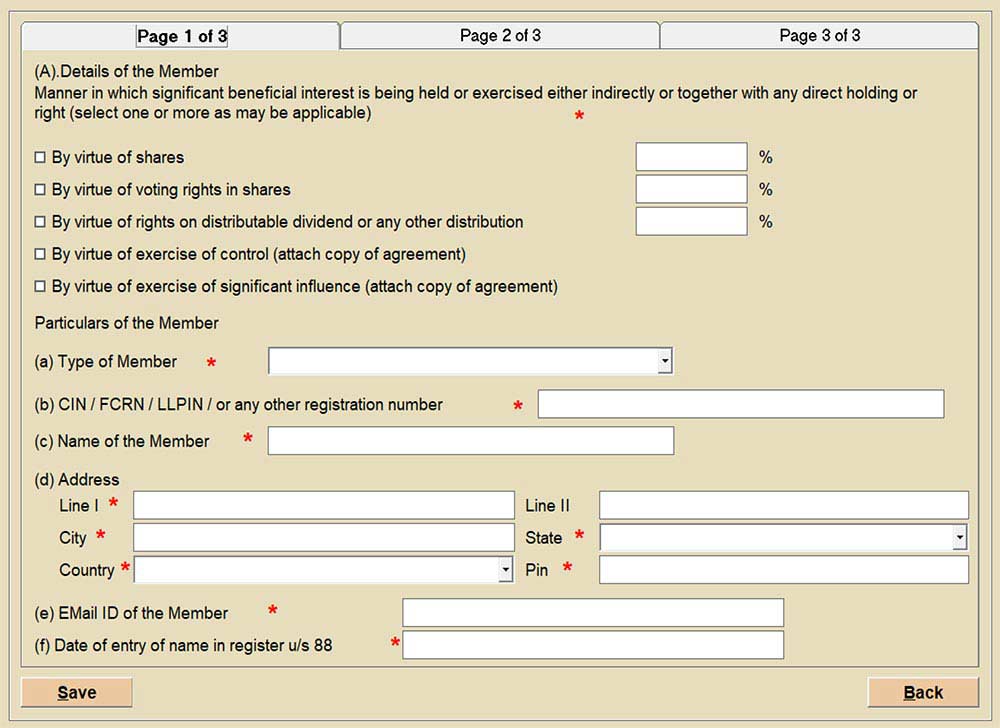

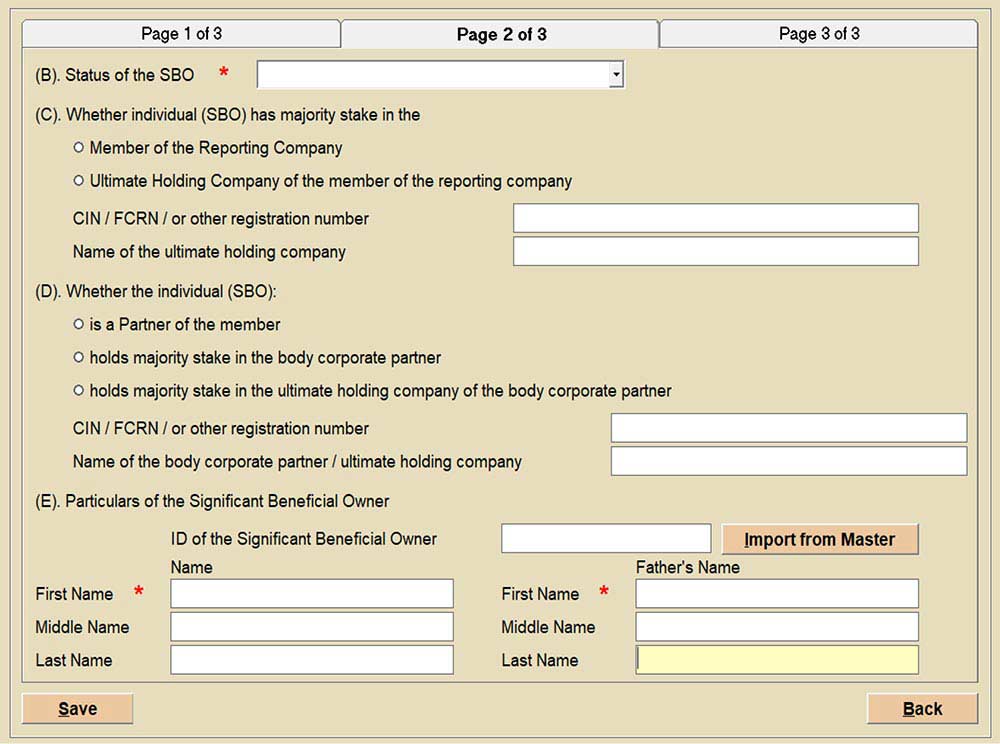

Step 9. On clicking on the Number of members through whom indirect holding a new page will be enabled as shown below where you can add members by the “ADD” option:

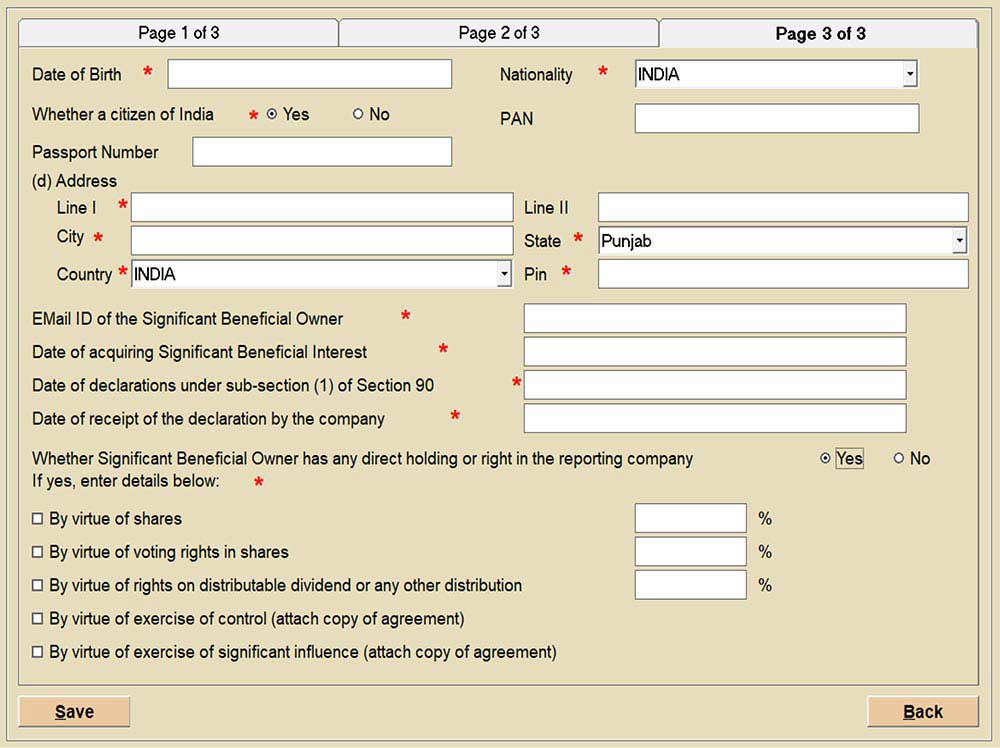

Step 10. By clicking on Add a new page will be open for entering the Details of a member, fill in the requisite details and save to proceed further:

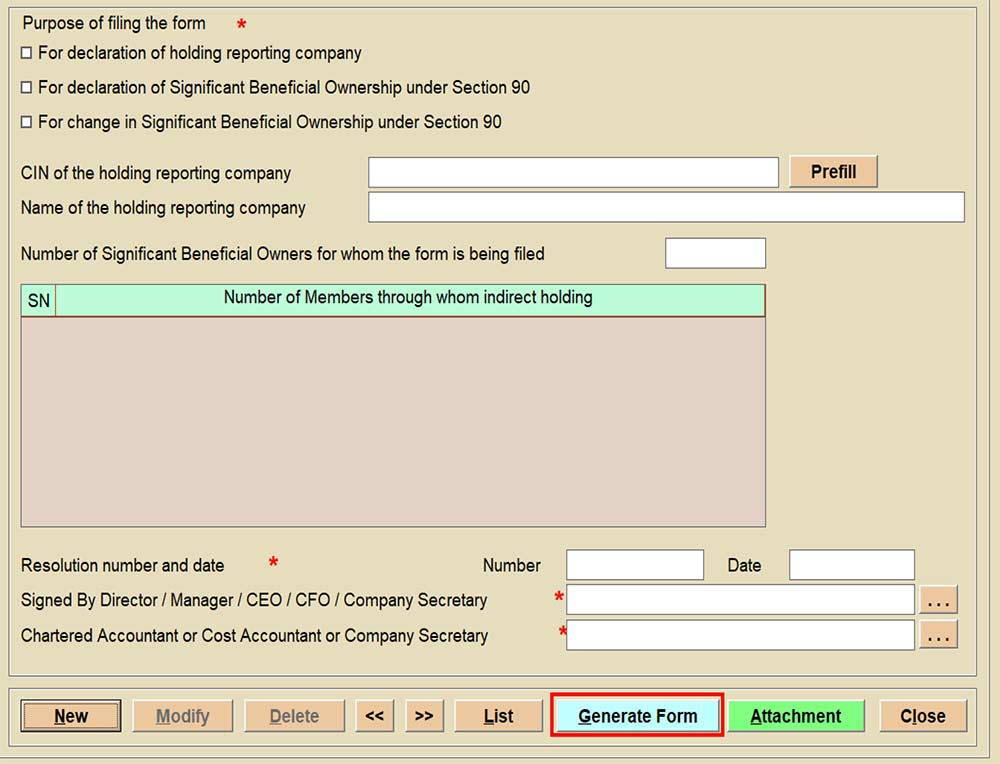

Step 11. Enter the Resolution date and number and select authorised signatories. Save the form.

Step 12. Click on generate form and your form will be saved on the MCA portal.

Step 13. Further, view the form on the MCA portal, save and submit the form.