The Andhra Pradesh High Court in a ruling stayed the publication of a notification issued via the Institute of Chartered Accountants of India (ICAI) removing a Chartered Accountant (CA) name from its register of members for making bogus GST invoices and fake claims of the ITC, CA was accused.

The writ petition has been filed by a CA Akshay Jain, an associate member of the Institute of Chartered Accountants of India (ICAI) practising since December 15, 2016, contesting the disciplinary action taken by the Disciplinary Committee of ICAI. The Director General of GST Intelligence has filed a complaint against him dated January 25, 2021, alleging professional misconduct.

The counsel of the applicant claimed that the Disciplinary Committee was unable to comply with the due process under the Chartered Accountants Act, 1949 and that the applicant was not provided with the chance to cross-check the witnesses and claimed the proceedings were performed just in an ordinary manner.

The committee dated October 24, 2024, found him guilty and offered a 5-year removal from the membership register of ICAI which came into force from January 3, 2025. The respondent (ICAI) defended the case by claiming that the applicant had another statutory remedy u/s 22(G) of the Chartered Accountants Act to appeal the decision.

It was mentioned by the counsel of the respondent that the applicant had approached the court without exhausting this remedy and was unable to allege any procedural malafide or breach of natural justice.

It was noted by Justice Venkateswarlu Nimmagadda that the applicant had bypassed the legal plea process and the urgency of the case warranted interim relief. The publication of the Gazette notification has stayed under the court removing the name of the applicant from the ICAI register w.e.f January 3, 2025, till the petitioner files a statutory appeal.

The court ordered the applicant to submit a plea before the Appellate authority in 4 weeks including an interlocutory application asking for interim suspension of the disciplinary proceedings. The respondents sought to communicate the decision of the court to the related parties.

Read Also: All About DGGI and Its Role in Preventing GST Evasion

The writ petition was disposed of and the applicant was suggested to move with the appellate process. On either party, no costs have been implemented by the court.

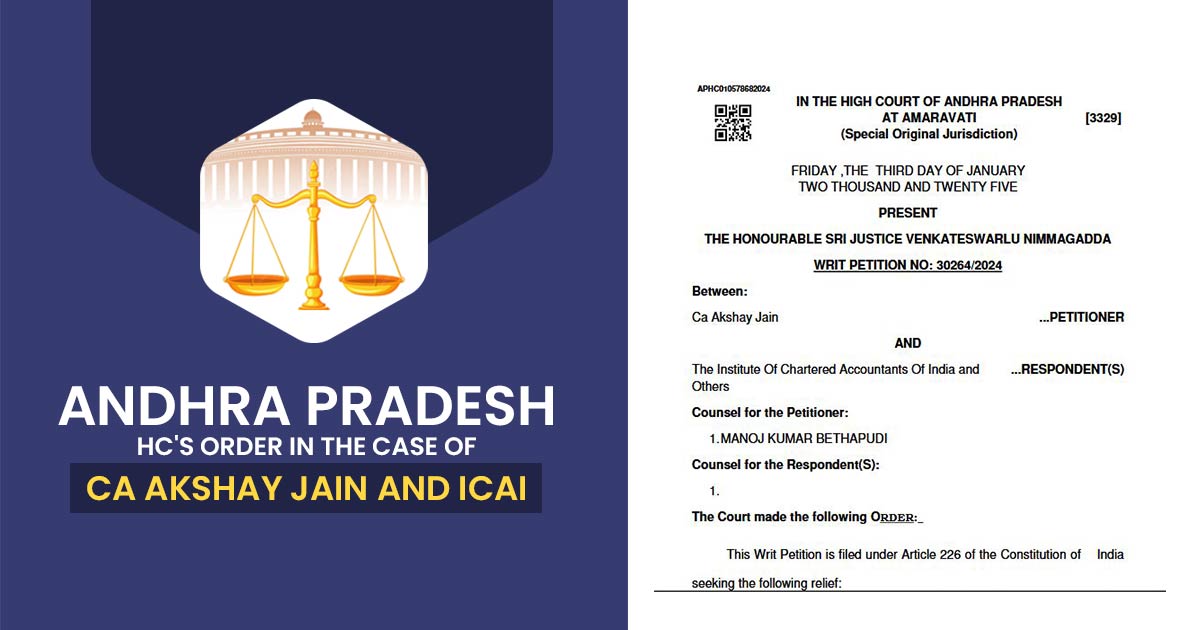

| Case Title | CA Akshay Jain And ICAI |

| Citation | Writ Petition No: 30264/2024 |

| Date | 03.01.2025 |

| Petitioner by | Manoj Kumar Bethapud |

| Andhra Pradesh High Court | Read Order |