It was carried out by the Delhi High Court (HC) that the fees collected via the Central Electricity Regulatory Commission (CERC) and the Delhi Electricity Regulatory Commission (DERC) cannot be subject to the goods and services tax (GST).

The ruling came in answer to the show cause notices furnished via the tax authorities asking for the GST on the regulatory fees under the Central GST (CGST) Act, 2017, and the Integrated GST (IGST) Act, 2017.

Under Service Accounting Code 998631, the tax authorities had categorised the fees as taxable services that relate to “support services to electricity transmission and distribution”, subject to an 18 per cent GST. As per the court the regulatory and adjudicatory functions of CERC and DERC, undergone under the Electricity Act, 2003, were statutory obligations and not business activities.

Read Also: What If Electricity Comes Under GST India?

It was outlined by the court that the commission’s operations being statutory in nature and undergone without pecuniary gain, are not entitled to ‘business’ u/s 2(17) of the CGST Act. It was emphasized that Schedule III of the CGST Act does not have the services rendered via the courts and tribunals from GST. it was ruled by the court that CERC and DERC, as quasi-judicial bodies, fall within this exemption.

The claim of the tax authorities has been rejected by the court that the statute and adjudicatory roles of the commissions could be separated, citing that their operations are non-separable and inherently statutory. It was mentioned by the court that the notifications under the CGST or IGST Acts cannot override the statutory exemptions given under the CGST Act. The Show Cause Notice (SCN) as arbitrary and unsustainable has been reaffirmed by the court.

The high court has mentioned that the Central and Delhi Electricity Regulatory Commissions, being quasi-judicial authorities, are not businesses, and their role is to govern the electricity sector in the public interest.

It consists of chores such as setting tariffs, issuing licenses, and ensuring fair practices, which are legal liabilities instead of services for profit. It stresses that such regulatory activities would not be equated to commercial services and therefore any fees or charges they collect like processing fees for licenses, are waived from GST under the law.

Recommended: GST Will Be Levied on the Installation of Electricity Distribution Systems by DISCOMs

It was outlined by the ruling that the operations are performed in furtherance of statutory duties, not for pecuniary gain, and therefore do not drop within the extent of ‘business’ u/s 2(17) of the CGST Act.

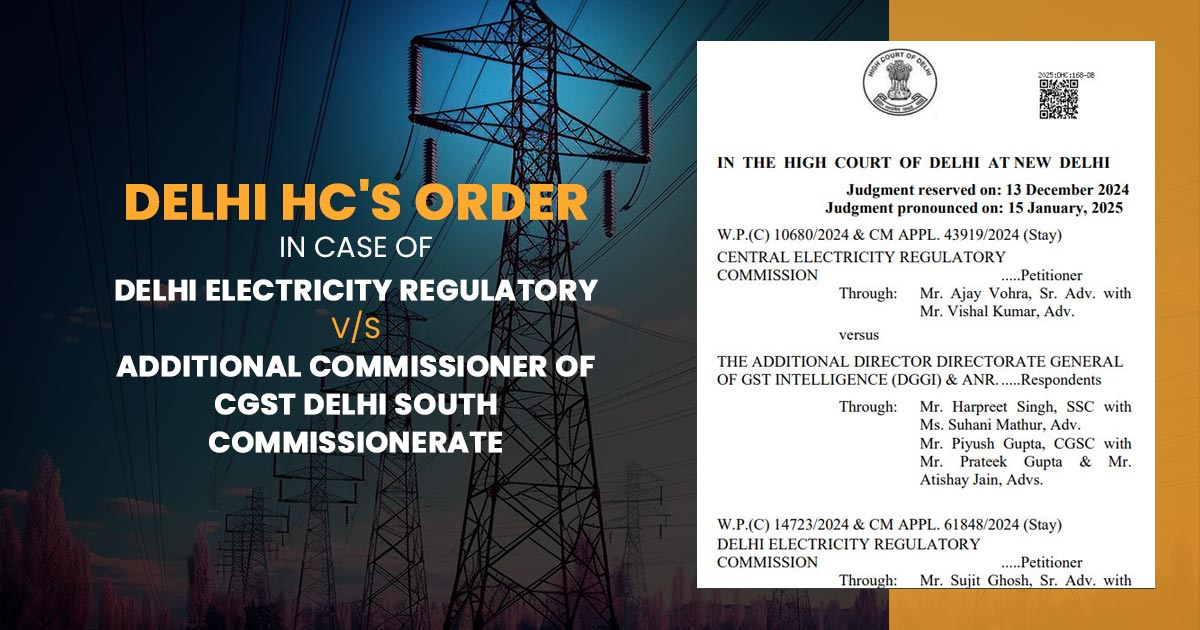

| Case Title | Delhi Electricity Regulatory vs. Additional Commissioner of CGST Delhi South Commissionerate |

| Citation | W.P.(C) 10680/2024 & W.P.(C) 14723/2024 |

| Date | 15.01.2025 |

| Petitioner by | Mr Ajay Vohra, Mr Vishal Kumar |

| Respondent by | Mr Harpreet Singh, Ms Suhani Mathur, Mr Piyush Gupta, Mr Prateek Gupta, Mr Atishay Jain |

| Delhi High Court | Read Order |