When a business has no tax deductions during a specific period, filing a Nil TDS Return is a way to comply with legal and regulatory requirements related to tax withholding.

Top Reasons Why Businesses Should File Nil TDS Returns

If a business hasn’t had any Tax Deducted at Source (TDS) during a certain period, it still needs to file a report stating that no tax was deducted. This is known as submitting Nil TDS returns.

Doing this helps the business avoid any penalties or fines. Here’s a simpler breakdown of why this is important:

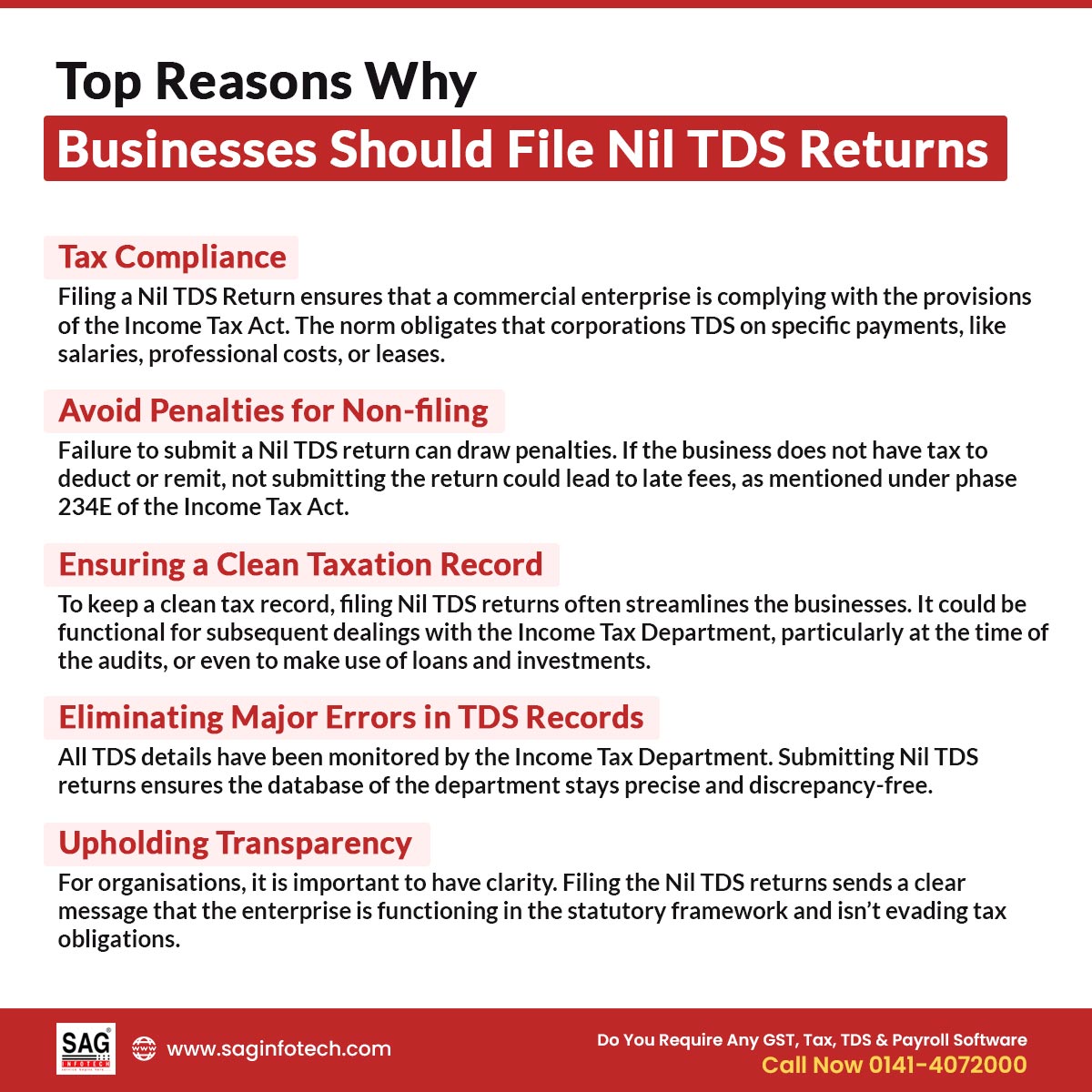

Tax Compliance

Filing a Nil TDS Return ensures that a commercial enterprise is complying with the provisions of the Income Tax Act. The norm obligates that corporations deduct tax at source on specific payments, like salaries, professional costs, or leases.

If no such bills or tax deductions are there at a certain phase in a duration, agencies are not required to file a Nil TDS return.

Avoid Penalties for Non-filing

Failure to submit a Nil TDS return can draw penalties. If the business does not have tax to deduct or remit, not submitting the return could lead to late fees, as mentioned under phase 234E of the Income Tax Act.

Over time, these penalties may rise, affecting the financial health of the enterprise.

Ensuring a Clean Taxation Record

To keep a clean tax record, filing Nil TDS returns often streamlines the businesses. It could be functional for subsequent dealings with the Income Tax Department, particularly at the time of the audits, or even to make use of it for loans and investments.

Read Also: Step-by-Step Process To File TDS Return Online By Utility

A responsible taxpayer is said to be the one who conducts business with a consistent record of well-timed tax filings, together with Nil TDS returns.

Eliminating Major Errors in TDS Records

All TDS details have been monitored by the Income Tax Department. Submitting Nil TDS returns ensures the database of the department stays precise and discrepancy-free.

If a commercial business is unable to file, then it could create confusion or an assumption that the business has neglected to deduct TDS when it must secure.

Upholding Transparency

For organizations, it is important to have clarity. Filing the Nil TDS returns sends a clear message that the enterprise is functioning in the statutory framework and isn’t evading tax obligations.

Recommended: DOs & DON’Ts for TDS Deductors While Statement Filing, Deposit & Demand Closure

It permits building the consideration of stakeholders along with the buyers, banks, and providers, who may compare the integrity of the commercial enterprise’s financial.

Closure: The Nil TDS return submission is more than merely a procedural need. It guarantees legal compliance, avoids penalties, enables carrying an effortless tax report, prevents discrepancies, and boosts transparency in business operations.