In the aforesaid case, the ITAT remanded the case to the CIT(A) post noting that no effective chance was provided before the taxpayer, and the taxpayer was enabled to verify the AO additions if the opportunity may be provided.

The taxpayer has chosen the presumptive basis of taxation u/s 44AD. The AO has started the proceedings on the taxpayer based on the foundation that the taxpayer has deposited Rs 1,65,47,220 in his bank account but the taxpayer has not submitted his income return nor proposed the cited amount for taxation.

AO has furnished various notices of hearing which were left uncomplied and hence the above-said cash deposits of Rs 1.65 crores were added to the taxpayer’s income u/s 68.

The Plea Was Dismissed by CIT(A)

Before Ahmedabad ITAT it was claimed via the taxpayer that CIT(A) disposed of the plea without proceeding into the merits of the matter. Two notices have been issued by CIT(A) against which the taxpayer asked for the adjournment.

CIT(A) without providing any additional chance has dismissed the plea without independent application of mind. The taxpayer can show that the existing additions are not obligated to be sustained if they are provided a chance. These taxpayer’s submission was not objected to via the revenue.

Read Also: Cuttack ITAT Remands Case to CIT(A) for Reassessment of Non-Compliance and Evaluation of Evidence

The case was restored by the ITAT to file CIT(A) for afresh consideration.

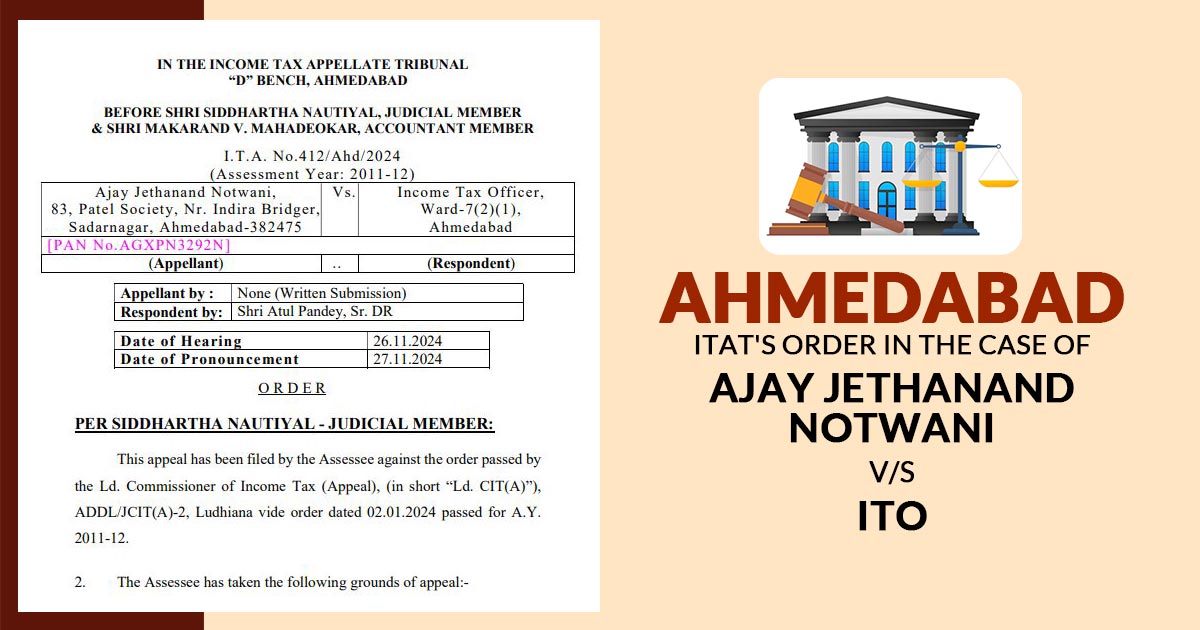

| Case Title | Ajay Jethanand Notwani vs. ITO |

| Citation | I.T.A. No.412/Ahd/2024 |

| Date | 27.11.2024 |

| Appellant by | None (Written Submission) |

| Respondent by | Shri Atul Pandey |

| Ahmedabad ITAT | Read Order |