The Bombay High Court carried that as the revocation orders for the registration cancellation on the application of the applicant were passed opposite to the norms of natural justice, after that all the forthcoming proceedings have been initiated, which are consequential, would get quashed.

The Division Bench of Justice M. S. Sonak and Justice Jitendra Jain marked that “Before the revocation of cancellation of registration, the Petitioner was not supplied with the documents based on which its application for cancellation of registration was rejected, which is contrary to the principles of natural justice.”

Case Facts

The CGST Authority on June 28, 2021, furnished a registration certificate to respondents in Form GST REG-06. On May 09, 2023, the applicant/taxpayer applied to cancel the registration in Form GST REG-16. As per the application, the CGST authorities cancelled the registration of the applicant.

Thereafter dated Feb 20, 2024, the CGST furnished an email before the applicant citing that the cancellation order was revoked as per the orders obtained via the appellate authority/ Higher authority for the restoration of the cancellation order. Identical to that the order was passed rejecting the application of the applicant for the cancellation of the registration on May 09, 2023.

CGST authority on Feb 26, 2024, has furnished a Show Cause Notice (SCN) before the applicant as to why the registration must not get cancelled towards the same that has been received via fraud, wilful misstatement, or suppression of facts as per Sec 29(2)(e) of CGST Act, 2017. Subsequently, an order was passed on March 08, 2024, for the cancellation of registration with retrospective effect from June 27, 2020.

When the applicant objected it was answered via the Dy Commissioner of CGST that the registration cancelled was restored and consequently cancelled ab initio as mentioned by the State GST authorities.

When CGST authorities notify the applicant to receive an NOC from the State GST authorities for the revocation of the GST cancellation of registration then the applicant approaches the High Court.

Bombay High Court Observation

It was marked via Bench that the application of the applicant for the cancellation of registration was accepted via the Respondents, and the cancellation came into force on May 08, 2023.

After 10 months without furnishing any hearing or show cause notice for the revocation of the cancellation of the registration the respondents revoked the cancellation based on the thing that it was undertaken as per the obtained orders from the Appellate Authority / Higher Authority, the Bench mentioned.

Read Also: Delhi HC Quashes GST Cancellation Order Due to Lack of Specifics in Show Cause Notice

The bench encountered that who was this Appellate Authority/ Higher Authority or what the order made was nowhere revealed to the applicant during that time but after the cancellation order was incurred.

It was mentioned by the bench that it was mandatory for the respondents to furnish an SCN towards the revocation of cancellation of registration before passing the order.

By not issuing any SCN the restoration of the cancellation of registration is opposite to the norms of the natural justice, Bench mentioned.

Form GST REG-05 rejected the application for the cancellation of registration mentioned for the reasons, the bench encountered that the mentioned Form does not hold any cause and the space following the phrase “following reason” is blank.

Hence the application rejection for the cancellation of registration is opposite to the norms of natural justice as it does not carry any cause and the omission is expressive of the non-application of mind, as per the bench.

As the decision-making process was flawed the HC quashed the order.

As there was a failure of natural justice, the HC granted freedom to the respondents to proceed as per the statute.

Considering the suspicion of the respondent that the applicant may use the input tax credit (ITC) to its GST credit and attempt to render the additional proceedings unproductive, the HC restrained the petitioner from using the same ITC for a certain reasonable duration at which the respondents shall be required to conclude their proceedings.

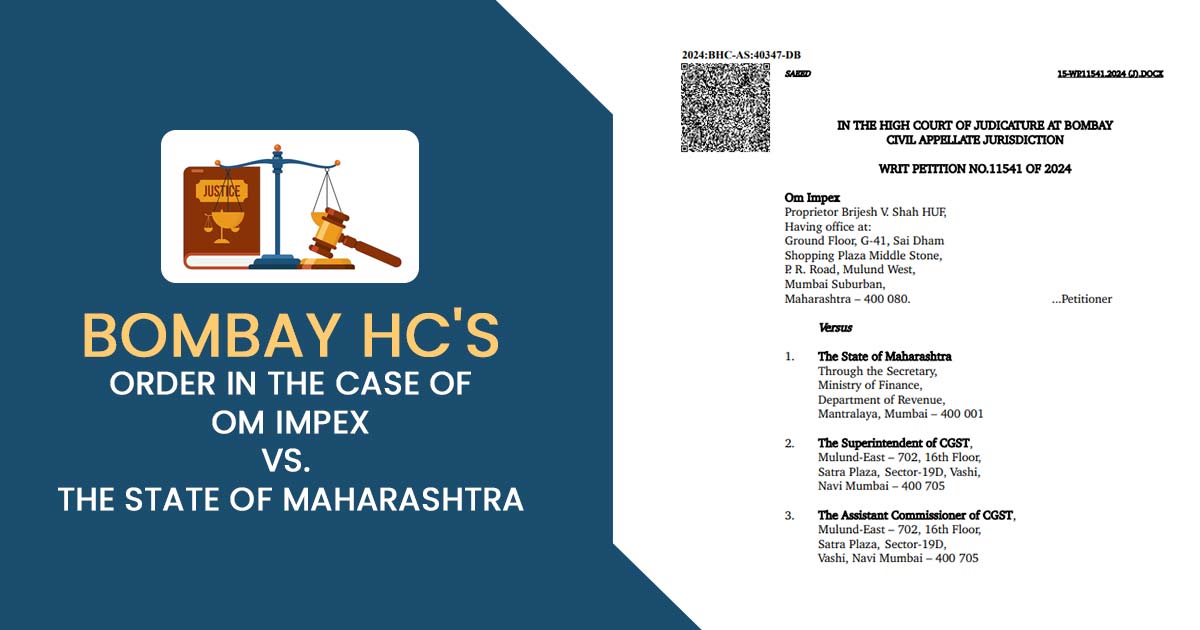

| Case Title | Om Impex vs. The State of Maharashtra |

| Citation | Writ Petition No.11541 of 2024 |

| Date | 08.10.2024 |

| Counsel For Petitioner | Mr Sujit Sahoo |

| Counsel For Respondent | Ms S. D. Vyas, Ms Dhruti Kapadia |

| Bombay High Court | Read Order |