The assessees earlier were obligated to reconcile the Input tax credit claimed in FORM GSTR-3B with the information shown in FORM GSTR-2A as per sub-rule (4) was inserted into Rule 36 of the Central Goods and Services Rules, 2017 (“the CGST Rules”) w.e.f. October 09, 2019.

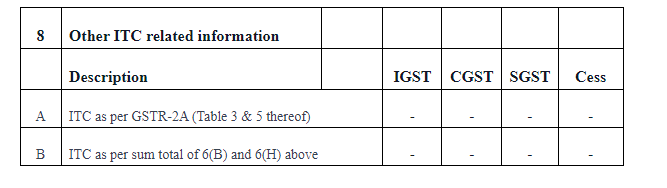

Also, the same condition emerges as of the obligation under Table 8 of FORM GSTR-9, where the assessee was needed to reconcile the ITC opted with the related numbers in FORM GSTR-2A. For easier understanding the contents of Table 8(A) of FORM GSTR-9 are reproduced below:

Now-

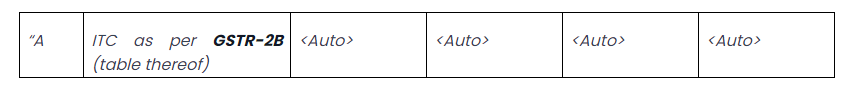

The CBIC vide Notification No. 20/2024 – Central Tax dated October 8, 2024, has replaced ITC as per GSTR-2A from ITC as per GSTR-3B. The same is reproduced below:

- In the articulated rules, in FORM GSTR-9, in the table, in Pt. III, in serial number 8, for serial number A and the entries relating thereto, the subsequent serial number and entries shall be replaced, like:-

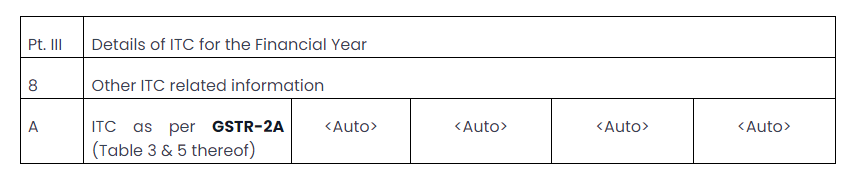

Before it was as follows:

Our Observations:

In Rule 61 CBIC vide Notification No. 82/2020–Central Tax dated November 10, 2020 introduced amendments. With effect from January 01, 2021 FORM GSTR 2B was introduced. To provide the legal backing to claim the ITC as per FORM GSTR-2B, Finance Act, 2021 has inserted a new clause (aa) to sub-section (2) of Section 16 of the CGST Act:

(aa) the details of the invoice or debit note directed to in clause (a) have been provided via the supplier in the statement of outward supplies and this information has been communicated to the receiver of such invoice or debit note in the designated way u/s 37.

Afterwards, the CBIC vide Notification No. 39/2021–Central Tax on December 21, 2021, notified the below-mentioned revisions of the Finance Act, 2021 with effect from January 01, 2022, and as per that, Rule 36(4) of the CGST Rules was replaced from further amended vide Notification No. 40/2021-Central Tax, dated December 29, 2021, with effect from January 01, 2022. The Rule 36(4) after the amendment read as below:

“(4) No input tax credit shall be availed by a registered person in respect of invoices or debit notes the details of which are required to be furnished under sub-section (1) of section 37 unless,-

(a) the details of such invoices or debit notes have been furnished by the supplier in the statement of outward supplies in FORM GSTR-1, as amended in FORM GSTR-1A if any, or using the invoice furnishing facility; and

(b) the details of input tax credit in respect of such invoices or debit notes have been communicated to the registered person in FORM GSTR-2B under sub-rule (7) of rule 60.”

A registered person from January 01, 2022, was needed to claim the ITC that appears merely in FORM GSTR-2B.

Consequently to align with the above said amendments the CBIC has replaced FORM GSTR-2A with FORM GSTR-2B for the reconciliation. The assessee is needed to reconcile the claimed input tax credit (ITC) in FORM GSTR-3B with the information in FORM GSTR-2B under Table 8 of FORM GSTR-9 and to file FORM GSTR-9.

The very interchange eases the compliance needs as the assessees are now liable to reconcile the ITC merely with FORM GSTR-2B.