The Chandigarh bench of the Income Tax Appellate Tribunal ( ITAT ) asked the Assessing Officer ( AO ) to allow the Foreign Tax Credit ( FTC ) as Form 67 was filed on the extended due date along with the Income Tax Return (ITR).

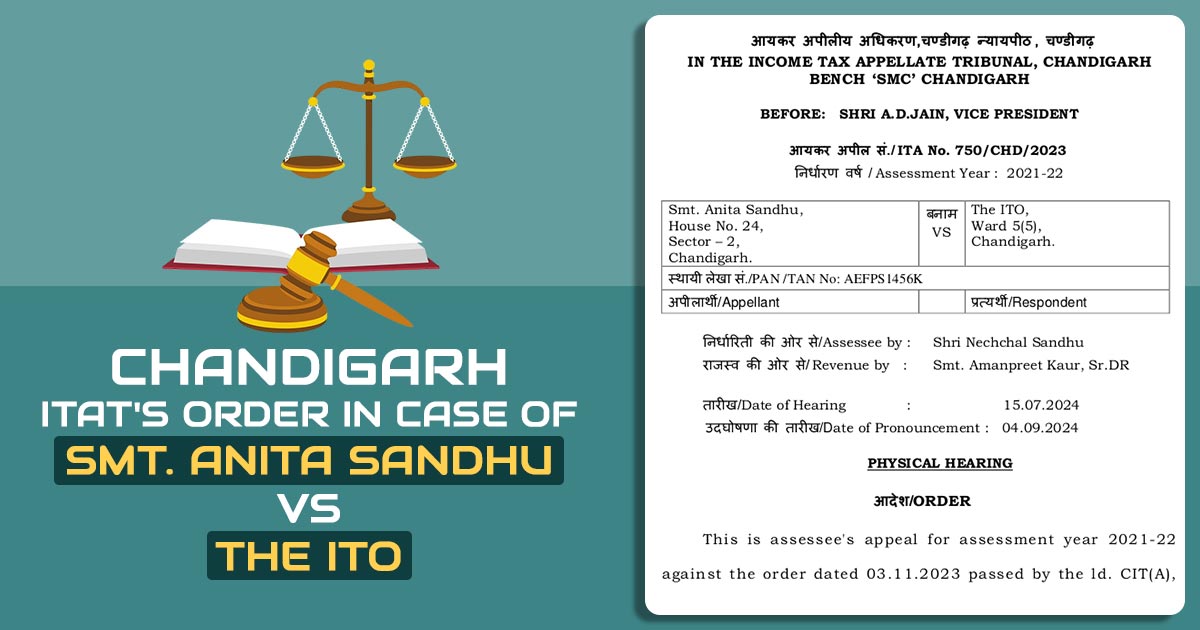

Towards the matter, the taxpayer Anita Sandhu, had furnished the appeal to the ITAT against the impugned order passed by the Commissioner of Income Tax (Appeals) of the order on 03.11.2023.

The taxpayer furnished her ITR for the AY 2021-22 dated 02.09.2021, asserting a Foreign Tax Credit ( FTC ) of Rs. 71,308 for taxes paid in Canada. Form 67, describing the overseas income and the FTC was furnished with the return on the identical date. However, the FTC claim was not accepted in the intimation furnished u/s 143(1) dated 05.07.2023.

The disallowance of FTC was carried by the CIT(A)

It was claimed by the taxpayer that the FTC claim must be permitted since Form 67 has been submitted by the extended deadline.

ITAT bench noted that in the same matter, since Form 67 was furnished in the extended due dates for the income returns, the bench reversed the order of the CIT(A), remarking that the CIT(A) losses to acknowledge material documentary proof, along with the acknowledgement receipt of Form 67 filed dated 02.09.2021 with the ITR.

Therefore ITAT bench sought AO to regard Form 67 and authorise the FTC to the taxpayer, as per the statutory.

The ITAT bench, including A.D. Jain ( Vice President ), permitted the taxpayers’ appeal.

Read Also: Madras HC Permits FTC Claim as Form-67 Filed After ITR But Just Before Intimation

Shri Nechchal Sandhu represents the taxpayer and the Smt. Amanpreet Kaur represents the Revenue.

| Case Title | Smt. Anita Sandhu Vs. The ITO |

| Citation | ITA No. 750/CHD/2023 |

| Date | 04.09.2024 |

| Assessee by | Shri Nechchal Sandhu |

| Revenue by | Smt. Amanpreet Kaur, Sr.DR |

| Chandigarh ITAT | Read Order |