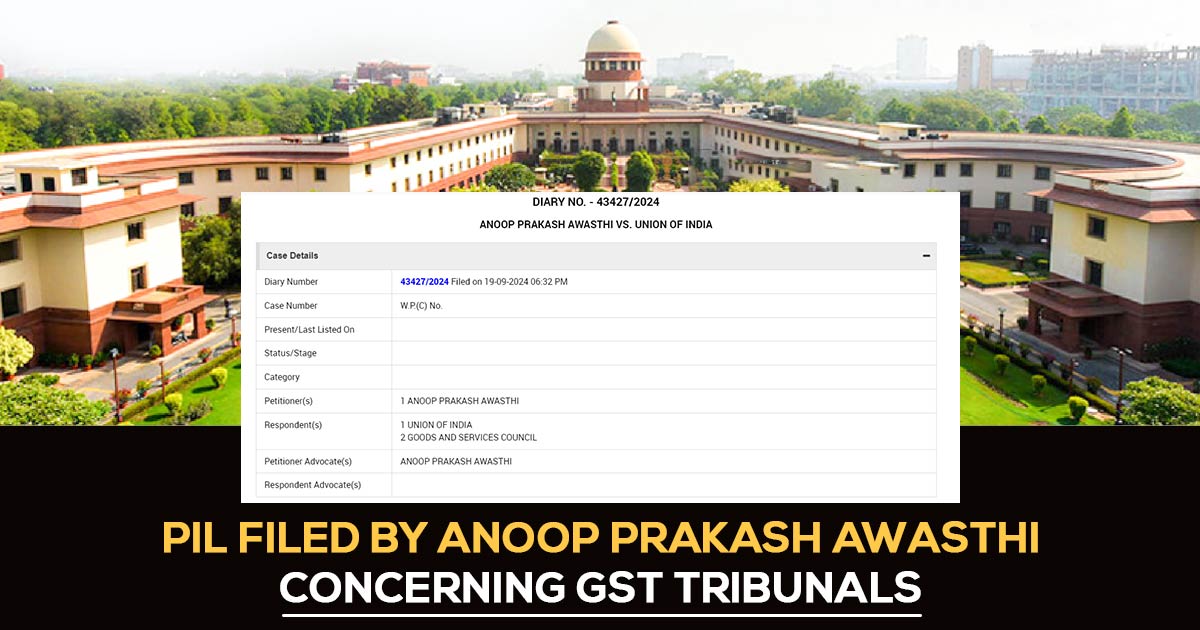

A public interest litigation has proceeded to the Supreme Court seeking the recommendation of the centre to finish the process of appointment of judicial and technical members, find the premises for running benches, make a website, allocate the budget, and operationalize the GST appellate tribunal within a timely manner.

Within the interest of public advocate Anoop Prakash Awasthi filed the plea in which he asked to provide suggestions to the centre and goods and services council to finish the process of appointment judicial and technical members and find the premises for running the benches, create a website and operationalize the GST Appellate Tribunal within the said time specifically before the 31st December 2024 or as early as possible.

As per the petition, “The enactment and implementation of Goods and Services Tax (GST) in the country in 2017 has been an extraordinary and unprecedented indirect tax reform in the country, however the issue of establishment of the Goods and Services Tax Appellate Tribunal is a long pending issue since the Central Goods and Services Tax Act, 2017 came into 2017, In contradistinction to the judicial adjudicatory authorities established and made operational for all other major revenue and taxation related statutes, the legal adjudicatory mechanism for GST related issues has been limited to approaching the High Courts under their Writ jurisdiction, thus, substantially burdening the Highs Courts with unnecessary litigation,”

Read Also: Central Govt. to Prohibit Threat and Coercion in GST Search and Seizures, SC

The petition mentioned that the process for appointment of an appellate authority on the judicial side to determine the GST pertinent problems had yet to be performed for the last 7 years.

The petition cited that “The process started in late 2023 but even thereafter it is not a bureaucratic priority to complete the process in a time-bound manner by recruiting and operationalising the GST Appellate Tribunal at Delhi and other places. That though the chairperson of the GST Appellate Authority was appointed on 6th May 2024, when the Justice (Retd.) Sanjay Kumar Mishra has been administered the oath of the chairperson of GST Appellate Tribunal but nothing further on the ground has been done by way of recruitment and appointment of judicial and technical members to the Tribunal,”

The functional GST Appellate Tribunal at 31 Places or at any place is an illusion till now, the petition stated. In 2017, the Goods and Services Tax (GST) came into force. In February 2024, the Revenue Secretary declared that the GST Appellate Tribunal may commence operation by July or August 2024, as per the petition.

The Central Government has been empowered by Section 109 of the Central Goods and Services Tax, 2017, in its Chapter XVIII on the suggestion of the GST council to start an Appellate Tribunal and benches thereof in diverse states of the country, with the National Bench of the Appellate Tribunal to be established at New Delhi.