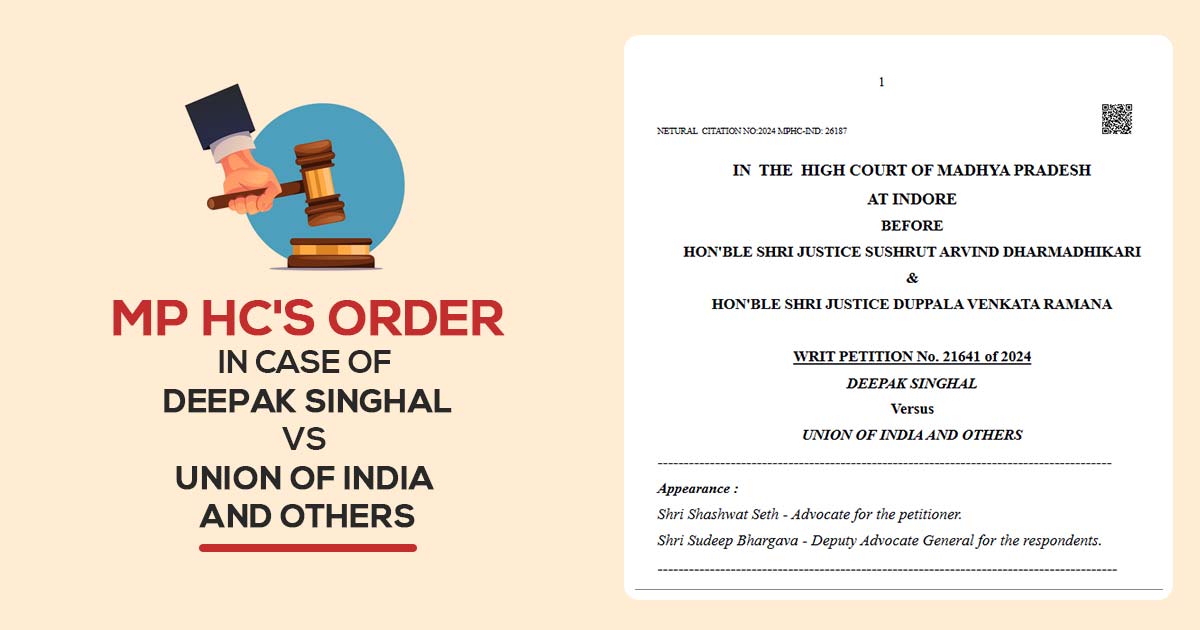

The Madhya Pradesh High Court carried that Goods and Services Tax (GST) authorities cannot invoke penal provisions of the Indian Penal Code (IPC) when the alleged offence comes within the GST Act [Deepak Singhal v. Union of India and Others].

A Bench of Justices SA Dharmadhikari and DV Ramana quashed criminal proceedings initiated against a businessman under diverse provisions of the IPC, expressing,

“…GST Act, 2017 is a special legislation which holistically deals with procedure, penalties and offences relating GST and at the cost of repetition this court cannot emphasise more that the GST Authorities cannot be permitted to bypass procedure for launching prosecution under GST Act, 2017 and invoke provisions of Indian Penal Code.”

If rather the conducting the mentioned proceedings under the GST Act the GST authorities delegate it to the local police then it shall defeat the Act’s objective.

With a petition the court dealing that asks to quash the criminal proceedings infused under distinct provisions of the IPC against the applicant. It was alleged that the applicant has running a fake and bogus registered firm that has provided invoices/bills without supplying the goods or services.

It was claimed by the applicant that via direct infusing of the IPC provisions, the GST authorities overlooked the procedural provisions under the GST act, specifically u/s 132(6), which directs the sanction of the GST Commissioner before prosecution.

The respondent’s counsel mentioned that the tax offences under the GST Act and those under the IPC are not the same and hence no bar on registration of offences under the IPC via police authorities on the GST authority’s compliance is there.

It was discovered by the court that when the allegation against the applicant opts at face value then it comprises an offence covered via the penal provision of section 132 of the GST Act. It cited that no sanction was chosen from the commissioner, as needed u/s 132(6) of the GST Act, before registration of the FIR.

Read Also: SC Rejects Anticipatory Bail in GST Summons Case U/S 69, Grants Interim Protection

Therefore against the applicant, it quashes the criminal proceedings.

For the applicant Advocate Shashwat Seth appeared and the central government has been represented by Deputy Advocate General Sudeep Bhargava.

| Case Title | Deepak Singhal Versus Union of India and Others |

| Citation | Writ Petition No. 21641 of 2024 |

| Date | 11.09.2024 |

| For Petitioner | Shri Shashwat Seth |

| For Respondents | Shri Sudeep Bhargava |

| Madhya Pradesh High Court | Read Order |