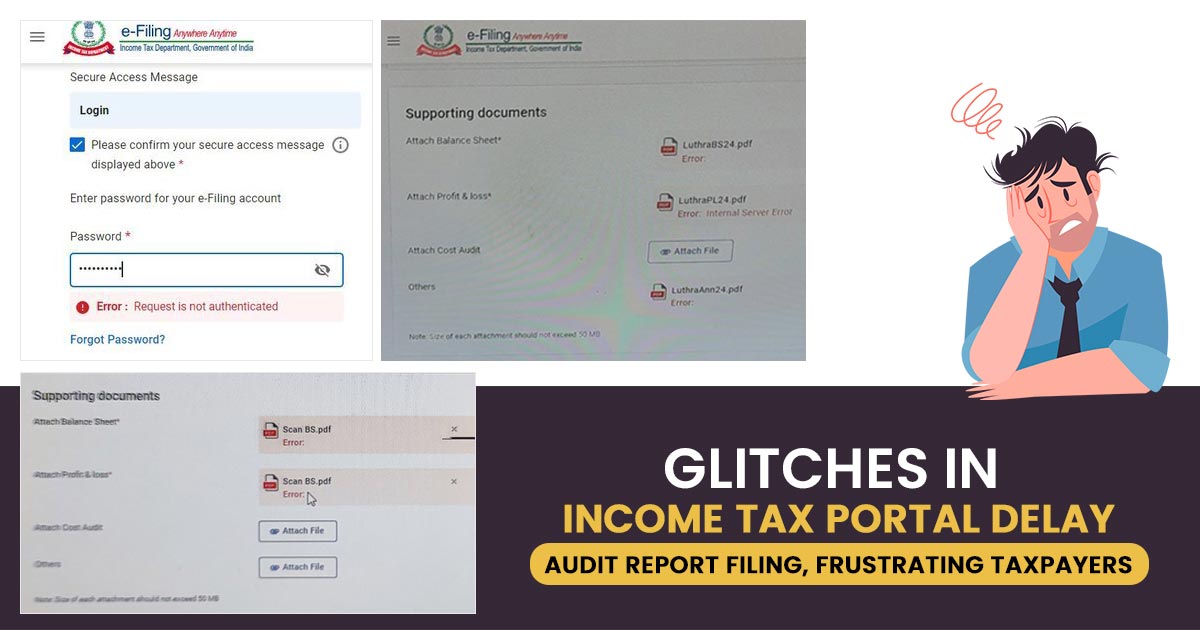

For providing the tax audit reports within the due date of September 30, 2024, professionals and taxpayers are tussling with technical problems on the e-filing portal of the income tax department.

Around late September 17, 2024, the problem has been started when many users notified being not able to upload the tax audit reports because of the attachment failures.

Read Also: Your Income Tax Queries and Our Solution by Tax Experts

As per CA Deepak Chopra, Chairman of the Direct Tax Committee of the Karnataka State Chartered Accountants Association (KSCAA), the high traffic on the portal is been generated due to the coming due date that directed to sluggish performance and frequent technical errors.

The slow response of the portal and the inability to accept the attachments generate influential disruptions. Tax experts mentioned the stress incurred on the auditors and assessees, cited that the portal was not responding on September 18 and came under operation only at late night.

The same has put pressure on professionals attempting to satisfy the compliance due dates. To show the ongoing issues the users have taken to social media with many calling for immediate action.

Various Chartered Accountants (CA) have recommended that the technical issues seem the consequence of the insufficient infrastructure to manage the rise in traffic.

The experts are asking the assessees to provide their filings as soon as possible to prevent the issue that may emerge at the last minute.

Read Also: Free Download Gen Balance Sheet Software for Filing Tax Audit Report

The tax professionals are urging that the income tax department update the e-filing portal capacity to ensure a streamlined process as the due date approaches.