The Bangalore bench of the Income Tax Appellate Tribunal ( ITAT ) in a case quashed a tax penalty imposed u/s 270 of the Income Tax Act 1961, remarking that the taxpayer failed to file a Return due to a bona fide misunderstanding.

The taxpayer Sekhon Jagtar Singh, in this case, is an individual who did not file a return for the relevant AY 2017-18 U/s 139 of the Income Tax Act. The income of the taxpayer included salary, and he disclosed this income only after receiving notices u/s 148 of the Act, which is related to the reassessment of income.

Answering such notices the taxpayer provides Form 16, a certificate issued by the employer detailing the tax deducted at source ( TDS ) and income earned. AO in the reassessment proceedings noted that the taxpayer has claimed an excessive deduction u/s 24 of the tax statute amounting to ₹74,951, which represented interest on a housing loan.

The deduction was not permitted and the amount was added to the total income of the taxpayer resulting in an evaluated income of Rs 58,70,680. For underreporting income under Section 270A of the tax legislature AO invoked penalty proceedings as the taxpayer does not file the original return of income.

The penalty was calculated as 50% of the tax asked to be evaded of Rs 8,16,895. The taxpayer dissatisfied files an appeal against the same to the Commissioner of Income Tax ( Appeals ). On ple, CIT(A) verified the penalty directing the taxpayer to file a plea to the ITAT.

Before the appellate tribunal, the representative counsel of the taxpayer claimed that the whole tax on the salary income would have been deducted before by the employer and hence there was a bona fide belief that there was no underreporting of income.

It was claimed by the representative that the penalty u/s 270A of the income tax statute must not apply in the same case since the taxpayer has no objective to misreport or conceal income. The taxpayer opined, that he filed the returns regularly in previous years and would have furnished the important information to his tax consultant, assuming that the return for the year in question has been furnished.

The taxpayer has changed jobs in the year and all the tax obligations were duly deducted via the employer and deposited with the government. It was asserted by the taxpayer that his failure to furnish the return was due to a bona fide belief that his tax liabilities were satisfied via TDS, and no objective to under-report the income.

The representative of the department kept the order of the lower authorities citing that the taxpayer was mandated to file the income tax return under section 139, though unable to perform the same. The council claimed that the failure to furnish the income return consequence in the underreporting of the income, justifying the penalty imposed by the AO.

The division bench of Mr Waseem Ahmed and Mr Keshav Dubey on analyzing the matter remarked that the AO does not accept the reason of the taxpayer who was claiming that the taxpayer was asked to furnish the income return however does not furnish it and that the Form 16 submission in the assessment proceedings does not waive him from the penalty for underreporting of the income.

It was considered by the tribunal that the whole tax obligation had been deducted at source earlier via the employer and shown in the records of the department that no revenue loss is there. The tribunal directed to Section 270A(6)(a) of ITA, which quoted that no penalty shall be charged if the taxpayer furnishes an effective explanation for the income and discloses all the material facts.

Read Also: ITAT Allows Rectification Due to Misleading Suggestion by Auditor, Leading to Higher Tax Payment

The tribunal was persuaded that the taxpayers’ elaboration was bona fide, provided that he filed the returns regularly earlier and no objective was there to evade the income. It was observed by the tribunal that the disallowed deduction of ₹74,951 under Section 24 of ITA was availed as per the bona fide belief and therefore no penalty must be imposed for underreporting the income.

It was quoted that the tribunal in an identical case, Parulben Vijaykumar Patel vs. ITO, where Ahmedabad Tribunal carried that when the taxpayer’s opinion is bona fide and the income was disclosed, albeit via Form 16 or Form 26AS, no penalty must be levied u/s 270A of the tax statute.

Consequently, the order of CIT(A) has been set aside by the tribunal, and the AO has been asked to remove the penalty of Rs 8,16,895 imposed u/s 270A of ITA.

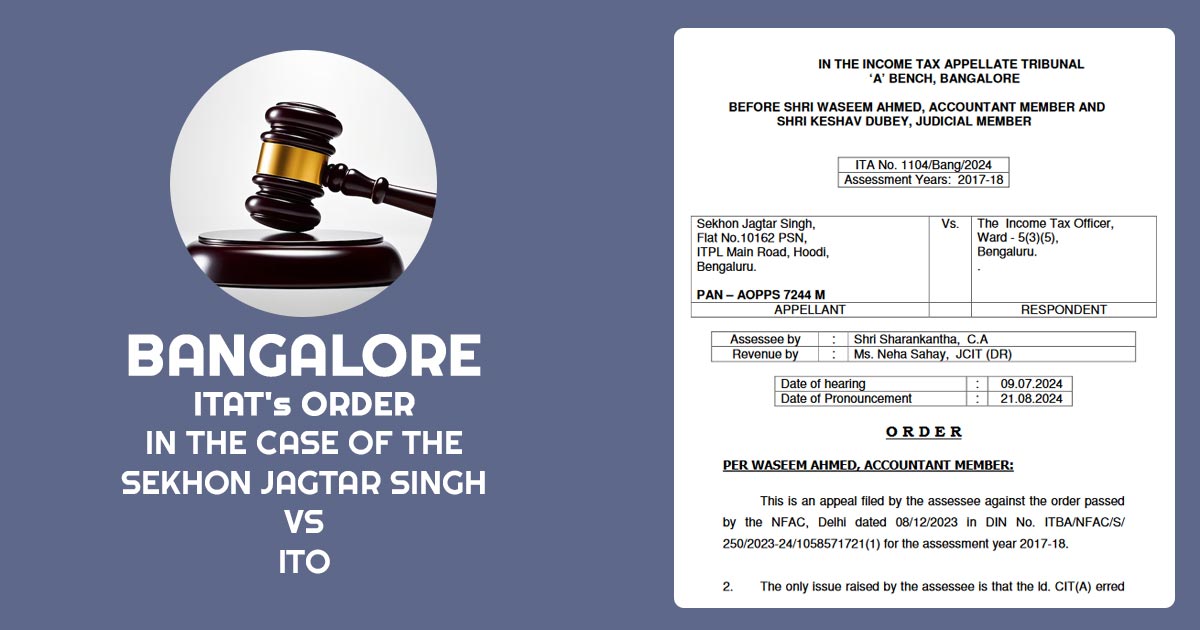

| Case Title | Sekhon Jagtar Singh Vs ITO |

| Citation | ITA No. 1104/Bang/2024 |

| Date | 21.08.2024 |

| Assessee by | Shri Sharankantha |

| Revenue by | Ms. Neha Sahay |

| Bangalore ITAT | Read Order |