The order of the AAR has been quashed by the Rajasthan High Court, Jaipur Bench, rejecting the advance ruling as not maintainable because the applicant was not the supplier.

The bench of Justice Avneesh Jhingan and Justice Ashutosh Kumar has remarked that the petition against the advance ruling is furnished u/s 100 of the CGST Act. The related officer, the jurisdictional officer, or the applicant can choose an appeal against the ruling given u/s 98(4). No appeal is furnished against rejecting the application u/s 98(2) of the CGST Act. The petitioner’s application was dismissed at the threshold u/s 98(2) as not maintainable. The section states that an appeal can be filed just against the orders pronounced under Section 98(4) of the CGST Act.

Under the Goods and Services Tax Act, 2017 the applicant/taxpayer is enrolled and is in electricity transmission. In the furtherance of the business, the applicant involves contractors. The supply of material ex-work is made to further the execution of the contract. The contractor used to transport goods and raised invoices for the transportation. For an advance ruling the applicant filed an application on the problem as to whether in fact of the matters, the transportation of goods was waived under Serial No.18 of Notification No.12/2007 Central Tax (Rate).

U/s 97 of the Central Goods and Service Tax Act, 2017 AAR held application is not maintainable since the applicant was not the supplier.

It was argued by the applicant that in the matter of the non-applicability of the exemption notification, the application would be obligated to file the tax on the reverse charge basis, the services being in the reported class. The opinion is that in Sections 95 and 97 no restriction was there that the application for the advance ruling could be incurred merely via the supplier.

It was argued by the applicant that the objects that the impugned order is appealable. The advance ruling could be asked via the supplier or proposed supplier. Under the sort of supplier, the applicant is covered.

Chapter XVII of the CGST Act deals with advance rulings. Definitions are in Section 95, and it commences with “unless the context otherwise requires.” Under Clause (a), an ‘advance ruling’ is a judgment of the Authority, the Appellate Authority, or the National Appellate Authority at the instance of the applicant on matters or on the issues identified in Sub-Section (2) of Section 97 or Sub-Section (1) of Section 100 or of Section 101C and concerning the supply of goods or services or both, being undertaken or proposed to be undertaken by the applicant.

Clause (b) describes appellate authority for advance ruling as directed in Section 99. Under Clause (c), ‘applicant’ is described as any person registered or wants to obtain registration under the Act. Application under Clause (d) means an application made to the Authority under Section 97(1).

Read Also: Rajasthan’s GST AAAR Denies AAR’s Decision and Orders for a Fresh Ruling on Canteen Subsidies

An application for an advance ruling can be filed by any applicant who wishes to get an advance ruling given by section 97(1). An application citing the question to be directed is to be made in the said way and accompanied by the mentioned fee. Section 97(2) stipulates the problems for which the question for an advance ruling can be strived. Clause (b) of Sub-Section 2 “applicability of notification issued under the provisions of this Act” shall be pertinent for the said matter.

Section 98 furnishes the process to be chosen on the receipt via the application for an advance ruling. Under subsection 2, the council post determines the application, recording it, and furnishing a chance of hearing to the applicant and the related officer ought to pass an order either acknowledging or rejecting the application. Proviso to Sub-Section 2 furnishes that the application for advance ruling would not be accepted on the question raised, pending, or decided in the case of the applicant under any of the provisions of the CGST Act.

Recommended: RJ GST AAR Cancels Petitioner’s Application, Supply and Tax Payment Completed

Under the second proviso, the application would not get rejected without allotting a chance of hearing. The third proviso mentions the causes for rejecting the application. Sub-Section 3 mandates the supply of the order passed under Sub-Section 2 to the applicant and the related officer. Under Sub-Section 4, the authority, after analyzing material placed before it and after furnishing a chance of hearing, shall pronounce an advance ruling on the asked question.

Sub-Section 5 deals with the process to be chosen in case there is a difference of opinion amongst the members of the Authority. Sub-section 6 obligates the authority to pronounce the advance ruling within 90 days of the receipt of the application. Sub-Section 7 specifies that the ruling will be pronounced and signed by the members and certified in the stipulated manner.

AAR order has been quashed by the court and remanded the case back to AAR for deciding the application afresh u/s 98(4) of the CGST Act.

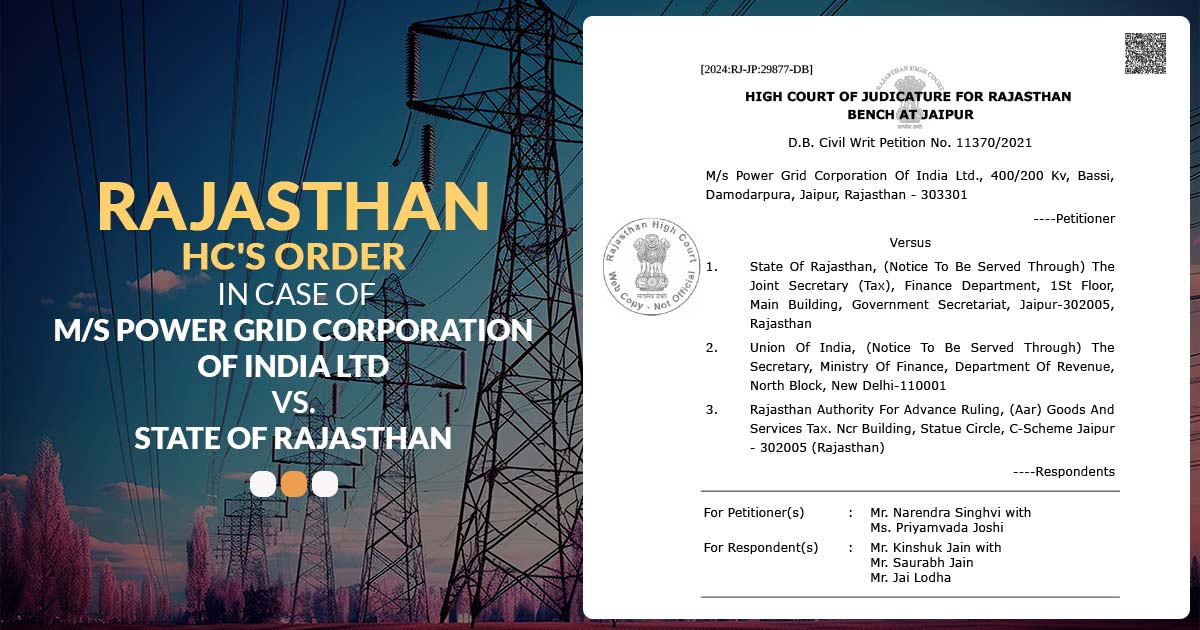

| Case Title | M/s Power Grid Corporation Of India Ltd Vs. State Of Rajasthan |

| Citation | No. 11370/2021 |

| Date | 09.07.2024 |

| For Petitioner(s) | Mr Narendra Singhvi, Ms Priyamvada Joshi |

| For Respondent(s) | Mr Kinshuk Jain, Mr Saurabh Jain, Mr Jai Lodha |

| Rajasthan High Court | Read Order |