The Orissa High Court in a judgment allowed to improve the error that emerged in GST Returns -1 from B2C to B2B. it was discovered by the court that the applicant remarked the error after the opposite part ruled the legitimate running bill amount of the applicant via notifying the same for the aforesaid error dated 1st August 2022.

The applicant M/s. Chintamaniswar Constructions asked the court to provide direction to the opposite Parties the GST department to allow the applicant to correct the GST Return filed for the period 2020-21 and 2021-22 from B2B rather than B2C as was incorrectly filed under GSTR-1 to get the GST Input Tax Credit ( ITC ) benefit by M/s.

The Odisha Police Housing and Welfare Corporation Ltd. (O.P. No.7), is the principal contractor. The deadline by which the rectification must have been taken out was 20th October 2021 and 30th November 2022 respectively.

It was mentioned by the taxpayer that the error was witnessed after the opposite part held up the legitimate running bill amount of the applicant via notifying the same for the aforesaid error dated 1st August 2022. It is the applicant’s matter that subsequently it has been making requests to the opposite parties to allow the same to fix the GSTR-1 Form but to no avail.

The opposite party’s opinion is that once the due date for the rectification of the forms is lapsed, no additional indulgence can be allotted to the applicant.

It was seen by the court that via allowing the taxpayer to improve the aforesaid error there shall be no loss whatever the cause to the opposite parties. It is not that there would be any tax escapement. The same is just concerned with the Input Tax Credit advantage which in any case needs to be provided before the taxpayer. Opposite to that if the same is not allowed the taxpayer would unnecessarily be prejudiced.

Laying in M/s. SUN DYE CHEM v. The Assistant Commissioner ST, the division bench comprising Justice Dr. B R Sarangi and Justice G Satapathy allowed the Petitioner to resubmit the revamped Form-GSTR-1 from B2C to B2B for the aforesaid periods 2020-21 and 2021-22 and to enable the applicant to do the same in a direction is issued to the Opposite Parties to receive it manually.

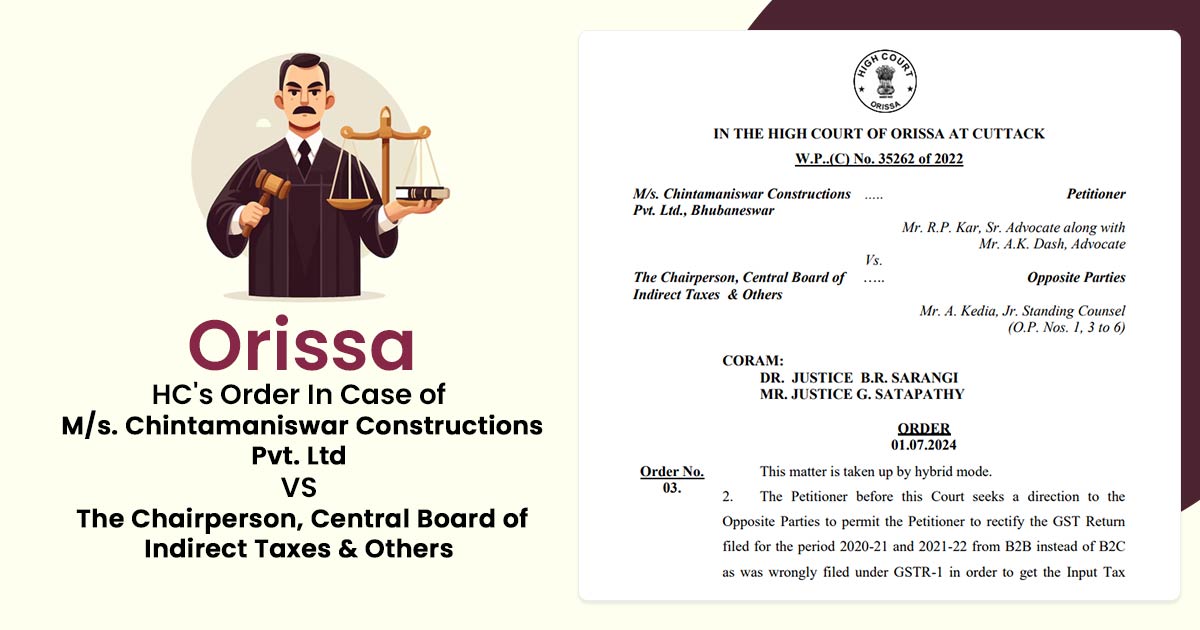

| Case Title | M/s. Chintamaniswar Constructions Pvt. Ltd Vs. The Chairperson, Central Board of Indirect Taxes & Others |

| Citation | W.P..(C) No. 35262 of 2022 |

| Date | 01.07.2024 |

| Counsel For Appellant | Mr. R.P. Kar, Sr. Advocate along with Mr. A.K. Dash, Advocate |

| Counsel For Respondent | Mr. A. Kedia, Jr. Standing Counsel |

| Orissa High Court | Read Order |