The order was been quashed by the Bangalore Bench of Income Tax Appellate Tribunal ( ITAT ) rejecting the approval u/s 80G of the Income Tax Act as the Central Board of Direct Taxes ( CBDT ) has extended the deadline for filing Form 10A/10AB via press release on April 25, 2024, to June 30, 2022.

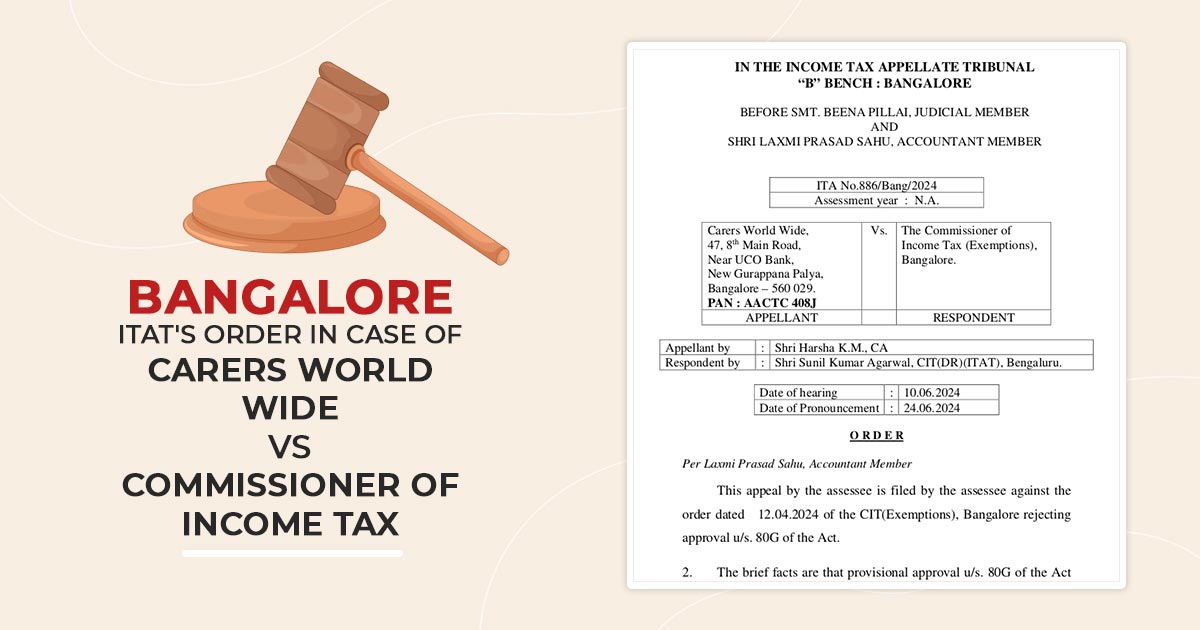

The applicant, Carers World Wide, has contested the order of the CIT (Exemptions), Bangalore, rejecting approval under Section 80G of the Income Tax Act. The assessee contended that the CBDT has extended the due date for filing Form 10A/10AB via press release dated April 25, 2024, to June 30, 2024.

U/s 80G of the Income Tax Act the provisional approval was granted in Form 10AC dated October 15, 2021, from October 15, 2021, to AY 2024-25, and the taxpayer applied Form 10AB on November 3, 2023, for regularization of approval u/s 80G of the Income Tax Act.

Section 80G of the Income Tax Act is for a deduction for donations created to certain charitable institutions or funds. The deduction is for individuals as well as companies. under Section 80G the deduction can be claimed on the amount donated to eligible institutions or funds.

During registration or approval of a trust, institution, or NGO for the first time, Form 10A is used. Any application towards the renewal of registration or approval of the trust will need to be made in Form 10AB.

The CIT (Exemptions) remarked that the taxpayer had belatedly filed the application in Form 10AB as per proviso to Section 80G(5) and rejected the taxpayer’s application.

The two-member bench of Beena Pillai (Judicial Member) and Laxmi Prasad Sahu (Accountant Member) has marked that the CBDT extended the deadline for filing Form 10A/Form 10AB up to June 30, 2024, concerning provisions of Section 10(23C), Section 12A, Section 80G, and Section 35 of the Income Tax Act.

On April 25, 2024, it was apparent that the CBDT issued Circular No. 07/2024, additionally extending the deadline for filing Form 10A and Form 10AB under the Income-tax Act, 1961, up to June 30, 2024. The tribunal while permitting the appeal, remanded the case back to the CIT (Exemptions) for fresh consideration

| Case Title | Carers World Wide Vs. The Commissioner of Income Tax |

| Citation | ITA No.886/Bang/2024 |

| Date | 24.06.2024 |

| Appellant by | Shri Harsha K.M., CA |

| Respondent by | Shri Sunil Kumar Agarwal, CIT(DR)(ITAT), Bengaluru |

| Bangalore ITAT | Read Order |