The New Delhi bench of the Income Tax Appellate Tribunal ( ITAT ) ruled that payment made overseas for delivering a report on Tariff Change is not FTS and set aside the demand of Tax Deducted at Source ( TDS ) under section 195 of the Income Tax Act, 1961.

While framing the assessment, AO witnessed that Lx Pantos India Private Limited, the taxpayer had claimed an amount of INR 89,42,83,355 for the shipment clearing and forwarding expenses. It was witnessed that out of this amount, an amount of INR 33,49,56,683 was paid overseas on which no tax was deducted by the taxpayer.

The taxpayer has been called by the AO to explain the cause of why it is unable to deduct tax concerning section 195 since he believed that the services generated to the taxpayer via the persons hired via it fell beneath the class of the consulting services and payments made before the pirates, are obligated for deducting tax at source as the same was squarely covered under the provisions of section 195 of the Act which mandates deduction of tax at source on payments made to a non-resident.

The bench noted that if the opinion of the Revenue is accepted, any data received by the taxpayer from non-residents during business would be deemed as a rendition of consultancy services by the non-resident. The bench also observed that the Revenue had not disputed the fact that freight and logistics services were given via the non-residents.

Since the payment was solely for transport, procurement, customs clearance, delivery, warehousing, and picking-up services, it could not be considered payment for consultancy services, stated the Bench. In this matter, ACIT vs M/s. Indiar Carriers Pvt Ltd, it was carried that payment made to the freight forwarding agent is counted under Circular No. 715 dt Aug 8, 1995, and, consequently, it was not for managerial services and the expenditure was in nature of business expenses.

The Revenue’s main reason for considering the payment to the overseas logistics company as consultancy services was based on one of the terms of the contract between the Assessee and the overseas parties. The overseas parties provided advice to the Assessee on changing tariff ratios.

However, the ITAT noted that simply providing this advice does not qualify as providing consultancy services. The ITAT stated that offering such information alone does not warrant categorizing the entire service as managerial or consultancy services.

Section 195 of the Income Tax Act specifies the TDS provision for individuals making payments such as interest or other amounts, excluding salary, to an NRI or a foreign company. According to Section 9(1)(vii) of the Income Tax Act, any income deemed to accrue or arise in India, even if earned by a non-resident, is levied to tax in India.

This provision is crucial as it broadens the scope of taxable income in India and includes non-resident taxpayers. The Two-member Bench including Kul Bharat (Judicial Member) and M. Balaganesh (Accountant Member) witnessed that it is not a matter that overseas parties have their Permanent Establishment (“PE”) in India and make income through the business set up and controlled in India. Consequently, the same amount is not levied to tax in India and no tax is required to be deducted at source.

Read Also: Earning via FTS or Royalty May Force Foreign Companies/Non-residents to File ITR

The Tribunal while dismissing the petition of the revenue, concluded that as the income could not be stated as considered to accrue or arise in India no confusion is there for the income that has not been obtained as deemed to be received as accruing or arising in India, no tax is levied on such income.

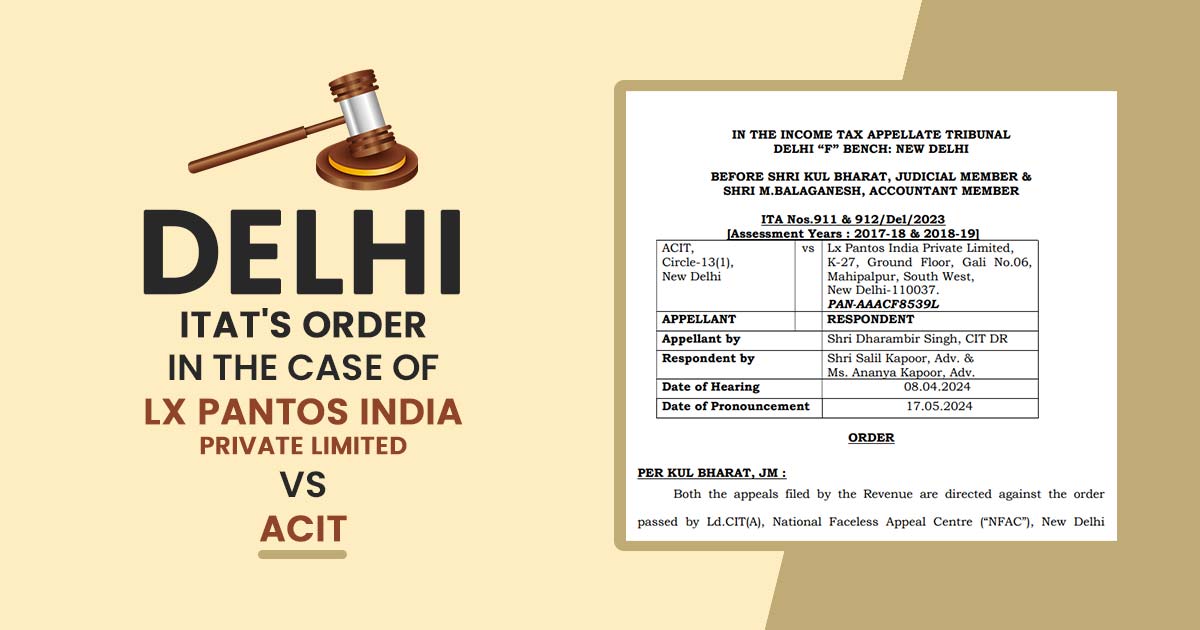

| Case Title | Lx Pantos India Private Limited Vs ACIT |

| Citation | ITA Nos.911 & 912/Del/2023 |

| Date | 17.05.2024 |

| Assessee by | Shri Dharambir Singh, CIT DR |

| Revenue by | Shri Salil Kapoor, Adv. & Ms. Ananya Kapoor, Adv. |

| Delhi ITAT | Read Order |