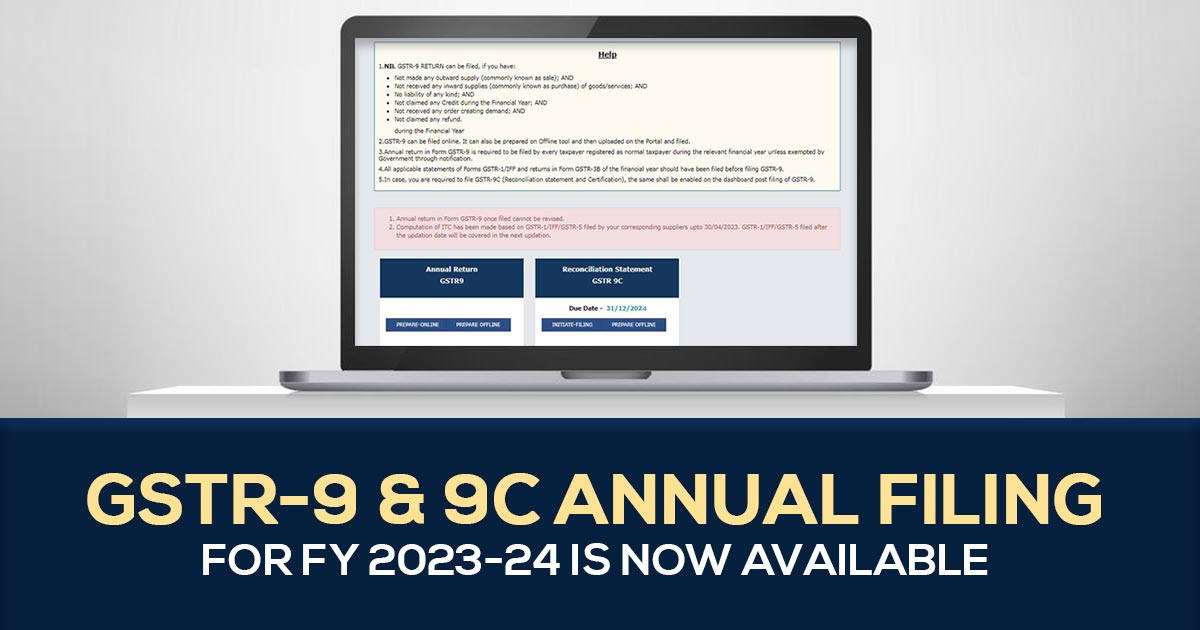

The option to submit final annual returns (GSTR 9) and reconciliation statements (GSTR-9C) through the GST Portal has been enabled by the Goods and Services Tax (GST). The deadline for submitting the FY 2023-2024 returns and statements is December 31, 2024.

Regular taxpayers in India who are registered for the Goods and Services Tax (GST) must file the GSTR-9, an annual return form. It compiles data on taxes paid, outgoing and incoming supplier details, and input tax credit (ITC) claims made for each financial year.

Taxpayers whose annual turnover exceeds a set threshold limit are required to file the GSTR-9C, which is a reconciliation statement and a certification form. A qualified chartered accountant or cost accountant must prepare this statement.

Steps to File GSTR-9

- Login to GST Portal

- Navigate to Services > Returns > Annual Return

- Select Financial Year > Search Go to Annual Return GSTR 9 > Prepare Online / Prepare offline (as you prefer)

Choose between an annual return with data or a NIL return by responding to a questionnaire. Add necessary or required information to the table. Preview the draft in Excel or PDF format. After commuting liabilities and late fees (if any), continue to file GSTR 9.

Steps to File GSTR-9C

- Login to the GST Portal

- Navigate to Services > Returns > Annual Return

- Select Financial Year > Search

Download GSTR 9, Download Form GSTR-9C, Tables Derived from Form GSTR-9, Fill the form with the auditor, and submit the file.

The taxpayer may update or correct any mistakes or omissions in the previously submitted GSTR-9 in the return for the next fiscal year.

The taxpayer must have an active GSTIN and have provided all essential forms, namely Forms GSTR-1/IFF and Form GSTR-3B, for the corresponding financial year prior to submitting the yearly returns.