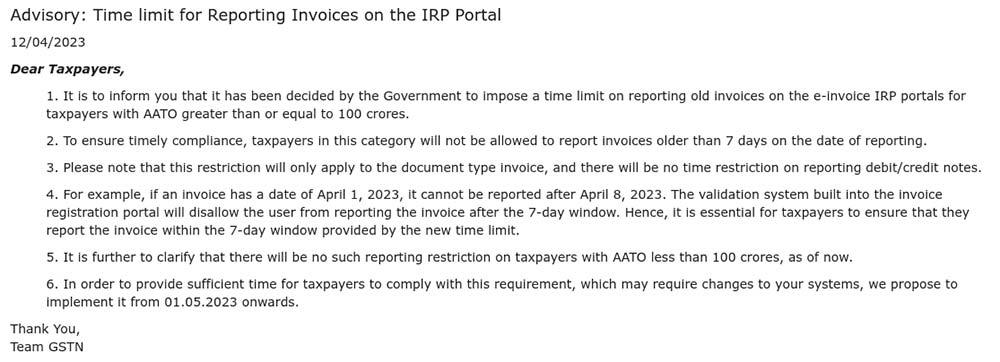

An advisory has been issued by the Goods and Services Tax Network (GSTN), in which it has been decided to set a time limit for reporting the goods and services tax invoices on the IRP Portal.

Following the advisory, the government came to the conclusion that there should be a deadline for reporting delayed invoices on IRP portals. Under this, only those taxpayers fall in this category who have an annual aggregate turnover (AATO) equal to or greater than INR 100 cr.

This group of taxpayers will not be allowed to record invoices that are more than 7 days old on the reporting date.

This means an invoice dated April 1, 2023, cannot be reported after 7 days (April 8, 2023). After 7 days, it won’t be validated by the system on the portal. It will reject the invoice registration. Therefore, it is mandatory for taxpayers to make certain that they do not miss the deadline for reporting invoices, which is 7 days.

Important: Step-by-Step Guide to Generate E-invoice Under GST with Benefits

They also made it clear that taxpayers with an annual aggregate turnover of fewer than 100 crores will no longer be subject to any reporting restrictions.

To give the taxpayer enough time to fulfil the requirement, they may make changes to it on May 1, 2023. It also included improvements to your system.

The Goods and Services Tax Network (GSTN) had previously issued an advisory against the new e-invoice portals. It also made the suggestion of introducing four new invoice reporting portals. The discussed private IRPs are already available online to taxpayers for submitting GST e-invoices.