The precarious number of Goods and Service Tax Returns filing is what we are witnessing even after two years of Goods and Service Tax ( GST) regime. Only 60 percent of eligible return filers file GSTR-3B.

GST system has already completed two years of its existence but the number of GST return filers remained consistently unstable. At present, the number of tax returns is less than the required level. However, every three months we encounter some growth in it.

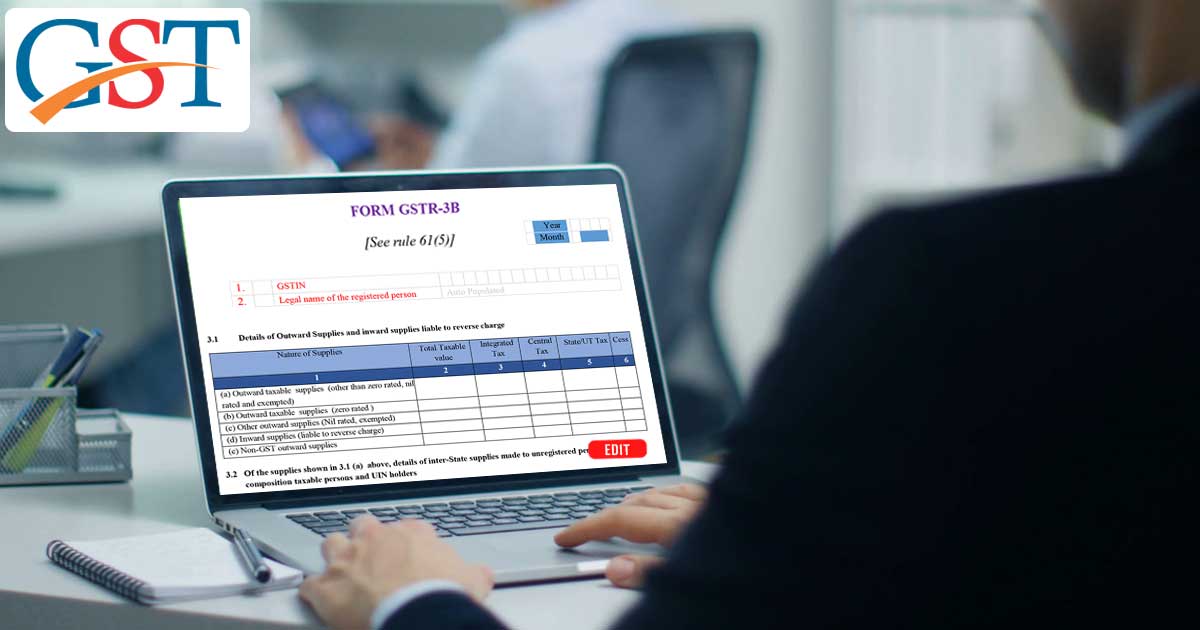

According to the news agency, analysts have not witnessed any significant improvement in the number of GSTR-3B return filing after July 2017. The merchants are filling it only after the fixed date of the monthly return. Only around 60 percent of taxpayers file this return.

Analysis of data released by the Goods and Service Tax Network (GSTN) clearly showcases that 50% of the total registered taxpayers had filed the GSTR-3B on the fixed date of July 2017. After this, on 23 June 2019, the figure elevated to 85 per cent.

As per the GST norms, traders have to file the monthly return GSTR-3B till 20th of next month whereas GSTR-1 has to be filed by the 10th of the month. There is a penalty for delayed filing of returns which is INR 25 per day for Central as well as State GST. In addition, there is also a provision for businessmen with zero tax liability. As per this provision, INR 10 per day is the penalty chargeable on late filing of returns by such traders.

According to analysts, if we dig deeper into the data of GSTR-1, we will conclude that the number Final Sale Returns, which has to be filled up every three months, increases which apparently depicts that the dealers under composition schemes and small traders are filing returns. Yet there is a huge gap between the traders who are eligible for filing GSTR-1 and who are actually filing these returns.