Find Quarterly TDS and TCS return due dates with the period and last date for filing for AY 2026-27 (FY 2025-26). TDS stands for tax deduction at source, while TCS stands for tax collected at source.

According to the Income-tax Act, if a person makes a payment to the recipient, TDS is required to be deducted at the prescribed rate and then deposited with the government. For the TCS, the person receiving the payment must collect tax from the person making the payment and deposit it thereafter with the government.

Here, we showcase the current due dates for filing TDS/ TCS returns as per the latest update by the government of India.

TDS/TCS Updates by Finance Ministry

- Circular No. 5 has been issued regarding the interest waiver on delayed TDS/TCS payments due to technical issues. Read Circular

- “Government to infuse Rs 50,000 crores liquidity by reducing rates of TDS, for non-salaried specified payments made to residents, and rates of Tax Collection at Source for specified receipts, by 25% of the existing rates”

SAG Infotech always works to help taxpayers by providing the necessary materials that make return filing easy. We cover the TDS return filing last date and TCS return filing due dates in a proper format (every quarter) for AY 2026-27 (FY 2025-26). Also, the taxpayer gets the details of the TDS/TCS payment deposits every month for government and non-government employees.

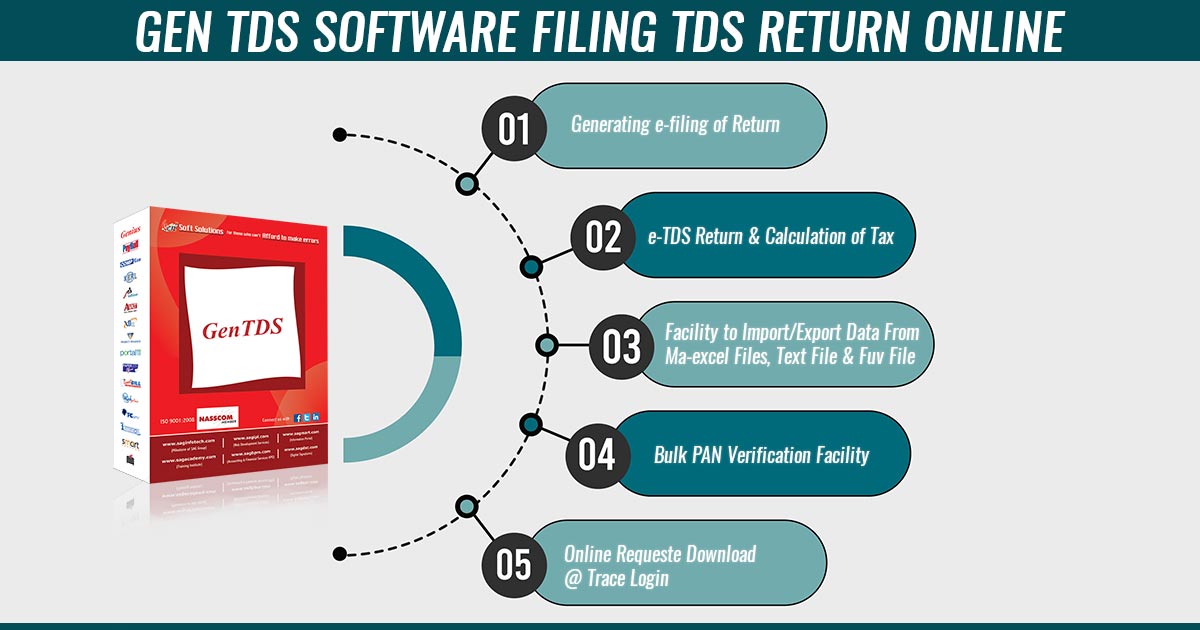

Recommended: Free Download Trial Version of TDS Return Filing Software

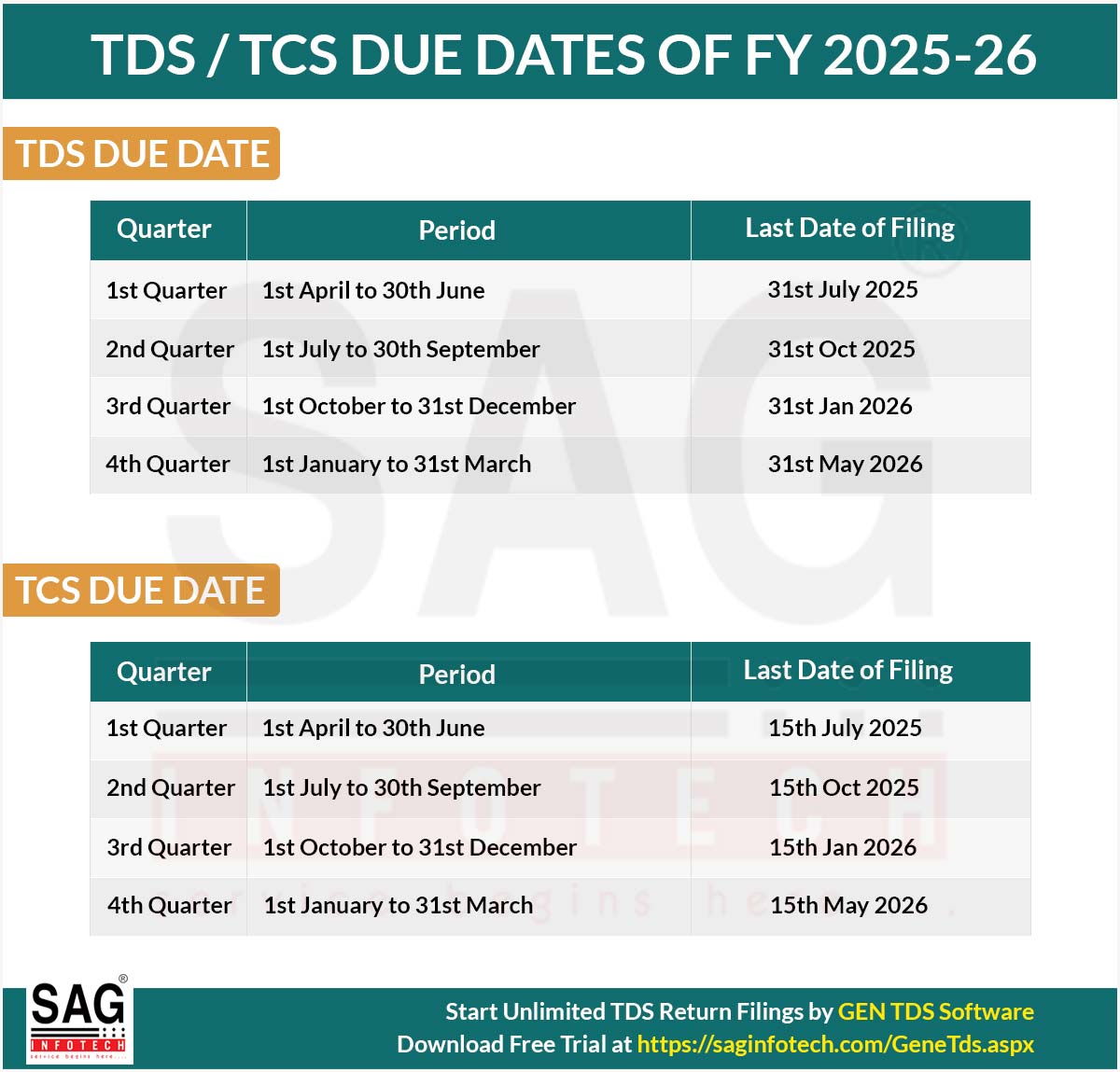

Here we have provided the Last Dates of FY 2025-26 for TDS Return Filing, along with the Last Dates of FY 2025-26 for TCS Return Filing.

TDS Return Due Date Quarterly for FY 2025-26

| Quarter | Period | Last Date of Filing |

|---|---|---|

| 1st Quarter | 1st April to 30th June | 31st July 2025 |

| 2nd Quarter | 1st July to 30th September | 31st October 2025 |

| 3rd Quarter | 1st October to 31st December | 31st Jan 2026 |

| 4th Quarter | 1st January to 31st March | 31st May 2026 |

Due Date of Quarterly TCS Returns for FY 2025–26

| Quarter | Period | Last Date of Filing |

|---|---|---|

| 1st Quarter | 1st April to 30th June | 15th July 2025 |

| 2nd Quarter | 1st July to 30th September | 15th October 2025 |

| 3rd Quarter | 1st October to 31st December | 15th Jan 2026 |

| 4th Quarter | 1st January to 31st March | 15th May 2026 |

Note:

- Quarterly TDS/TCS Certificate: After uploading a quarterly TDS return, you can generate a TDS/TCS certificate within 15 days of uploading your return.

TDS & TCS Payment Deposit Due Dates for Govt & Non-government

- The due date for depositing TCS is the 7th of next month.

- Due dates for depositing TDS are as follows:

- For non-government Deductors- the 7th of next month (except for March, where the due date is the 30th of April)

- For Government Deductors-

i) If paid through a challan, the 7th of the next month

ii) If paid through book entry- Same day, i.e. the day on which TDS was deducted.

Monthly TDS and TCS Payment Due Dates

| Deduction Month | Due Dates for Depositing TDS and TCS |

|---|---|

| November 2025 | 7th December 2025 |

| December 2025 | 7th January 2026 |

| January 2026 | 7th February 2026 |

| February 2026 | 7th March 2026 |

| March 2026 | 7th April (TCS) | 30th April 2026 (TDS) |

Can I File a TDS Return After a Holiday or on Sunday?

Tax-deductible at the source is done at the time of the payment to the receiver, and the tax deducted is directly deposited by the giver to the government. The TDS filing is mandatory for everyone who has been into payment transactions and therefore calls for various compliance by the government.

The upcoming TDS return filing due date given by the government is near. As per the sources, it has been found that the upcoming TDS return due date is falling on a Sunday, which is a public holiday; therefore, one can also pay the TDS on the next working day.

Due Date of 15G/15H Form

The due date for quarterly furnishing of 15G/15H declaration received by the payer from 1/04/2017 onwards and the manner for dealing with 15G/15H received by the payer during the period from 01/10/2015 to 31/03/2016 has been specified in Notification No. 09/2016 dated 9th June 2016 wide F.No.DGIT(S)/CPC(TDS)/DCIT/15GH/2016-17/4539.

| S.No. | Scenarios | Original Due Date |

|---|---|---|

| 1 | For 15G/H Received from 1/04/2025 to 30/06/2025 | 15/07/2025 |

| 2 | For 15G/H Received from 01/07/2025 to 30/09/2025 | 15/10/2025 |

| 3 | For 15G/H Received from 01/10/2025 to 30/12/2025 | 15/01/2026 |

| 4 | For 15G/H Received from 01/01/2026 to 31/03/2026 | 30/04/2026 |

TDS on Purchase of Immovable Property

- The time limit for TDS deposition on the purchase of immovable property is the 30th day of the following month in which the property is purchased. For Example, if the property is purchased in the month of June, then TDS can be deposited by 30th July.

Penalties on TDS/TCS Quarterly Return Filing After Due Date

TDS ensures an on-time tax payment on behalf of the income generator, but not on behalf of the one who deducts the tax. For example, if an employer deducted tax on behalf of an employee, it implies that the employee has paid the tax, but that doesn’t mean the employer has also paid the same. So, here comes the role of penalties and late payment charges.

In our day-to-day life, we come across such terms as late payment fees, fines, etc, on pending bills or outstanding payments. The same is true with income tax; the penalty or delayed payment fees are charged by the Income Tax Department (ITD) to an individual who is not in compliance with the IT law or cannot meet his/her tax duties in a good manner. So when such individuals fail to pay the taxes on time, the penalties are levied along with interest.

In the same way, if a deductor or employer who deducts the TDS (Tax Deducted at Source) from the income of their employees fails to pay TDS to the government or fails to submit relevant tax documents to the IT department on time, they become liable to pay penalties for the late or non-payment of TDS.

Section 234E of the Income Tax Act, which was introduced on 1st July 2012, deals with the late payment fees or penalty applicable for late submission of quarterly TDS/TCS returns by the Deductor to the ITD.

Late Filing Fee If You Miss The Quarterly TDS/TCS Return Due Date

According to Section 234E, a late fine of INR. 200 per day has to be paid to the Income Tax Department in case of late filing of TDS/TCS return, and the fine will be levied for every single day of delay until the late payment charges become equal to the amount of TDS and not more than that.

Let’s understand it through an example. Suppose you have to pay a TDS amount of INR 5000 on 1st March, but you pay the TDS amount on 30th June, then the total amount of penalty will be calculated as INR 200 X 122 days = INR 24,400.

Since the calculated value of the penalty is more than the actual amount of TDS, i.e., INR 5000, you will be liable to pay only INR 5000 as the late filing charges.

Interest in Non-Payment of TDS/TCS

In addition to the penalty, interest will also be charged. The interest is payable by the taxpayers before the filing of the TDS return. The details about interest rates are given in Section 201A.

- For delayed payments of advanced tax, self-assessment tax, regular tax, TDS, TCS, equalization levy, STT, and CTT made between 20th March 2020 and 30th June 2020, the reduced interest rate at 9% instead of 12 %/18 % per annum ( i.e. 0.75% per month instead of 1/1.5 per cent per month) will be charged for this period. No late fee/penalty shall be charged for delay relating to this period. However, none or short payments of TDS/TCS made after 30th June will attract the following interest liability:-

- When a part or whole amount of tax is non-deducted at source, then 1% per month interest is subject to TDS/TCS amount when the Interest period starts from the date on which the tax was deductible and lasts till the actual date of deduction.

- When a part or whole amount of TDS is not paid, then 1.5% per month interest is subject to the TDS/TCS amount when the Interest period starts from the deduction date and lasts till the actual date of payment.

- Interest at the rate of 1.5% per month ( from the date when it was deducted to the actual date of deposit) has to be paid for the late payment of TDS after deduction.

- Note: The interest is calculated on the basis of a number of months and not on the basis of a number of days, so a part of a month will be taken as a whole month.

For Instance, if you have to pay the TDS amount of INR 3000, which you deducted on January 15th. But you paid this TDS after the actual date of the TDS deposit, on May 29th. So, the interest will be calculated as INR 3000 X 1.5% per month X 5= INR 225.

However, according to many High Court Cases, a month is thirty days. But under the Income Tax Act of 1961, there is no precise definition for a month.

The most noteworthy point:

- The calculation of interest for the payable TDS amount is done based on the date from when the TDS was deducted instead of the date on which it was due.

For example, if the due date of the TDS payment is April 15th, and the TDS was deducted on March 30th. So, here the interest will be calculated for the period starting from March 30th, instead of April 15th, which is the due date.

It becomes quite troublesome when you miss the due date of the TDS payment by a day or two. Let’s suppose May 10th was the due date for paying TDS for a TDS that was deducted on April 15th, and due to any reason, you missed the due date but paid the TDS on the very next day, meaning on May 11th. In such a case, the interest calculation will begin from April 15th, and unnecessarily you would have to pay interest for two months, i.e., 1.5% per month X 2= 3%.

Therefore, it is very important to pay TDS before the due date of TDS payment to avert such obligations of paying huge interest and penalties.

Penalty

According to the norms of the Income Tax Act, you might become liable to pay the penalty of an equal amount as the deducted/collected amount

Prosecution under Section 276B

Section 276B states that if a person fails to pay to the credit of the Central Government within the specified time, as mentioned above, the TDS by him according to the provisions of Chapter XVII-B, he shall be penalised with a fine along with severe imprisonment for a period between 3 months and 7 years. The punishment will be based on the circumstances or the inspection done by the concerned tax authority or assessment officer.

Penalty Sections for Late Filing of Quarterly TDS/TCS Return

- Penalty (Sec 234E): The TDS deductor will be accountable for paying a penalty of INR 200/- per day to the IT department till the date the complete TDS amount is paid. However, the penalty shall be limited to the actual TDS amount and can not be more than that.

- Penalty (Sec 271H): As per this section, when an individual fails to file the TDS/TCS return before the due dates, the Assessing Officer may direct him/her to pay a penalty under section 271H along with the late fee applicable as per section 234E.

The penalty under section 271H starts from INR.10,000 and can be extended to INR 1,00,000 when the Deductor/Collector files a wrong return.

Conditions when no penalty is levied for delayed filing or payment of TDS/TCS return as per section 271H.

- The tax deducted at source is paid to the credit of the government.

- The interest, along with late filing fees, is paid to the credit of the government.

- The TDS/TCS return is filed before the expiry of one year from the due date, as stated (provided that the return submitted is correct)

See Also: Income Tax Important Dates for Current Financial Year

Most Important FAQs Regarding TDS and TCS Return Filing Due Dates

Q.1 – What is the penalty fee to file a Quarterly TDS and TCS return after the due date?

Rs 200 per day is the late filing fee for the Quarterly TDS and TCS returns after the due date till the default continues. The late fee could be at most the amount of TDS deducted.

Q.2 – Who is obligated for the TDS deduction?

The deductor must deduct TDS before depositing the payment with the government. TDS is deducted whatever the mode of payment cash, cheque, or credit, and is linked with the PAN of the deductor and deducted.

Q.3 – What is the method to compute TDS on salary?

As per the income tax slab the TDS on salary is computed applicable to the employee after adjusting all the qualified deductions and exemptions. The salary is among the income where the employer (deductor) deducts full tax obligation as TDS.

Q.4 – What are Form 24Q, 26Q, 27Q, 27EQ?

Such Forms are the respective formats specified by the IT department for TDS/TCS returns. Form 24Q is specified for the return of TDS details on salary payments, Form 26Q for the Return of TDS details on other than salary payments (Domestic), Form 27Q is for the Return of TDS details on other than salary payments (NRI/Foreign) and Form 27EQ is for TCS returns.

Q.5 – Who is not obligated to file TDS?

An individual ought not to pay TDS if he/she is making a payment to a person or HUF whose books are not audited. If the payment is made to RBI, the government, or a mutual fund then the TDS does not need to be deducted. If the payment is incurred before a transporter who has 10 or fewer goods carriers and is engaged in the business that needs leasing, hiring, or plying goods carriage.

These individuals would be mandated to fill Form 26Q with the information of the non-deduction of tax including the PAN of the payee. If the payment has been made before the non-resident person for doing any work then the TDS does not get applied.

Q.6 – Who can have a TDS refund?

TDS returns having a valid Tax Collection and Deduction Number (TAN) are furnished via the employers or organizations. An individual is needed to deduct tax at the source and it is needed to be deposited in the said time who is filing the payments that are cited under the Income Tax Act.

Dear Sir/ Madam,

What is payment date of TCS Liabilty for the month of March 2024 ?

The due date of depositing of TCS Liability for the month of March 2024 is 7th of next month.

What is the basis for calculating additional late filing fee against the processing of latest correction

There is no additional filing fees against correction but if at the time of correction not mention original return filing date date then calculate additional late filing fees.

Please send pdf folder my mail

Dear Sir,

when i have deposit TCS for the month of march23 on 24.04.2023. can i paid interest of one month. if yes, to please Clarified why ?

yes you are require to pay Interest for two month as TCS deposit date was 07-04-2023.

Int amount- TCS deducted*1.5%*2 mnth.

you need to pay intt for 2 month

if the tax exemption limit is 3 lac Rupees then why not the TDS collected after getting 3 lac. the salary.

we all should have to free from first quarter TDS

After the exemption limit, we are liable for to pay tax otherwise no.

What is the due date of filing TDS return of AY 2022-23

Sir whether late fees u/s 234E for filing tds returns after due dates can be waived off under any clause p

We want to revise TDS returns (suppliers) for FY 20-21. When is the due date?

You can do it at any time from TRACES

I have the same question, why TCS return date not extended by Govt. is Corona pandemic only for TDS files not for TCS. Why no relaxation given.

What’s the due date for TDS payment for Qtr4 of FY 2020-21 (Jan-Mar21) and the due date for filing of TDS return.

I want to learn TDs return

Date of tds filing has been revised from 30-june -2020 to 15th-july-2021

Last date of filing TDS return for Q3 FY 2020-21 is 31 Jan. 2021 while the last date for Q2 FY 2020-21 is 31st March 2021. How can this be? Is the tax department hoodwinking taxpayers?

I received a demand notice for late filing of Q3 FY 2020-21 TDS return, even though I filed it on 26th March 2021.

Please contact to department

LAST DATE FORM Q3 WAS 31ST. JAN,21. SO, LATE FILING FEES APPLICABLE IN YOUR CASE.

Tds refund

Extent tds tcs return

Sir, If TDS – Q1 return for the FY 2020-21 will be filed on 30.04.2021 instead of 31st March2021, the late filing fee @ Rs.200/- per day will calculate from 01.04.21 to 30.04.21 or from 01.08.2020 – Please inform

A late fee will be calculated from 01.04.2021 as the due date was extended to 31.03.2021

LATE FILING FEES FROM 01.04.21 TO 30.04.21

What was the due date for MGT 7 and penalty for OPC

The due date for OPC for Filing MGT-7 is within 180 days from the closure of the financial year i.e. 27 September and penalty will be counted from September 28 per day 100 Rs till the Default Continues.

I want to file 3 qtr returns (q1/q2/q3) together. which provisional receipt number (q4 of the previous year) should I mention in all returns. ? or I have to file one at a time i.e. after getting provisional receipt of the previous return.

I want to revise my Q3 TCS 27EQ Return for FY 2020-21, but neither conso file request is allowed nor online correction, how can we make the required changes?

Please wait for some time for the request of conso file or online correction.

You can file correction from NSDL.

We have Paid TCS every month on time, but by mistake, we have filed TCS Return late by 15 days, what will be the late changes & Penalty.

Thank you

Per day 200/- rupees

Sir,

We have applied for TAN and meanwhile, we deducted TDS under various sections. By the time we get TAN the due date for the TDS deposit will be over.

Do we require to pay interest and penalty on late payment/deposition of TDS in Govt. treasury though we got TAN late?

Please clarify.

Regards,

Dipak

Yes, you are required to pay interest and penalty on late payment/deposition of TDS.

Respected Sir, A property purchased in the personal name of proprietor before 5 years and EMI is deducted from the business account so the paid amount is shown as withdrawn in the capital but now we want to try this property in firm assets, is this possible. If possible advise what to do.

Thanks, Sirji

While I am preparing 26Q – Q2 for the financial year 2020-21, I cannot able to find the 94J option in Annexure I part under deductee details. Is there any changes in the 194J deductions? Kindly request you share the correct details.

Please contact to Traces Portal.

Yes…!

Section code has been changed you need to type/mention as 4JA instead of 94J.

Sir, I want to know the last date for filing e-tds return for the quarter ended 30th September 2020 (F.Y.2020-21)

31st March 2021 is the last date for filingb e-tds return.

31st Mar’2021

The due dates mentioned by you of the 1st qtr and 2nd qtr of 2020-21 are wrong. Correct them.

Please refer notification No 35/2020.

Sir my father has taken a home loan in Sep 2018 from an Indian bank @8.60% p.a for a flat to be allocated by Group Housing Coop Society costing Rs.3780800/- and paid the amount to society on Sept,18 but the flat could not be allocated to him by society due to delay tactics of management of society and Registrar Coop Societies.

Lastly, he resigned from the society and society refund his home loan amount with 6% interest p.a. in February2020 to the Indian bank as per agreement. They deducted the 10% TDS and 2&half percent admv charges. Bank also charged interest nearly 3,22000 for this period. There is two side loss –intt by bank and TDS on intt by society has to be paid @ 30% as per income slab of my father. whereas he has no gain from this home loan. What type of rebate my father can get under which rule please guide in detail. Thanking you

PLEASE REFER SECTION 80C,80EEA & 24(B) OF INCOME TAX ACT

Dear Sir, logic could not understand for the IIIqtr filling due date is 31.1.21, while I and IInd Qtr is 31.3.21, and IVth is 31.5.21?

The filing due date for TDS returns of FY 2020-21 is 31st March 2021.

TDS deducted under 194J for Technical services 2% and others 10% how to shown in 26Q for these two transactions

Maybe the system is shown as demand for lower deduction (2% for technical services)

You have to select an appropriate subsection.

Sir,

Still, I did not file TDS return of the 4th quarter FY 2019-20 and also not paid the TDS amount of march 2020. What are the interest and penalty until today……25/08/2020

Interest at the rate of 1.5% per month will be paid for non-payment of TDS and a Late fee of Rs 200 per day is required to be paid.

Sir,

I Have submitted my return for AY 2020-21 on 12th June 2020 with a claim of refund but still have not got a refund. when it will be deposited in my account?

Please check your refund status with NSDL

I have bought a home in Feb 2020, the downpayment was paid in February, and the agreement was done in February but the bank released a loan in March. I have not paid the TDS. is there any relaxation for COVID, if not what might be the penalty amount

“Please contact to department”

There was relaxation for payment till 15th July Last date for submission of return was 31st July I had filed a return on 31-07-2020 (26Q 4). I had made payments in June/July for FY 2019-20. Now the department has issued an intimation and asking to pay Penalty delayed payment and also charging interest.

There was relaxation for payment of TDS amount till 30th June 2020 (Due dates of payment of which falls during the period of 20th day of March 2020 to the 29th day of June 2020) with a reduced rate of interest of 0.75%.

what is the last date for filling QTR-1 2020 TDS return

Normal date is july-20 is the date extended

31st March 2021

if 26Q return filed on 10.10.2020 for 1st qtr. of 2020-21 than the late filing fee/penalty will be charged or not ….as the return’s due date is 31.03.2021

No late fees will be charged.

Pan no ########, I submitted a return on 22 August 2020. But no result till now.

Which lower tax deduction certificate needs to be mapped in TDS return for Q1 2020-21 on account of lower/Nil tax deduction certificate validity extended till 30-Jun-2020?

I have received demand on account of short deduction due to LDC, I have mapped old (2019-20) certificate no. mapped in the TDS return.

“Please contact to department”

Sir If I fail to deposit TDS amount on 31.07.2020 then how many interest charge is applicable or what is the procedure

TDS RETURN PENALTY FOR LATE FILING RERUN AFTER —- 31/7/2020

Please specify Quarter & FY

How to show COVID 19 TDS rate cut of 25% in 26Q

If the date of payment/credit is on or after 14th May 2020, reduced rate of TDS is applicable